June 1 was a pivotal date for cryptocurrency investors, with significant events on the horizon. The most exciting development stirring the markets is Hong Kong’s plan to open access to cryptocurrencies for individual investors. Additionally, the unveiling of crucial data, such as the interest rate decision, will inject activity into the markets.

Why is June Significant?

At 04:00 this morning, the U.S. House of Representatives passed the debt ceiling law. It’s now anticipated to secure Senate approval by June 5. Subsequently, with President Biden’s signature, the debt ceiling issue will be resolved until 2025. The worst-case scenario was the U.S. defaulting, which throughout May led to substantial losses in the cryptocurrency markets. Now that this issue has been eliminated, investors can breathe a sigh of relief.

Furthermore, on Wednesday, June 14, the Fed will announce its interest rate decision. Of course, we can’t forget the good news expected from Hong Kong in the coming days. Below, we will discuss everything you need to know about these developments, complete with dates and details.

Key Dates in June

Since the beginning of 2022, the macro front has put considerable pressure on cryptocurrencies. We have seen the impacts of nearly all developments, from interest rate decisions to PMI data, on cryptocurrency prices. Therefore, let’s examine the key dates in June.

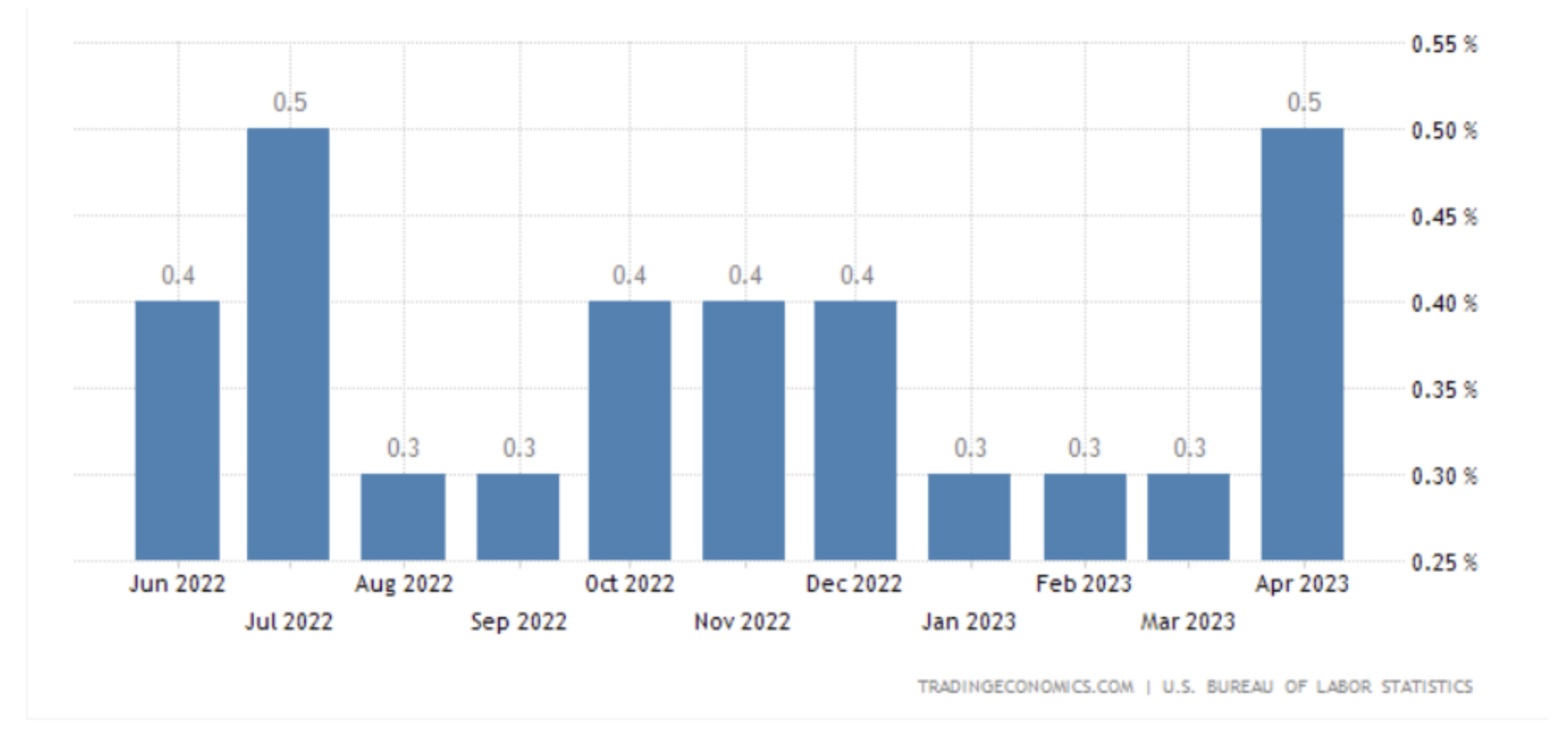

June 2, Friday 15:30 U.S. Average Hourly Earnings (Expected: 0.4%, Previous: 0.5%)

This data must meet or fall below expectations. If wages have risen above expectations in May, this will exacerbate the sticky inflation problem. We have often observed that high data depresses the markets due to wage increases’ direct connection with inflation.

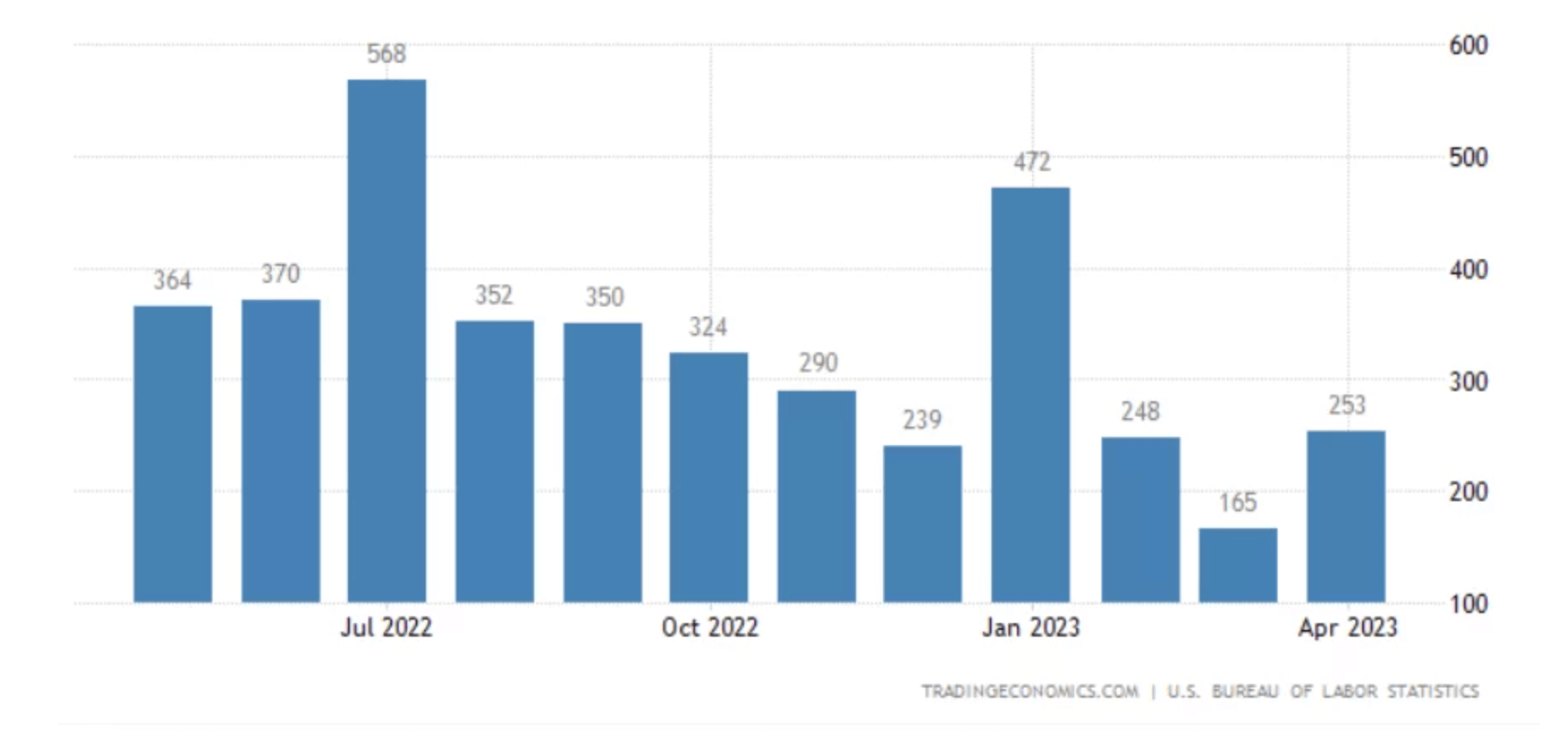

15:30 U.S. Non-Farm Payrolls (Expected: 180K, Previous: 253K)

At the start of this year, unusually high NFP data triggered rapid sales in the Bitcoin price. Employment needs to weaken, and high inflation will embolden the Fed, increasing the possibility of a rate hike in the upcoming meetings. The NFP data to be released tomorrow should be 180K or below. Especially after yesterday’s high JOLTS data, investors need this.

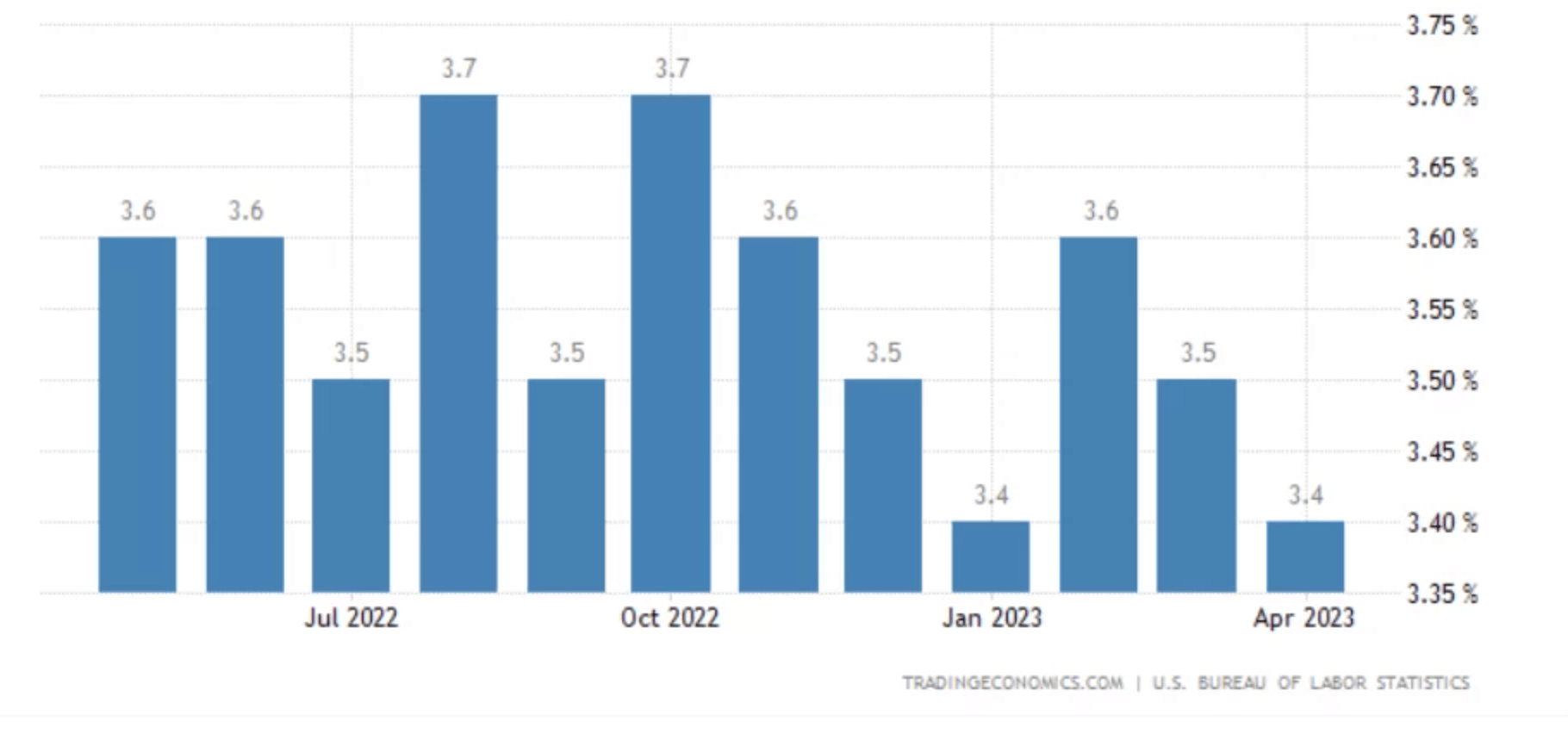

15:30 U.S. Unemployment Rate (Expected: 3.5%, Previous: 3.4%)

Fed members are aiming for an unemployment rate of up to 4.4% in the medium term. This is necessary for the battle against inflation, and a decrease in unemployment will lead them to tighten their monetary policy further. This data needs to be reported at 3.5% or above.

June 4, Sunday 13:00 OPEC Meeting

Cryptocurrencies are indirectly impacted by the OPEC meeting due to the potential influence on energy costs. The recent decline in energy costs has played a significant role in the reduction of U.S. inflation. From over $70 at the beginning of May, the price has decreased to a current level of $68, a positive development. We should not witness any outcome from the OPEC meeting that might inflate prices.

June 5, Monday 16:45 US Services PMI (Expected: 55.1) 17:00 US ISM PMI (Expected: 51.8)

PMI data informs us about the state of the economy. Figures over 50 signify economic growth. If the data significantly exceed expectations, cryptocurrencies may react negatively.

June 8, Thursday 15:30 US Unemployment Claims

We’ve already seen price fluctuations in May due to abnormal data in this regard. As mentioned earlier, the weakening employment situation and high unemployment claims are required.

June 13, Tuesday 15:30 US Inflation Data

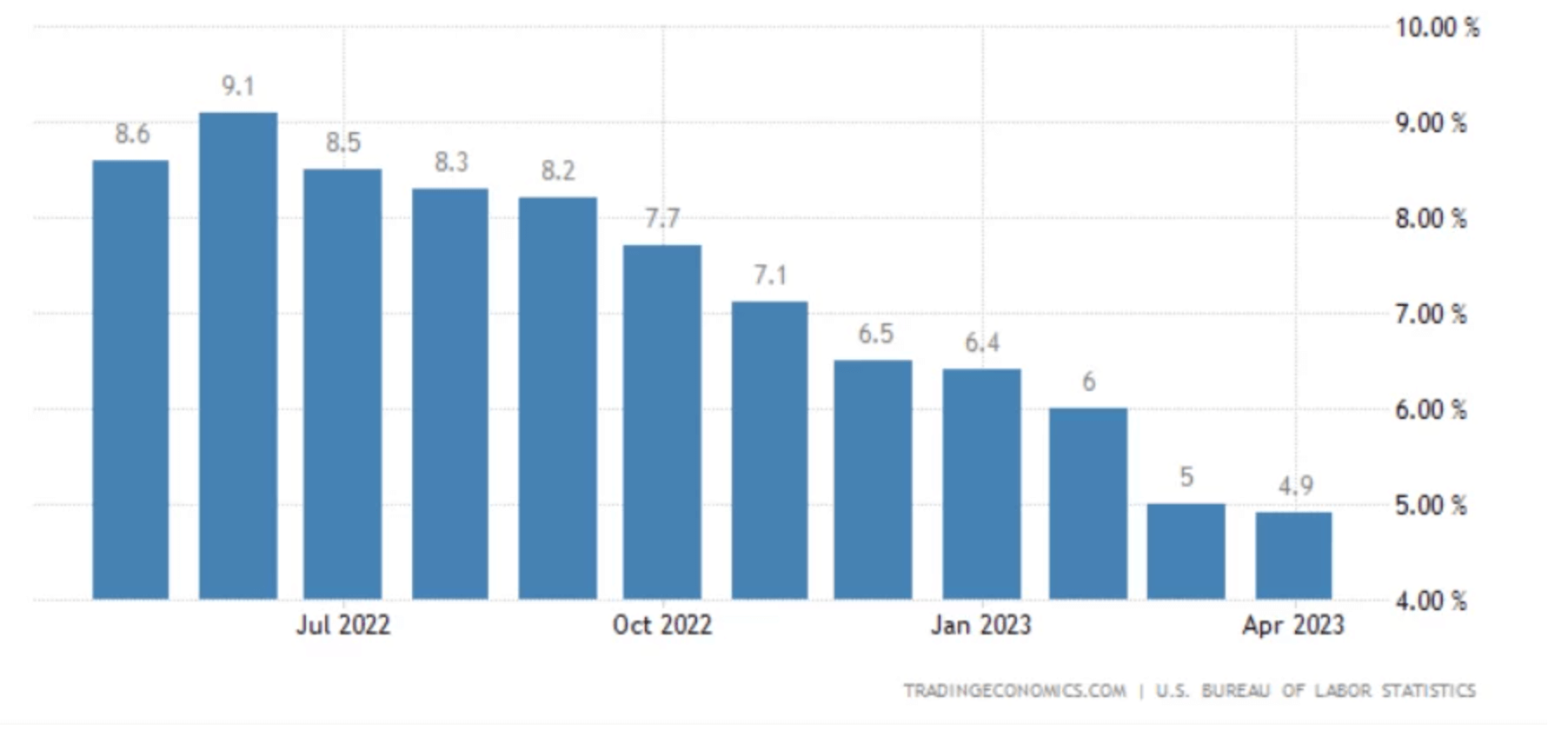

The general expectation among experts is that inflation will be slightly below the 4.9% mark. The reduction in oil prices will have a positive effect, as will the base effect causing inflation to steadily decline. If there’s no big surprise, inflation lower than the previous month’s 4.9% will be supportive for cryptocurrencies.

June 14, Wednesday 15:30 Producer Inflation

Last month, the producer inflation was 0.2, and it should rise similarly or less this month. The Producer Price Index (PPI) is a leading indicator of consumer inflation, hence this data will be closely watched. In May, consumer inflation was expected to decline because April’s PPI was below expectations.

21:00 Fed Rate Decision

Expectations vary day by day. Before Fed/Harker’s announcement yesterday, about 60% expected a rate hike. However, the Fed members’ indications for a pause led to 60% of the market expecting rates to be held steady. The expectation is that rates will remain steady in June, which wouldn’t be surprising if the above data comes in normally. A pause in rates and watching the effects of front-loaded rates is the correct move to measure the effects of credit tightening.

June 19, Monday US Markets Holiday

The Monday holiday benefited Bitcoin. If a positive sentiment forms after the interest rate decision, we might see a sudden surge on June 19.

June Altcoin Key Unlocks: Insights for Investors

Investors typically find out about key unlocks 1-3 days in advance, because these developments do not often make headlines. Major circulation supply increases should be closely monitored as they tend to trigger sales in the respective altcoin. Every Sunday, we share these details with you. But what major key unlocks are we going to witness in June?

Continuing SUI key unlocks, $59.5 million worth will be unlocked on June 3rd. DYDX postponed its major unlock, however, fractional unlocks are ongoing. A token worth $13.2 million, as of today, will be unlocked on June 6th. APTOS (APT) entered the scene with a low supply and reached double-digit prices. However, its supply is increasing. On June 12th, $38.8 million worth of APT Coin will enter circulation. BLUR and BIT will unlock $94 million worth on June 14-15th. APE will unlock $48 million worth on June 17th. OP Token will unlock $34 million worth on June 30th. This week, OP made a massive key unlock, and as its circulation supply rapidly increases, its price is dropping. We had warned about the OP Token key unlock on Sunday, before the downtrend gained momentum.

Three Major Concerns in June

We touched on important developments expected on the macro front of cryptocurrencies and specifically in altcoins. However, there are also ticking bombs threatening the markets and price catalysts. New developments on these fronts can cause significant fluctuations in the markets.

Genesis Bankruptcy Proceedings

The bankruptcy process is still ongoing, and the debt to Gemini has not been paid. The process has been prolonged due to disagreements among the parties. If Genesis does not succeed in its Chapter 11 bankruptcy process, it will be the worst development of June. This could also jeopardize the future of the parent company DCG. It is crucial to remember that many large crypto companies (Grayscale, CoinDesk etc.) operate under this company.

DCG is unable to make its final payment to Genesis and is experiencing liquidity issues. If this deepens, we must be prepared for bad news.

SEC Lawsuits

Last month, we saw the US SEC declare Filecoin as a security. The SEC has made many decisions on altcoins that have been securities for years. We had shared the details of the decision taken about 37 popular altcoins in our news dated May 19th. The move on Filecoin indicates that the SEC may continue to pressure US-based crypto companies on this issue in June.

In other words, we should be prepared for lawsuits or Wells notices. We know that these moves can bring serious sales in altcoins, investors can minimize their losses in possible bad surprises by setting their stop zones well.

End of Ripple Lawsuit Possible

The company CEO said the lawsuit could end within weeks. The lock on the Hinman documents will be unlocked on June 13th, one day before the Fed interest rate decision. This is a significant development for this lawsuit. If the Ripple CEO is right, we could see the lawsuit conclude in June. This could pave the way for a new peak in the range of $0.6 and $0.9 for XRP Coin.

Some lawyers following the lawsuit say this is an optimistic estimate. In our Ripple lawsuit news, we had discussed these expectations in detail.

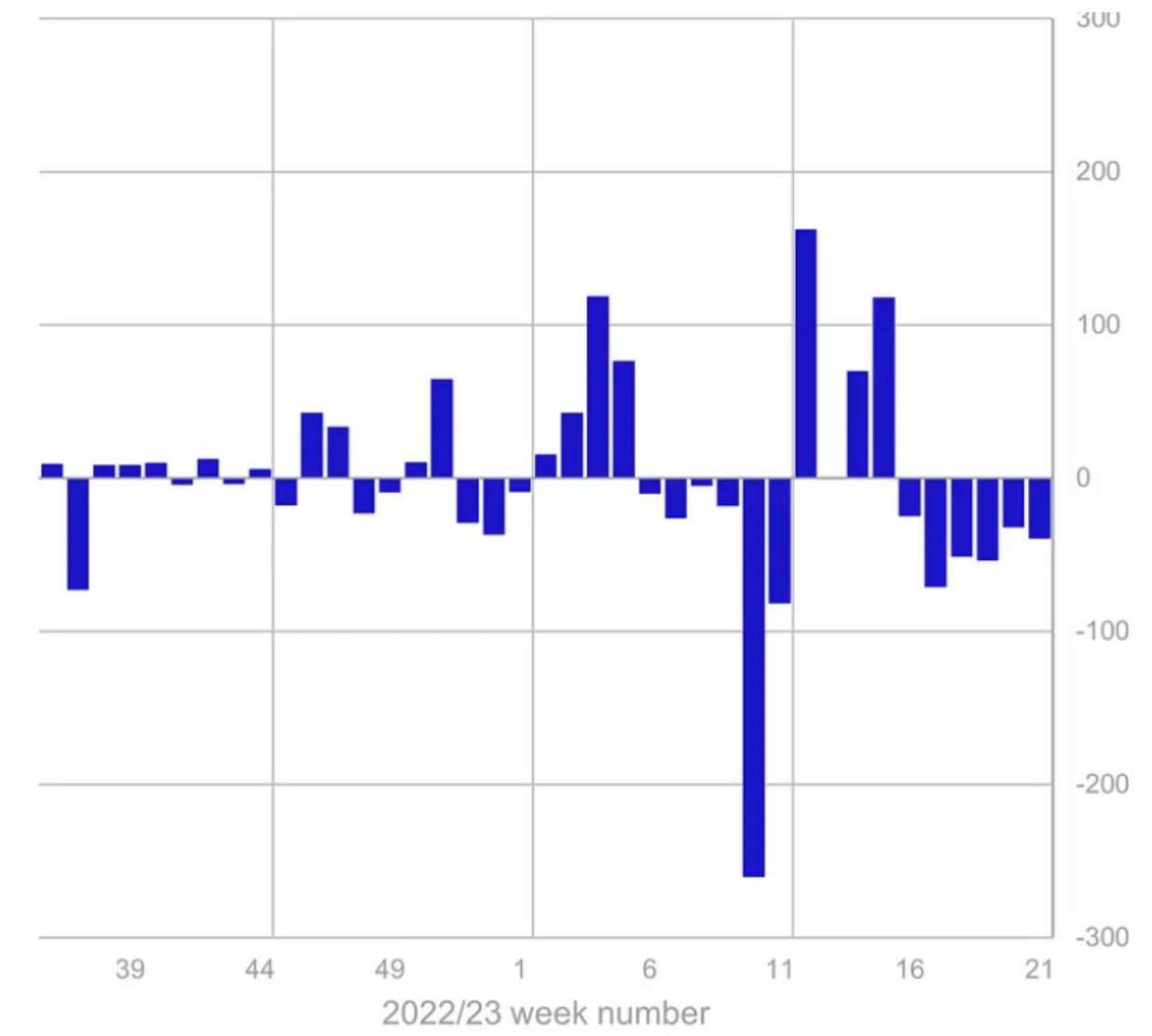

Corporate Investors in June

According to CoinShares data, there has been a continuous outflow from cryptocurrency funds by corporate and qualified investors for the past six weeks. This implies less expectation of a rise for the rest of the year. If there’s no surprise in the upcoming report next Monday, the steady withdrawals could negatively affect investors’ risk appetite.

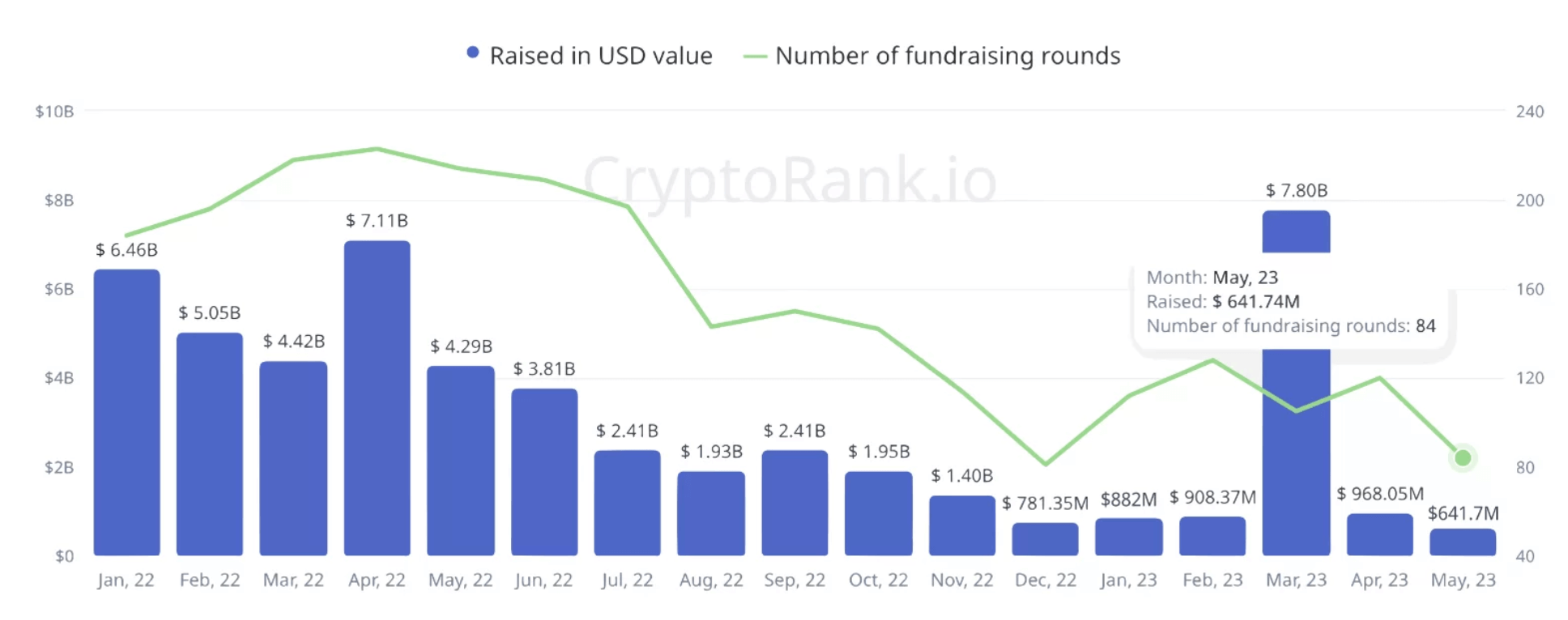

Meanwhile, crypto-focused funds continue to participate in seed investment rounds, even as outflows persist from Exchange-Traded Products (ETPs). In May, a total of $641 million was raised in 84 funding rounds, representing a 33% decrease compared to the previous month’s funding activities. Notably, web3 services and DeFi emerged as the most popular categories, providing funding of $152 million in 46 rounds.

The chart above shows a significant drop in corporate investments into crypto and web3 focused companies. Despite outflows from investment funds, companies continue to support projects still in the start-up phase.

Crypto-focused investment firms such as a16z, Animoca Brands, and Blockchain Capital continue to actively invest despite the bear market. Sam Altman’s project, Worldcoin, closed its Series C fund of $115 million with substantial participation from a16z crypto, Bain Capital Crypto, and Distributed Global.

June’s Bitcoin Price Forecast

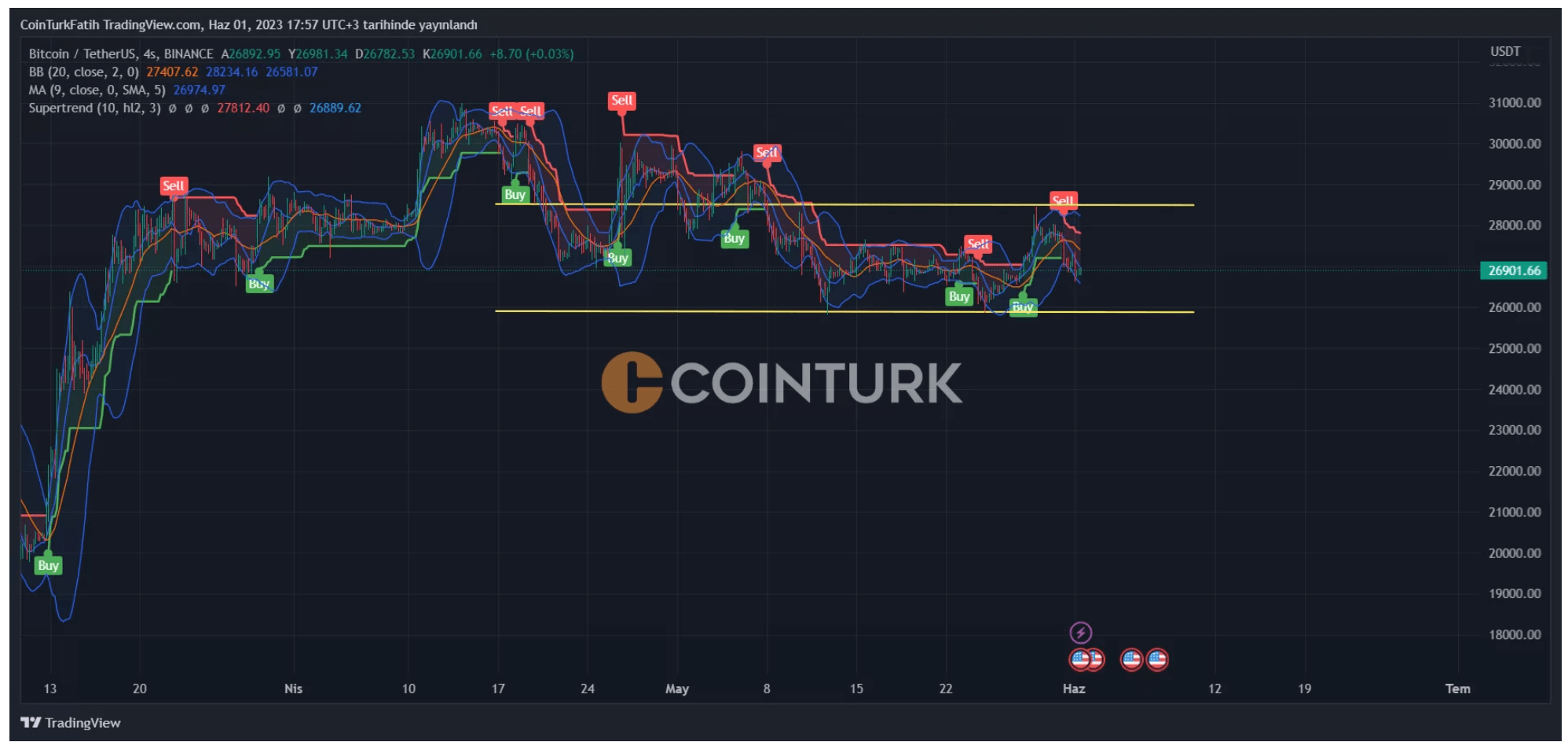

After discussing key developments, the current situation of corporations, and other details, we can now focus on the price. In the first week of May, we saw the sales from investors who purchased billions of dollars worth of BTC in January. This has caused a significant downturn in the markets. Additionally, the reduced activity of market makers like Jump Trading has drained liquidity. Consequently, we are seeing shallow liquidity and low volatility.

Historically, it is not feasible for the low volatility in Bitcoin’s price to continue this way. We should soon see a significant price movement in either direction.

Speaking of the price, Bitcoin has been moving between $28,500 and $25,886 since May 8. During the last recovery, it tested the ceiling line of this range. If closing below $27,192 continues in the coming days, we may see the price fall back down to $25,886. To break out of this low volatility, it will need to break one of these two lines.

If the price breaks down, we could see a larger move towards $23,800, and if it breaks up, towards $31,000. The trio of Hong Kong, interest decision, and debt ceiling may positively affect the price, so the possibility of breaking upward seems higher.

Expert Bitcoin Price Predictions

Finally, let’s discuss expert expectations for the price, and thus conclude our comprehensive evaluation of June.

JP Morgan Analysts

Led by Nikolaos Panigirtzoglou, JPMorgan strategists expect Bitcoin and altcoins to perform poorly in the short term. Their 12-month target is a peak price of $45,000 for Bitcoin as the production cost will jump to $40,000 due to halving. Their short-term negative expectations do not foresee a Bitcoin price below $20,000.

Michael Poppe

Poppe believes that closing above $26,900 in the short term will push the Bitcoin price to $29,000. He too expects the period of low volatility to end with an upward breakout.

Luke Gromen’s Outlook

Luke Gromen, a prominent market analyst, insists that Bitcoin’s price should rise in the medium term due to the inevitable monetary expansion that would follow any debt ceiling agreement. In a recent market evaluation, he reiterated his expectation for a market surge.

James Check’s Perspective

James Check, an analyst at Glassnode, predicts the conclusion of the period of low volatility. He further suggests that a Bitcoin price of $32,000 is within sight.

John Hussman’s Prediction

John Hussman, a well-known figure capable of predicting market crashes, anticipates a significant pullback in the U.S. stock market. He sets a target band of 3,000 for the S&P 500, and in this scenario, cryptocurrencies could experience a considerable drop. If Hussman’s prediction proves accurate, we may see Bitcoin’s price seeking a new bottom below $20,000.