Bitcoin (BTC) suffered a 4.5% fall over the past week, a repercussion of the ongoing mixed market sentiment.

Crypto Turbulence!

Bitcoin, the leading cryptocurrency, faced a challenging period as investors grappled with contradictory views and uncertainties in the market. This latest fall in Bitcoin’s value emphasizes the crypto’s volatility and sensitivity to various factors impacting overall market sentiment. BlackRock, the world’s largest asset manager’s CEO, released a warning concerning the risk to the US dollar’s reserve currency status.

He identified destabilizing factors such as the dispute over the debt limit, the potential for national default, and the risk of a credit rating downgrade. Furthermore, he predicted that the Federal Reserve would implement at least two more interest rate hikes.

The BlackRock head voiced his concern about the impact of the “drama” surrounding the debt ceiling on global faith in the dollar as the reserve currency. He stated, “I believe we will find a solution, but let’s be clear: The US is risking its reserve currency status.”

Bitcoin Price Prediction!

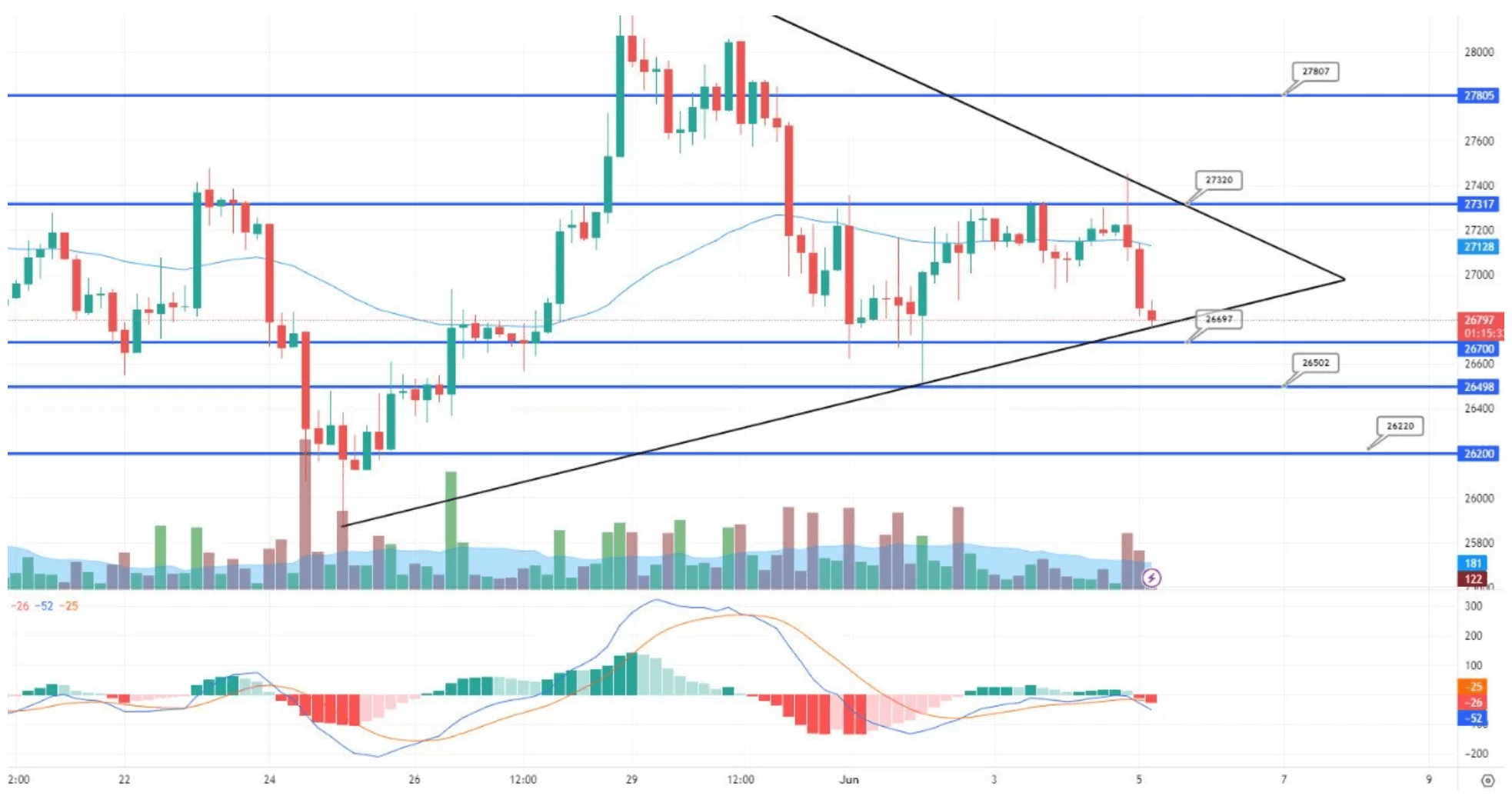

Meanwhile, Bitcoin finds strong support near the $26,750 mark in its current position, reinforcing a triple bottom formation signaling a possible bullish reversal. An hourly timeframe could also indicate a trend line providing support at this level, further enhancing the probability of an upward movement.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators could signal bullish conditions supporting a possible reversal scenario. Furthermore, the resistance level around $27,350 could exert upward pressure on Bitcoin’s price.

In such a scenario, tracking the next resistance levels around $26,950 and $27,650 could be significant. A substantial breakthrough above the $27,350 level could pull Bitcoin’s price to $27,650 and possibly higher, reaching levels of $27,900 or $28,000.

A break below the specified level could indicate a continuation of the downtrend. Conversely, if Bitcoin surpasses the $26,750 level, the next price movement will likely lean towards the downside.