Cryptocurrency markets have experienced dramatic ups and downs over the years. But what’s the next opportunity for the forthcoming bull season? Different aspects of crypto have taken center stage during various bull seasons. An analyst, famed for his accurate predictions of market lows, has disclosed what the significant opportunity could be in the next bull season.

Commentary by Analyst Known for Predicting Lows

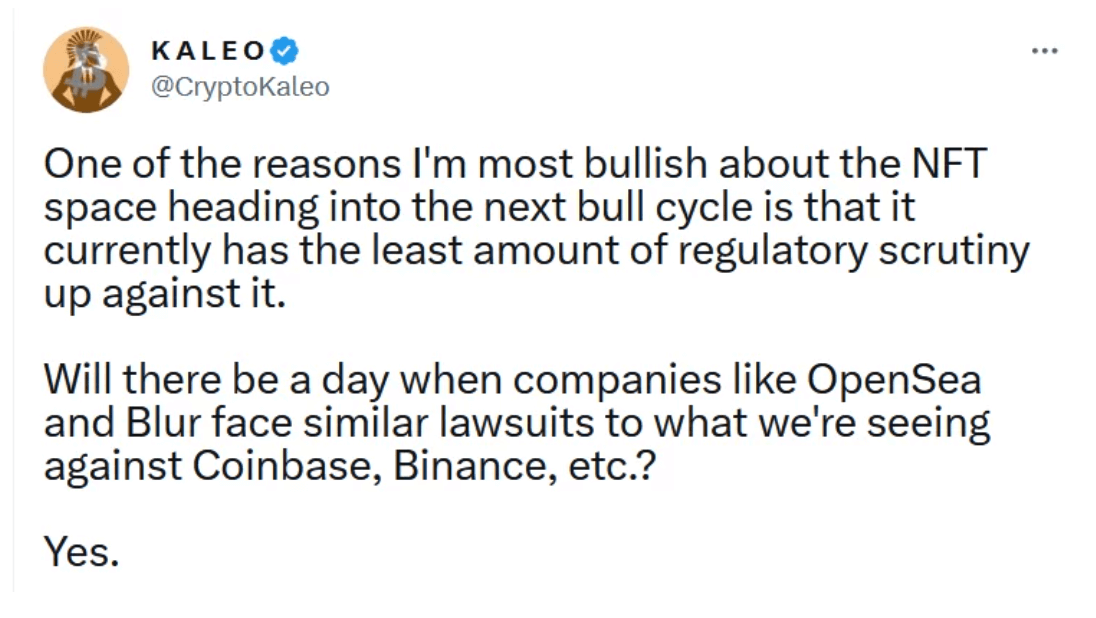

Under the pseudonym of Kaleo, the popular analyst who has accurately predicted market lows offered new predictions about the markets this week. He also highlighted the overlooked opportunity for the upcoming bull market. So, what is this next opportunity?

One of the reasons I’m most bullish about the NFT space going into the next bull cycle is that it currently has the least regulatory scrutiny.

Will there be a day when companies like OpenSea and Blur face lawsuits similar to those we’ve seen against firms like Coinbase and Binance?

Yes.

The total crypto market value is approximately 1.1T dollars.

The total NFT market value is less than 1% of this figure, standing at around 10 billion dollars.

Moreover, the total monthly sales volume for NFTs last month was only 809 million dollars, which is about 0.01% of the transaction volume in cryptocurrencies.

Rising Interest in NFTs

Kaleo believes the low share within the market will keep the SEC away from this field. Kaleo argues that the absence of regulatory scrutiny on NFTs implies there should be fewer disputes in the sector, leading to more significant growth.

The trader also contends that NFTs are the easiest thing for ordinary people to understand, which could pave the way for broader adoption.

NFTs also have the lowest intuitive entry barrier for the average person – that is, people understand the concept of digital collections. This makes more sense to them than randomly acquiring a dog token and praying.

Thus, while it’s easy to overlook the NFT market due to ‘lack of volume’, you’ll be missing out on a great opportunity in the next cycle. Everything is boring until it’s not.

Türkçe

Türkçe Español

Español