The Federal Reserve has turned markets into a firestorm over the past year, consistently urging caution in optimism. Especially risk market investors have been caught in the excitement of “is it over yet?” to avoid missing the turnaround from the bottom. We are heading towards a crucial Fed interest rate decision. So what’s Bank of America’s forecast?

Interest Rate Forecast

Bank of America strategist Michael Hartnett suggests that the Fed may need a 4% unemployment rate and a 6% rate hike to curb inflation. Hartnett’s forecast comes ahead of the publication of the Fed’s Summary of Economic Projections for the end of the year.

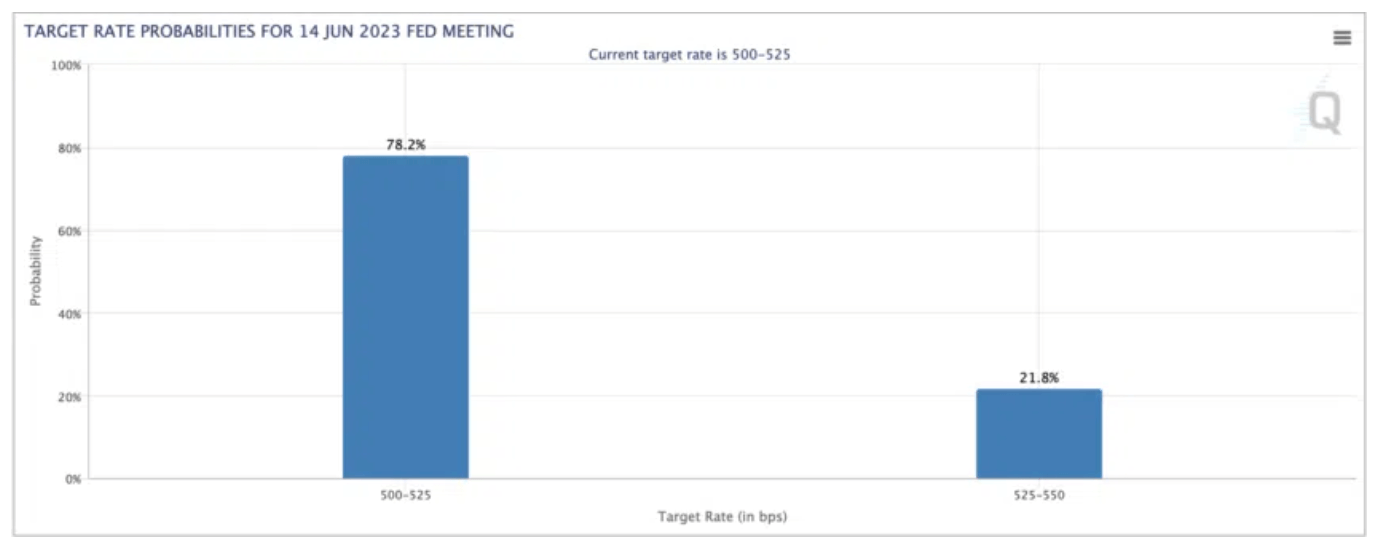

Despite the tepid response to inflation’s interest rate hikes, Federal Reserve Vice Chairman Philip Jefferson implied at the bank’s June meeting that rates will be held in the 5-5.25% range. Futures markets agree, with CME’s FedWatch setting the probability of interest rates remaining stable at 78%. This pause is likely temporary, as revised forecasts for July suggest the Fed may increase interest rates by a quarter point. The announcement of the May US Consumer Price Index on Tuesday is not expected to alter the possibility of a June rate hike.

Antoni Trenchev, CEO of crypto financial services firm Nexo, believes that Bitcoin will follow stocks when the Fed publishes its Summary of Economic Projections this week.

The news will likely reinforce investors’ faith in Bitcoin‘s medium-term expectations and will at least initially reflect market consensus on where the asset is headed.

Impact on Cryptocurrencies

The Fed will also announce its two-year interest rate forecasts at this meeting. From this perspective, the decision concerns more than just June. Risk markets, including cryptocurrencies, will look for changes in the Fed’s projections. The Fed had previously clearly declared that it would not make any cuts until the first quarter of 2024. If we see a step in the opposite direction, the crypto market could experience a rapid rise in the short term.

So will the Fed decide today is the right time for such excitement in the markets? Sticky core inflation says a resounding no. Investors may be more relaxed than in previous meetings, but the release of interest rates will likely not be enough to see fireworks in the sky.

Therefore, Bitcoin and gold investors will likely have to wait at least until the July meeting for interest rates to be held steady. Due to the Fed’s cautious stance, the dollar is likely to maintain or even increase its strength (DXY).

Türkçe

Türkçe Español

Español