By the end of 2021, as NFTs gained popularity, the Solana network emerged as the best alternative for small and medium-sized investors. Investors who were used to buying NFTs at Ethereum‘s transaction fee cost and selling them for high profits saw their gains turn into losses with the FTX crash. While some collections moved to rival networks, the Solana network still shows signs of life.

Solana (SOL) and NFTs

The Solana ecosystem has faced multiple blows since the beginning of the year. We have seen many popular collections, especially the y00ts, move to rival networks. Some even demanded mandatory donations from the Solana Foundation. However, in the past few months, SOL has launched several new features that have the potential to turn the tide in favor of the blockchain. As this happened, SOL bulls entered the market strongly, and the token price increased by double-digit percentages last week.

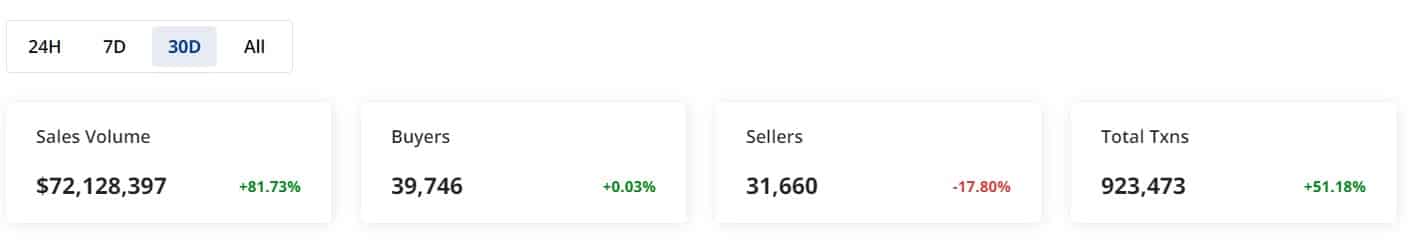

Data from CRYPTOSLAM shows that the total NFT sales volume on the blockchain has increased by over 80% in the last 30 days. Not only that, but the number of transactions has also increased by over 50%, which is promising. Surprisingly, despite the increase in sales volume and transactions, the number of sellers decreased last month.

According to DappRadar, EvIO, GGSG, and SolPunks have been the collections that contributed the most to the growth in the last 30 days.

Solana (SOL)

According to a post by 0xPrismatic, Solana still maintains its appeal and offers an environment similar to early entry opportunities. After being abandoned by most institutional investors following the FTX crash, the network is now trying to turn the critical resistance at $27 into support amidst the new developments regarding the XRP case. For now, it seems successful, and with the increasing demand in the NFT sector, SOL Coin may have good days ahead.

Looking at SOL’s daily chart, it appears that the uptrend may continue. For example, the data from the MACD indicates the dominance of buyers in the market. Solana’s Exponential Moving Average (EMA) Ribbon also shows an upward trend, increasing the likelihood of further price increases. There are no significant developments on the macro front that could suppress the price in the coming days. However, investors may need to exercise caution as we approach the end of the year when we will see the Fed’s interest rate decision.