Since the Federal Reserve (Fed) began aggressively raising interest rates in March 2022, the Japanese yen has significantly depreciated, experiencing one of the most severe currency movements in history. Data shows that the high volatility and excessive depreciation of the Japanese yen have driven Japanese investors towards Bitcoin, the world’s leading cryptocurrency.

Record Trading Volume for BTC/JPY Pair

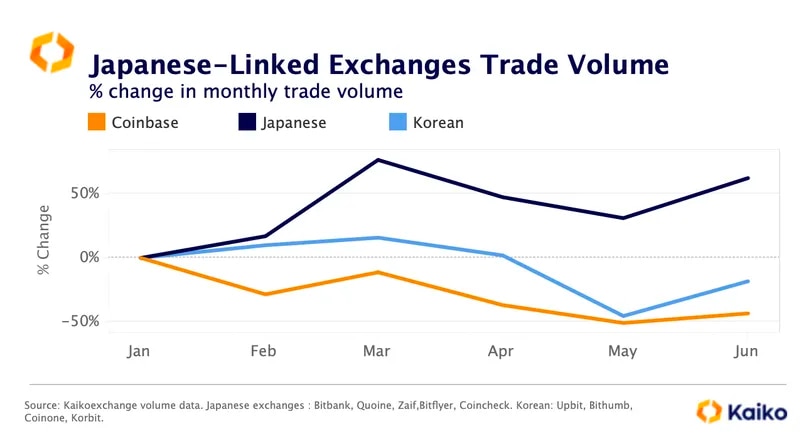

As the Japanese yen has significantly lost value due to the Fed’s aggressive interest rate hikes, Japanese investors have turned to Bitcoin as a hedge against traditional finance. The share of Bitcoin trading volume on Japanese exchanges increased from 69% to 80% in the first six months of the year, reaching a total trading volume of $4 billion in June, representing a 60% increase since the beginning of the year. The trading volume of the BTC/JPY pair, which reflects the value of Bitcoin against the Japanese yen, now accounts for 11% of the total trading volume of all fiat currency pairs.

Dessislava Aubert, a research analyst at Paris-based Kaiko, which tracks data from Japanese cryptocurrency exchanges such as Bitflyer, Coincheck, Bitbank, Quoine, and Zaif, noted that this indicates an increased appetite for Bitcoin in the Japanese markets. Bitcoin is widely regarded as a digital gold and a hedge against inflation and high currency fluctuations in many countries, including Japan.

Divergent Monetary Policies of the Fed and the Bank of Japan

Bitcoin’s price has surged over 84% since the beginning of the year, surpassing $30,000 and trading at a premium on Japanese exchanges. According to Aubert, Bitcoin has traded at an average premium ranging from 0.5% to 1.25% in the Japanese markets this year. The divergent monetary policies of the Fed and the Bank of Japan have played a significant role in the Japanese yen’s 6.3% depreciation against the US dollar. While the Fed has been raising interest rates, the Bank of Japan has maintained an accommodative stance amidst global tightening, leading to a faster depreciation of the Japanese yen.

Compared to the Korean market and Coinbase, listed on Nasdaq, trading activity on Japanese cryptocurrency exchanges has grown more rapidly. Given Japan’s established regulatory framework and the confidence in implementing sanctions to oversee the industry, this trend is likely to continue. Last month, Japan adopted a groundbreaking stablecoin bill to protect investors.

In the near future, the high volatility of the Japanese yen is expected to persist due to speculation that the Bank of Japan will maintain a hawkish stance on its monetary policy next week.

Türkçe

Türkçe Español

Español