FTX, Pepe (PEPE), and Psyop may seem like unrelated projects at first glance. However, a closer look reveals that they are all connected to Twitter (now known as X) and Twitter bots.

FTX Listings and Bot Interaction

FTX’s collapse had a profound impact on the entire crypto ecosystem, especially shortly after the crash of another major crypto project, Terra (LUNA).

Both FTX and Luna are currently involved in ongoing legal battles. However, recent findings indicate that FTX’s suspicious activities extend beyond its financial operations.

According to a report by NCRI, Twitter significantly increased the value of cryptocurrencies listed on FTX. The report revealed that whenever FTX listed new coins, there were sudden price increases largely driven by Twitter activities.

The analysis conducted by NCRI showed that a significant portion of online discussions about the coins listed on FTX (approximately 20%) involved bot-like accounts. Interestingly, these bot-like activities predicted the prices of many FTX coins in the data sample.

Although the bot activities are not directly linked to FTX itself, they have become more widespread and unrealistic after the coins were promoted by FTX. This suggests potential market manipulation through social media channels, raising concerns about the reality and transparency of FTX’s activities.

Where Do PEPE and PSYOP Fit In?

In 2023, there was a noticeable increase in meme coins in the crypto industry. Pepe and Psyop stood out with their rapid rise in market value, reaching 1 billion dollars. Concerns arose when NCRI analyzed the time series of account creations related to Pepe. The analysis revealed abnormal increases in new account creations, especially before the token’s launch.

These increases occurred in September 2022 and, more importantly, one day before Pepe’s launch on April 16, 2023. This pattern indicated possible manipulative tactics, such as using bots to artificially inflate the popularity of tokens.

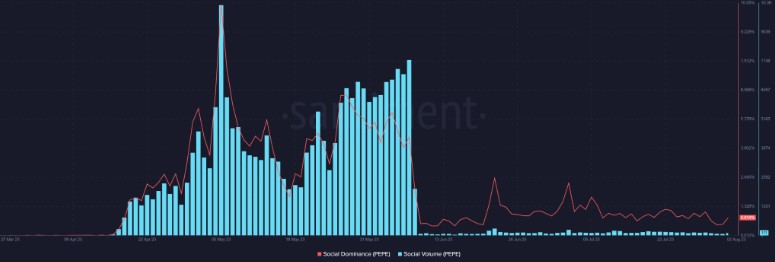

Santiment’s social metrics further highlighted suspicious activities. Pepe’s social volume and dominance showed significant increases after April 17. The social volume reached over 10,200 on May 5, and dominance exceeded 10%.

In addition, Elon Musk’s tweet on May 13 was associated with another increase in volume and dominance. Whether this was coincidental remains uncertain. At the time of writing, Pepe’s dominance had fallen below 1%, and the social volume had also decreased to around 100.

As for Psyop, it was launched shortly after Elon Musk tweeted about a Psyop in response to a shooting incident in the US. The timing drew attention and fueled speculation about potential connections between Musk’s tweet and the token’s launch.

Elon Musk and Dogecoin

It is well known that Elon Musk interacts with the Doge community through his tweets, often mocking and exciting investors. However, not all investors seemed pleased with his actions, and a group of investors filed a $258 billion lawsuit against him.

They accused Musk of artificially inflating Dogecoin‘s price by an astonishing 36,000% within two years before allowing its collapse. The lawsuit claimed that Musk took advantage of his status as the world’s richest person to operate and manipulate what they called the Dogecoin Ponzi scheme.

One key point of the lawsuit was Musk’s appearance on Saturday Night Live in May 2021, where he portrayed a fictional financial expert and referred to Dogecoin as a fraud.

According to some circles, the prevalence of unreal activities in the crypto world continues to be a growing concern, posing risks for investors. Manipulating such activities could create a Fear of Missing Out (FOMO) effect that significantly affects the prices of tokens or coins. This phenomenon has led to closer scrutiny of the crypto market, resulting in examples of pump and dump schemes.

Bitcoin (BTC) and Ethereum (ETH) ETF filings serve as evidence that as the crypto space becomes more mainstream, future regulatory policies may consider such manipulative practices.

Examining the Status of PEPE and PSYOP

The analysis of daily time frame charts for PSYOP and PEPE revealed interesting patterns in trading activities. PSYOP experienced a lack of interaction and low volume after its launch, leading to a significant price drop of over 99% from its initial listing price.

However, around July 17, there was a notable upward trend with an increase of over 697% in price. Despite this increase, PSYOP’s price has not reached the range witnessed during its launch, indicating that it is still far from its previous levels.

On the other hand, PEPE showed more activity than PSYOP on the daily time frame chart. However, like PSYOP, PEPE also experienced a significant loss of over 68% when compared to the price range at the time of its launch.

This suggests a decrease in Fear of Missing Out (FOMO) driven by bots and a return to more normal trading activities.

Türkçe

Türkçe Español

Español