In the world of memecoins, the Shiba Inu ecosystem continues to be one of the most proactive and vibrant. Despite being highly interconnected and having unifying community foundations, the top tokens in the Shiba Inu (SHIB), Bone ShibSwap (BONE), and Doge Killer (LEASH) show differences in on-chain fundamentals.

BONE, SHIB, and LEASH: Profitability Difference

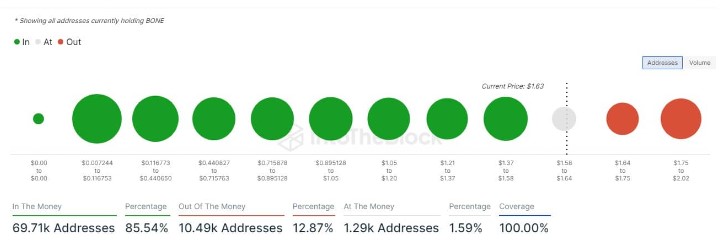

According to data from crypto analysis platform IntoTheBlock (ITB), BONE maintains an almost perfect working rate based on the profit percentage of its current holders. The data showed that 85.54% of the total 69,710 addresses hosted by BONE are currently in profit.

This figure is compared to Shiba Inu, where only 20.5% of the low address or network total, such as 261,980, is in profit. LEASH looks slightly better as 32.97% or approximately 9,450 addresses are currently in profit.

While each of these tokens has its own unique appeal arising from the services they offer as part of the crypto memecoin ecosystem, the combined outlook currently appears gloomy for investors.

Since profitability is a direct function of the protocol’s price movement, investors looking to make long-term investments in Shiba Inu will need to either venture with BONE or evaluate other alternative memecoins.

However, at the time of writing this article, all three tokens experienced declines of up to 3% in the past 24 hours, following the general market sentiment.

What Can Shibarium Change?

In mid-month, the long-awaited Layer-2 scaling solution for the Shiba Inu ecosystem, Shibarium, will be launched at the Blockchain Futurist Conference. The emergence of Shibarium is seen as an important catalyst for the best tokens in the Shiba Inu ecosystem to reach their true potential.

Shibarium could enhance BONE’s role as a governance token. It could also potentially be embraced by a wider audience together with LEASH and SHIB. It is still uncertain whether profitability criteria will change in the near future, but for now, BONE appears as the dominant leader with strong exchange support.

Türkçe

Türkçe Español

Español