A crypto whale holding a significant amount of Ethereum prevented a potential loss of $5 million by selling assets worth $41 million a few days before the market crash. The recent drop in prices occurred following allegations that SpaceX had sold Bitcoin, which most investors declared as FUD.

Whale Remains Unaffected by the Crash

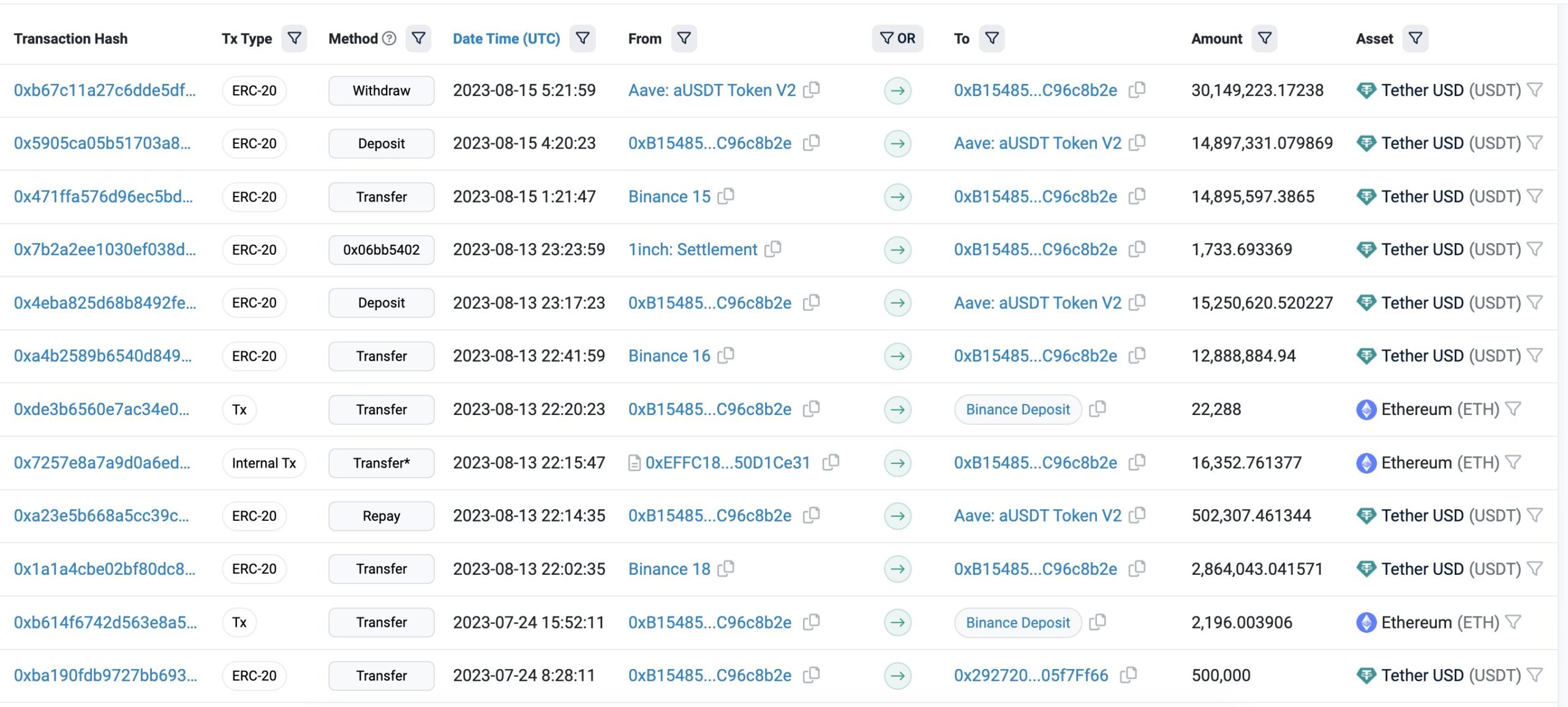

This transaction was shared by Lookonchain, a blockchain data analysis platform that tracks and shares smart transactions. The crypto whale deposited 22,341 ETH on Binance on August 18th and withdrew approximately $41 million.

While the crypto whale’s wallet lost around $1.7 million in value, they managed to avoid potential losses that could have exceeded $5 million when market prices dropped. On August 18th, the total crypto market value declined by 6%, reaching $1.1 trillion, which is the lowest level seen in at least two months.

Ethereum, the second-largest cryptocurrency by market value, dropped from approximately $1,820 per token on August 17th to around $1,597 the next day. Meanwhile, Bitcoin, which accounts for about 50% of the entire crypto market, fell from approximately $28,400 to $25,649 within the same time period, before briefly surpassing $26,000.

Cause of the Crash: SpaceX Allegations

The price drop followed a report highlighting that SpaceX, Elon Musk’s aerospace and space technology company, had sold its BTC holdings, which were valued at $373 million. It remains unclear whether all the assets were sold.

The company’s Bitcoin asset loss caused confusion among members of the crypto community. While some media outlets reported that the company had sold all its BTC holdings, others stated that they could not verify the amount sold based on the report’s statements. Some users on the X (formerly Twitter) platform referred to Musk as “paper hands,” a term used to describe those who cannot hold onto their cryptocurrencies for an extended period.

Türkçe

Türkçe Español

Español