XRP (XRP) and Cardano (ADA) prices have dropped for the second consecutive day as investors steer clear of riskier altcoins. Current data shows both altcoins in the red. Particularly noteworthy is ADA’s significant 3% intraday drop.

Cardano’s ADA Price Drops Despite Positive Developments

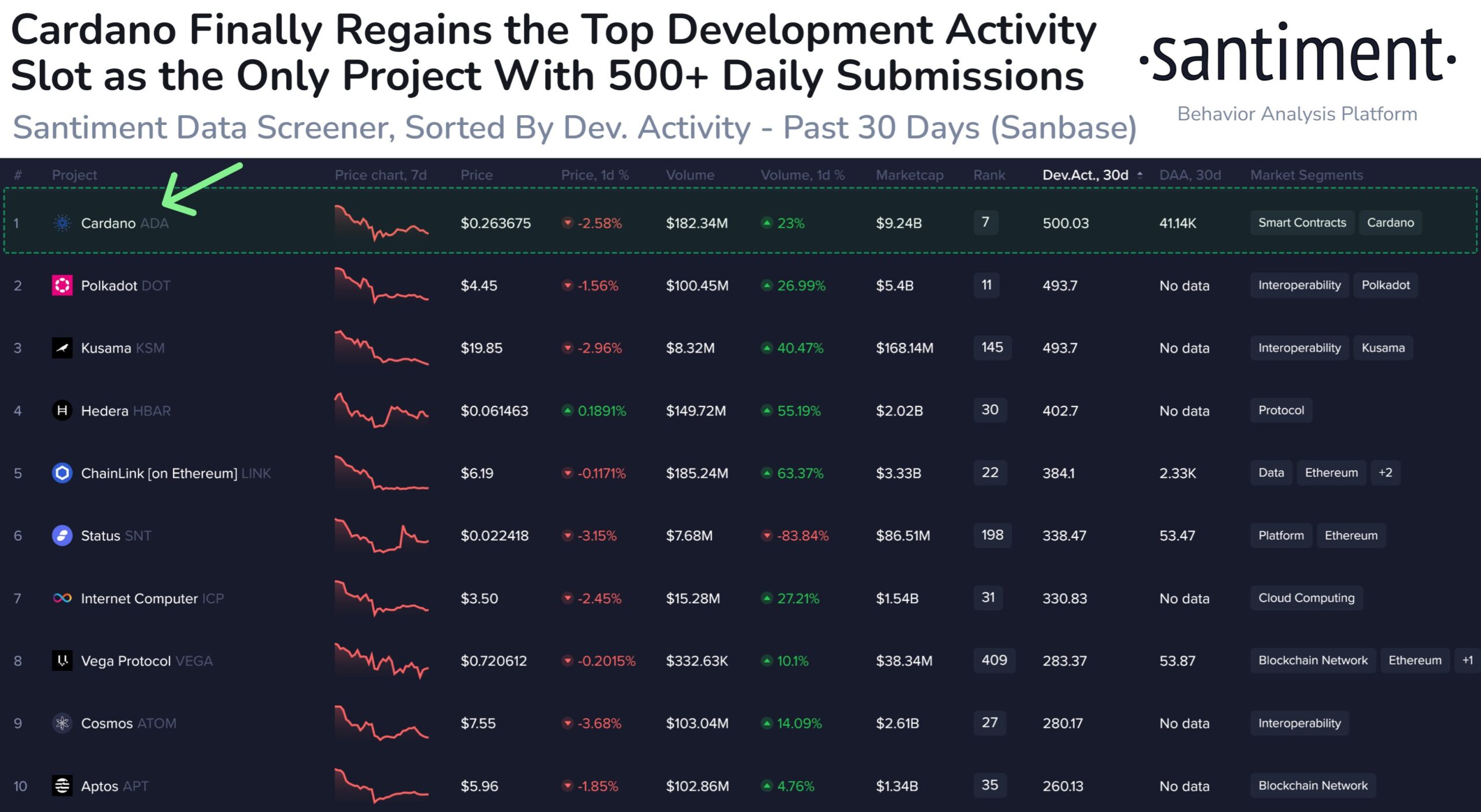

ADA’s price decline comes despite the recent announcement by data analysis platform Santiment that Cardano’s development activity surpassed Polkadot (DOT) and Kusama (KSM) last month, making it the most active blockchain network among all cryptocurrencies. Data shows that ADA’s price has dropped by 2.52% in the past 24 hours, trading at $0.2596.

The rest of the cryptocurrency market is also predominantly in a downward trend. Binance‘s utility token BNB experienced a 1.2% decrease due to concerns about a significant liquidation event on the Venus Protocol, a lending and borrowing platform built on the BNB Chain. According to data from crypto price tracking platform CoinGecko, Bitcoin (BTC) and Ethereum (ETH) have shown minimal changes in the past 24 hours and have failed to generate enough momentum to drive the market upwards.

Furthermore, the Nasdaq futures indicate further progress in US tech stocks, leading to increased gains in the broader equity market and indices following a positive closing session on August 21.

“Buy the Dip” and “Buy the Dip” Calls Decrease

Calls for buying assets at their perceived lowest point, known as “buy the dip,” have started to decrease amidst sideways price movements. On the other hand, calls for buying during a downtrend have seen a significant increase. Santiment notes that “this indicates that investors are still optimistic about a rapid market recovery, but we have seen a significant decrease in overconfidence in the past few days.”

Based on data collected from Reddit, X, Telegram, and 4Chan, Santiment concludes that the declining number of “buy the dip” and “buy the dip” calls suggests that investors are no longer confident in the market’s recovery and pessimism is resurfacing as prices continue to fall.

Additionally, analysts from leading cryptocurrency exchange Bitfinex expect professional investors to turn to sophisticated investment instruments such as futures and options to maximize their profits.

Türkçe

Türkçe Español

Español