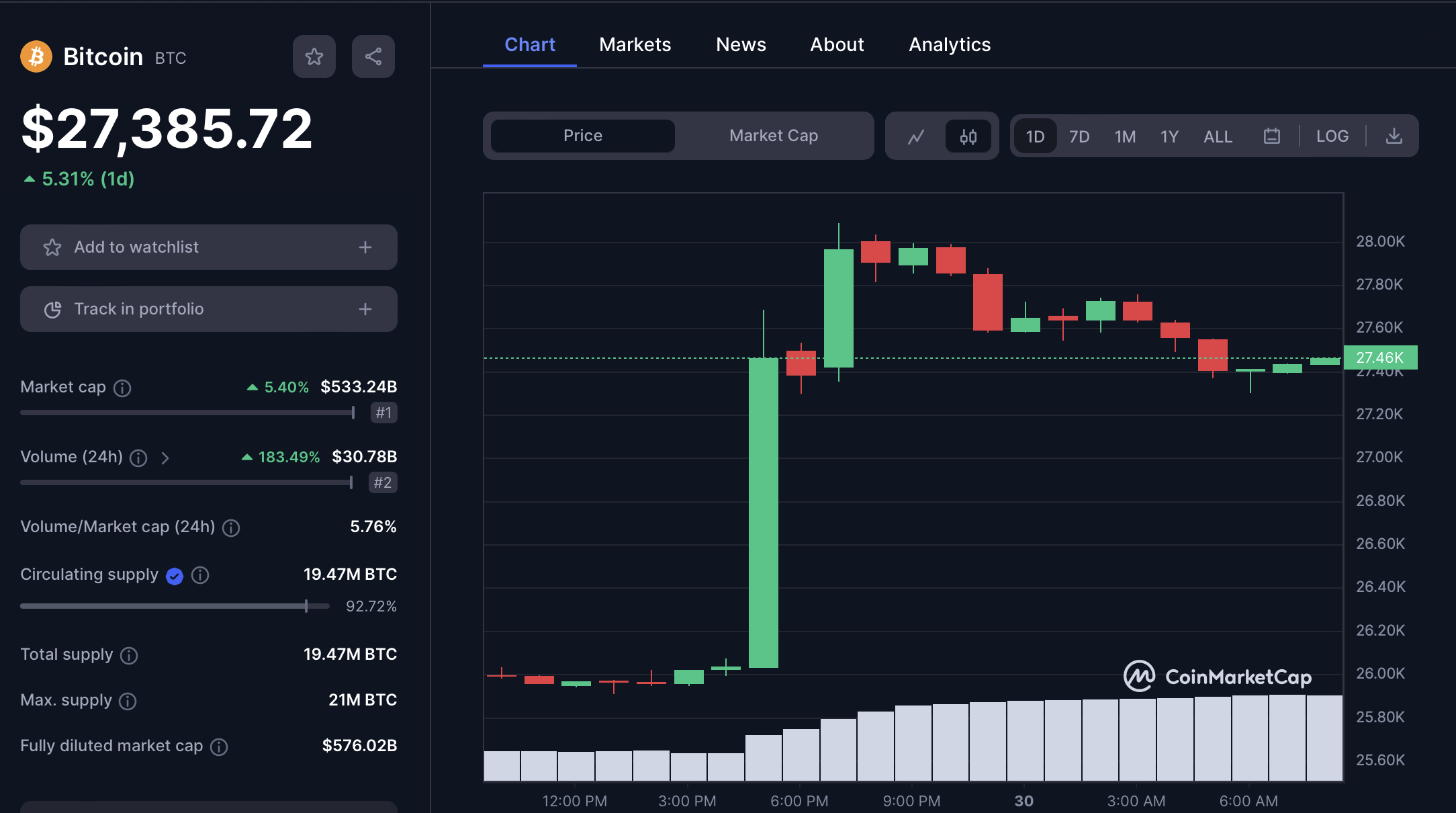

Following Grayscale’s victory in the SEC lawsuit, the cryptocurrency market surged rapidly yesterday. The leading cryptocurrency Bitcoin (BTC) surpassed the $28,000 price levels during the day. Additionally, there was a significant increase in volatility in the cryptocurrency market. According to Coinglass data, approximately $170 million worth of short and long positions were liquidated in the last 24 hours.

High Volatility in the Crypto Market

The Grayscale lawsuit had a strong impact on the markets. With the rapid rise of the cryptocurrency market, the leading cryptocurrency Bitcoin (BTC) also surpassed the $28,000 price levels yesterday. BTC, which gained more than 5% in the last 24 hours, started trading at around $27,300 at the time of writing this article.

Most altcoins in the cryptocurrency market recorded varying increases in value in the last 24 hours. The total market capitalization of the cryptocurrency ecosystem rose to $1.09 trillion, according to CoinMarketCap (CMC) data.

There was also a significant increase in trading volumes. The total trading volume of the cryptocurrency market surpassed $55 billion, showing an increase of over 130% in the last 24 hours.

Over $170 Million Liquidated in Hours

The cryptocurrency market followed a relatively flat trend compared to the past few weeks in mid-August. However, recent developments have caused the cryptocurrency market to regain momentum and increase in volatility.

With Grayscale’s victory in the SEC lawsuit, the volatility in the cryptocurrency market surged again yesterday. According to Coinglass data, a total of over $170 million worth of short and long positions were liquidated in the cryptocurrency market in the last 24 hours, with approximately $75 million being BTC positions.

The largest-scale liquidation occurred on Binance, a cryptocurrency exchange, with an ETH position worth $2.15 million. Furthermore, in the last 24 hours, over 46,000 investors had their positions liquidated in the cryptocurrency market.

Türkçe

Türkçe Español

Español