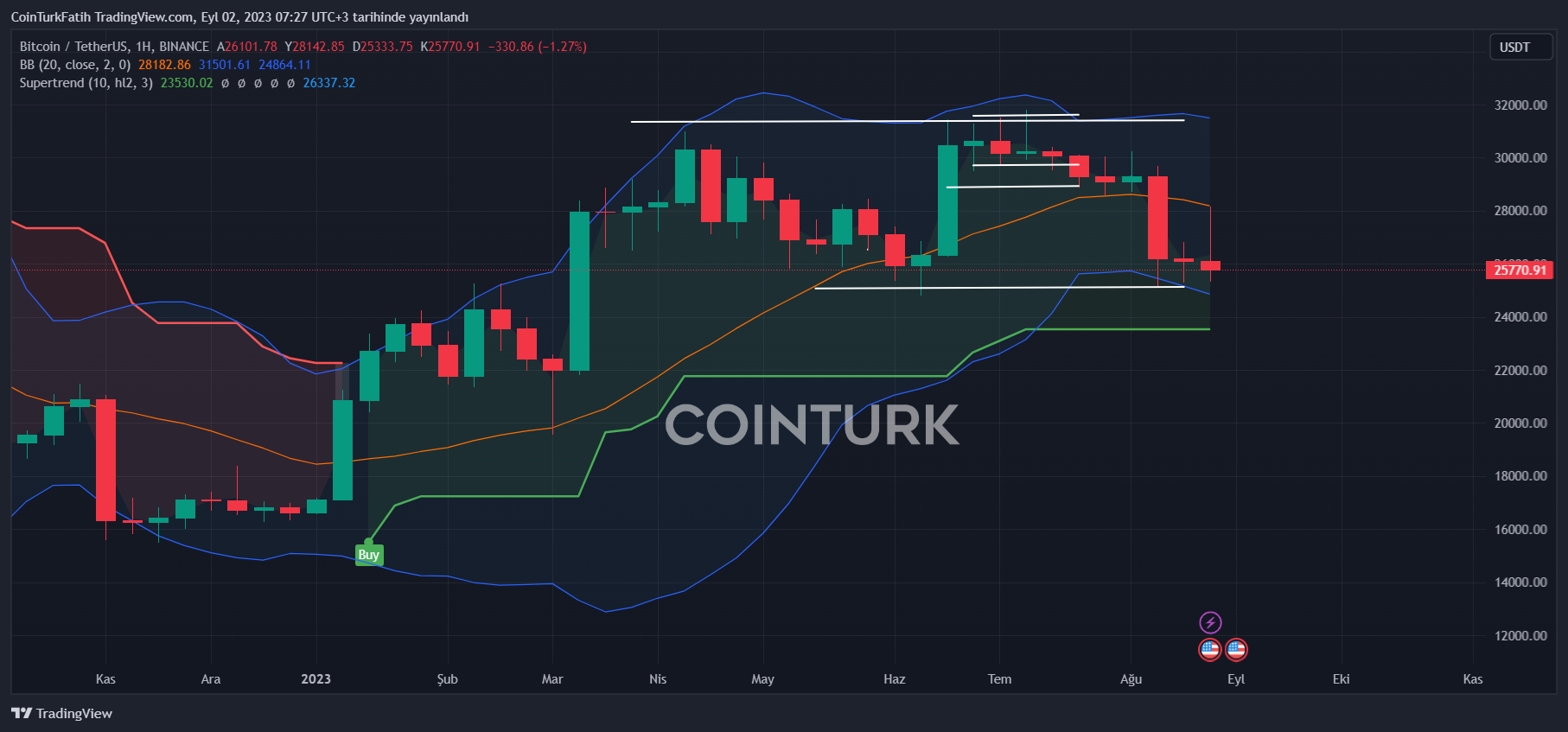

The price of Bitcoin dropped to $25,333 in the last 24 hours, causing even greater losses in altcoins. Risk appetite remains weak in the cryptocurrency markets, and this situation has not changed despite the GBTC news. There are several reasons why cryptocurrencies aren’t rising.

Cryptocurrencies Analysis

The upward momentum that led Bitcoin to a 56.4% gain since the beginning of the year largely evaporated as the price of Bitcoin dropped by 13% to close August. The decision in the GBTC case indicated the start of a new period of growth, but the excitement was short-lived as the massive BTC accumulations sent to exchanges turned into sell-offs, erasing the gains.

The sudden movements in BTC price resulted in losses of hundreds of millions of dollars. This significantly weakened the investors who were expecting an increase. It was already expected that the SEC would postpone its decision on ETF applications. Nevertheless, the market turned downward as if the GBTC decision had not been made. Considering the four-year cycles, this period may correspond to a time when we are running towards the bottom of 2020.

Why Aren’t Cryptocurrencies Rising?

Institutions have been withdrawing from crypto investment funds for weeks. The low trading volume continues in exchanges, and experienced traders continue the downward trend. There are many reasons for this both on the macro level and in the crypto sector.

Federal Reserve Chairman Jerome Powell took a hawkish stance in his speech at Jackson Hole on July 25. He emphasized that there may be a need for further interest rate increases while the fight against inflation continues. Last year, it was debated whether 5.5% would be a reasonable ceiling for interest rates. The bank failures and strong credit tightening in March created expectations that this ceiling could be announced earlier. However, the Fed is not stopping. Despite interest rates remaining above a reasonable level compared to inflation figures, there is a prevailing view that there may be one more increase this year.

Investors hope that Powell is bluffing. In 2021, when inflation reached new highs, the Fed Chairman mentioned that it was temporary in order to avoid causing a sharp turn. If he does not want to make a sharp turn in the opposite direction now, it can be considered reasonable for him to make more hawkish statements than necessary. The decisions that the Fed will announce on September 20 and the three-year interest rate projection can affect the medium-term performance of Bitcoin.

However, for now, investors are reluctant to take on more risks due to the potential lawsuit the US Department of Justice may file against Binance, as well as the pressure from the Fed and other regulators.

Türkçe

Türkçe Español

Español