With the decline in BTC futures data, the possibility of Bitcoin‘s price dropping to $22,000 is increasing. The price chart of Bitcoin leaves no doubt that investor sentiment has worsened after Grayscale Asset Manager’s successful appeal to the US Securities and Exchange Commission (SEC) on August 29, followed by the SEC’s postponement of numerous spot BTC exchange-traded fund requests.

Bitcoin Investment Trust Excitement Fades

By August 18, the 19% rally following the initial application of BlackRock ETF had completely reversed with Bitcoin returning to $26,000. Subsequently, attempts to regain the $28,000 support level failed after positive news related to Grayscale Bitcoin Trust increased the likelihood of ETF approval.

The morale of cryptocurrency investors was tarnished when the S&P 500 index closed at 4,515 on September 1, just 6.3% below its all-time high in January 2022. Even gold, which has been unable to surpass the $2,000 level since mid-May, is 6.5% away from its all-time high. As a result, the excitement among Bitcoin investors for the 2024 halving event is diminishing.

Some analysts attribute Bitcoin’s lackluster performance to ongoing lawsuits against two leading exchanges, Binance and Coinbase. Furthermore, many sources claim that the US Department of Justice could accuse Binance of criminal investigation, based on allegations of potential violations of money laundering and sanctions involving Russian entities. North Code Capital CIO and Bitcoin supporter Pentoshi expressed his views on the current conditions in a tweet.

According to Pentoshi, potential gains from the approval of spot ETFs will outweigh the impact of final regulatory actions on exchanges. However, this analysis does not take into account the fact that US inflation, as measured by the Consumer Price Index, decreased from 9.1% in June 2022 to 3.2% in July 2023.

Additionally, the Federal Reserve’s total assets decreased from a peak of $8.73 trillion in March 2023 to $8.12 trillion. This indicates that the monetary authority is withdrawing liquidity from the markets, which undermines Bitcoin’s narrative as a hedge against inflation. Looking at a longer time frame, Bitcoin has maintained the $25,000 level since mid-March, but a closer look at derivative data indicates that bulls’ belief is being tested.

Worrying Development in Futures Data

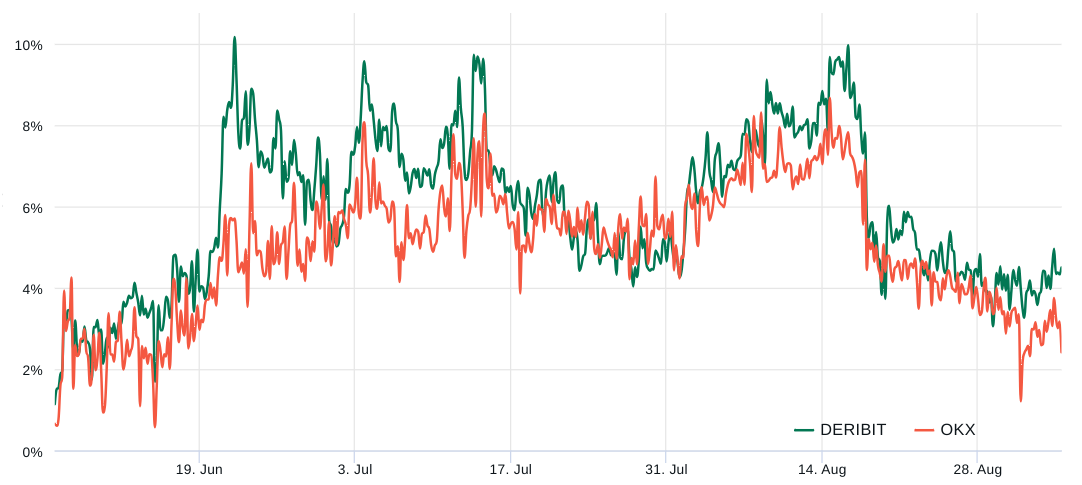

Bitcoin monthly futures contracts typically trade at a slight premium compared to spot markets, indicating that sellers demand more money to delay settlement. Therefore, in healthy markets, BTC futures contracts should trade at a premium of 5% to 10% annually, which is not unique to crypto markets.

The current 3.5% futures premium for Bitcoin is at its lowest level since mid-June before BlackRock’s spot ETF application. This indicator reflects a decrease in investor demand using futures contracts.

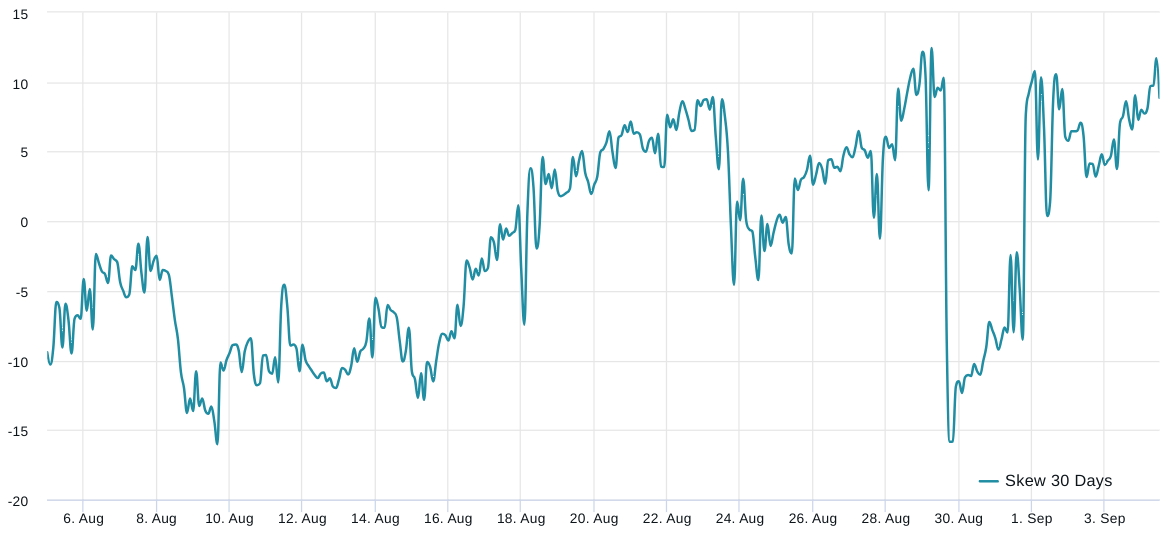

As shown above, the skewness of options with a 25% delta has entered the decline zone recently, with protective put options trading at a 9% premium compared to similar call options on September 4.

Futures Point to $22,000

Considering concerns about the lack of measures to prevent transactions taking place on unregulated offshore exchanges using stablecoins, a spot ETF approval for Bitcoin could potentially be delayed until 2024, strengthening the downward momentum. Meanwhile, regulatory uncertainty and fear surrounding potential actions by the Department of Justice or ongoing lawsuits against exchanges by the SEC are favoring the bears.

Ultimately, despite the increased likelihood of Bitcoin ETF approval, the recent inability to sustain positive price momentum suggests a possible retreat towards the $22,000 level, where the futures premium was last seen at 3.5%.

Türkçe

Türkçe Español

Español