The world’s largest cryptocurrency exchange, Binance, has published its 10th Proof of Reserves (PoR) report. According to the report, users hold approximately 588,000 Bitcoin (BTC) and 3.89 million Ethereum (ETH) on the exchange. Here are the highlights from the Proof of Reserves report.

Key Details and Figures from Binance’s Proof of Reserves Report

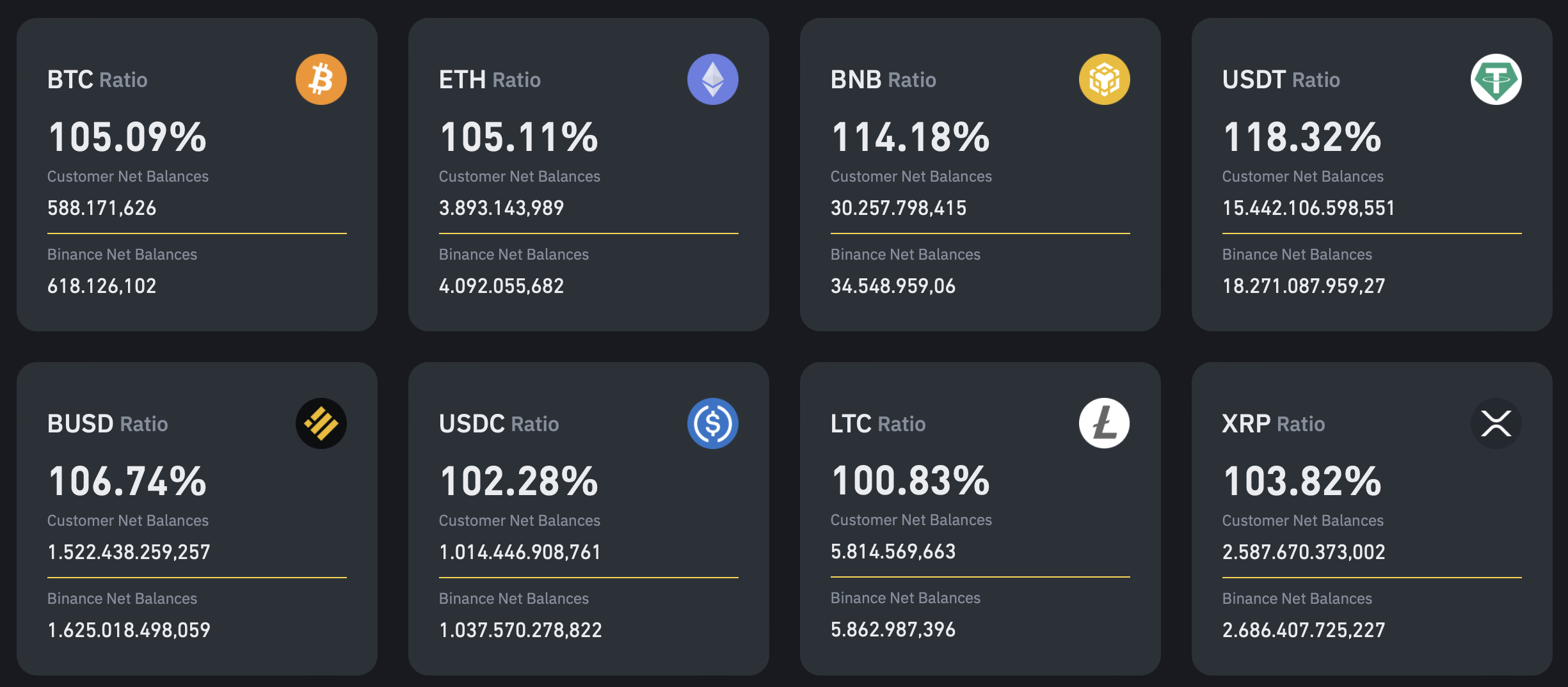

Binance, the giant cryptocurrency exchange, has released its highly anticipated Proof of Reserves report. The report reveals that users hold approximately 588,000 BTC, a 4.3% decrease from the previous report, and 3.89 million ETH on the exchange. Additionally, the report shows an increase in the number of Tether (USDT) holdings, rising by 1% to 15.44 billion USDT compared to the previous report.

The report also provides detailed figures on users’ holdings of various other cryptocurrencies on Binance. Users hold 30.25 million BNB, 1.52 billion Binance USD (BUSD), 1 billion USD Coin (USDC), 5.81 million Litecoin (LTC), 2.58 billion XRP (XRP), 29.98 million Solana (SOL), 54.45 million Chainlink (LINK), 138.19 million 1Inch (1INCH), 15.34 million Aptos (APT), 276.62 million Arbitrum (ARB), 93.23 million Curve DAO (CRV), 3.46 billion Chiliz (CHZ), and 11.81 billion Dogecoin (DOGE).

In addition to the above cryptocurrencies, the report also provides information on users’ assets and the corresponding reserves held by Binance for many other cryptocurrencies.

What is Proof of Reserves (PoR) for Cryptocurrency Exchanges?

Proof of Reserves (PoR) is a method that shows the assets held by cryptocurrency exchanges in custody wallets, especially for users. PoR provides evidence that the assets of users on cryptocurrency exchanges are fully and mutually held and protected in a 1:1 ratio.

For example, when a user deposits 1 BTC on a cryptocurrency exchange, the exchange’s reserves increase by at least 1 BTC to ensure the full backing of customer funds. This means that the cryptocurrency exchange holds all user assets in a 1:1 (and some reserves) ratio.

Türkçe

Türkçe Español

Español