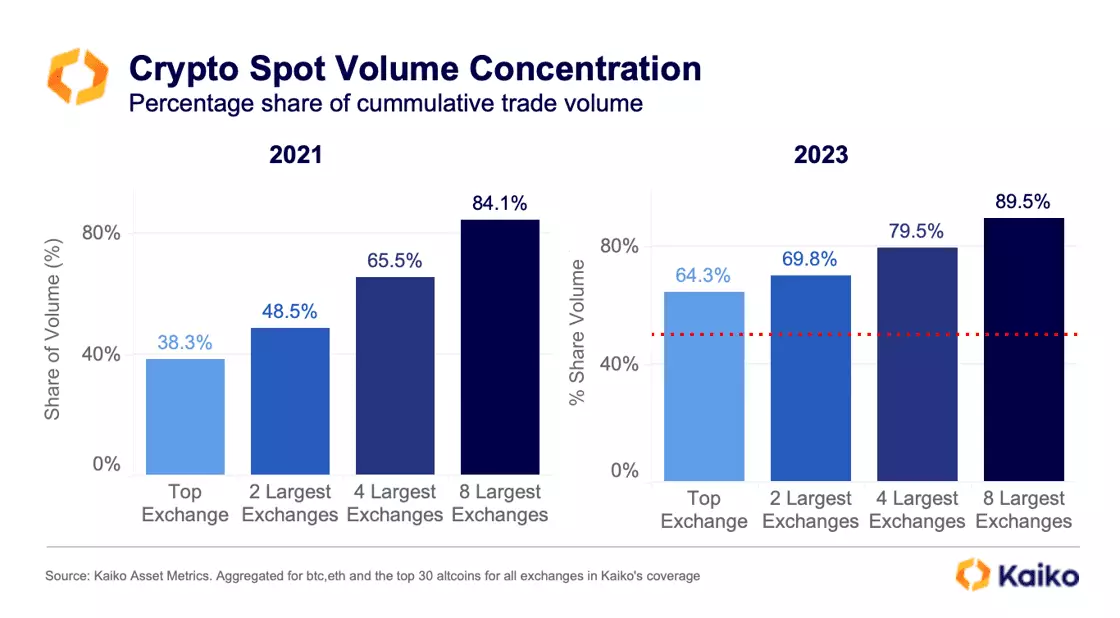

According to the data obtained, it shows that the world’s top cryptocurrency exchanges are taking an increasingly larger share of the industry’s trading volume. A leading analytics company has presented striking reports!

“Binance Maintains Its Leadership!”

Cryptocurrency analysis firm Kaiko claimed in a new report that the eight largest exchanges in the world account for over 91% of market depth and 89% of total volume. Just like a few years ago, Binance still maintains its leadership. The analytics firm stated the following:

Liquidity has intensified and continues to do so over time. By 2023, Binance, the largest exchange, accounted for 30.7% of global market depth and 64.3% of global trading volume. The top 8 platforms account for 91.7% of depth and 89.5% of volume. Since 2021, Binance’s spot volume market share has increased from 38.3% to 64.3%. It is worth noting that a significant portion of this increase is linked to Binance’s zero-commission trading promotion.

Leading analytics company Kaiko highlighted that liquidity is concentrated in only a handful of exchanges, and despite the existence of hundreds of trading platforms, most cater to only one segment of the market activity. The company stated the following on the subject:

From a market perspective, it would be optimal for liquidity to concentrate in only a few exchanges, but the cryptocurrency industry as a whole places great importance on decentralized structure. When it comes to centralized exchange (CEX) liquidity, there is very little decentralization.

Prominent Exchanges in Altcoins!

Due to the anti-cryptocurrency regulations agenda in the US, Kaiko emphasized that altcoin liquidity has suffered and concentrated in three major exchanges. The company stated the following:

Kraken has performed particularly well in altcoin liquidity, making it a strong competitor to Coinbase. Since August 2022, Kraken has not seen any decrease in market depth for the top 30 altcoins, while Coinbase has lost around $5 million in liquidity.