The volatility in the price of Bitcoin continues, with the price dropping below $25,000 yesterday after a long period of stability. However, this worrying movement was followed by a quick recovery. A popular analyst closely followed by investors highlighted a rare move before yesterday’s significant BTC price drop.

Crypto Expert’s Comment

Analyst Jason Pizzino shared his latest predictions about the markets approximately 24 hours ago. The analyst’s current view suggests that Bitcoin (BTC) and all other risky assets have now reached the bottom zone. Moreover, this signal also fuels hopes of a strong rally starting soon.

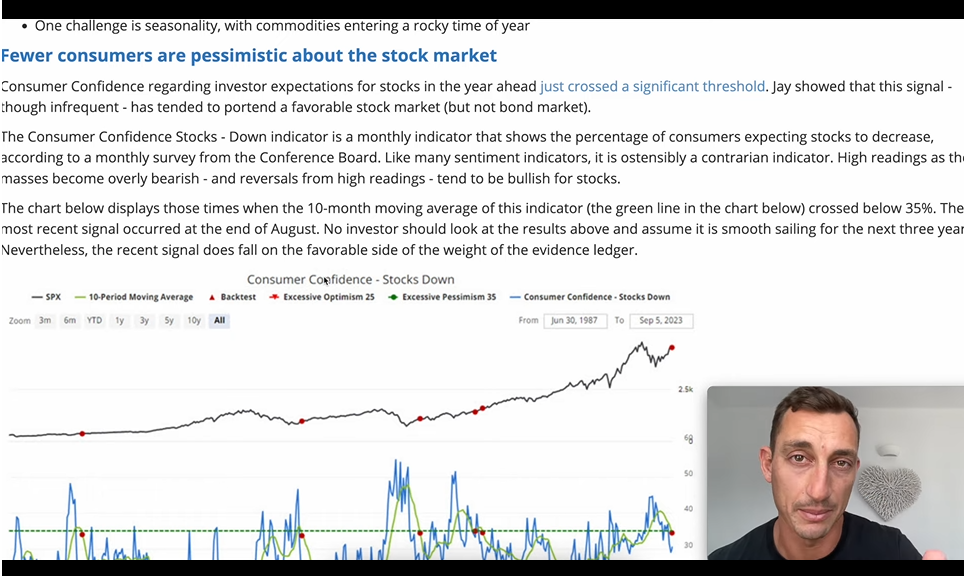

Referring to Sentimentrader’s data, Pizzino says that CCI essentially serves as a contrary indicator for the stock market, with downward CCI readings indicating future market growth and upward readings indicating enthusiasm.

“Like many sentiment indicators, this is a contrary indicator. As the masses enter a state of extreme decline, higher figures are observed. Therefore, you want to see reversals from higher readings. The masses were in a state of extreme decline.”

When Will Crypto Assets Rise?

With the confirmation of CCI’s reversal and its fall below the 70 level, Pizzino said that based on the past, stocks and cryptocurrencies should start to rise within the next three to six months. Therefore, we may witness an impressive rally for Bitcoin in the medium term.

“Many data points indicate that these markets will rise within the next three to six months. It’s not that far away. No one can know what will happen from today to tomorrow, but things look pretty good in the long run.”

Regarding Bitcoin, Pizzino says that a modest move towards key support levels is more likely than a dramatic plunge to much lower prices.

“At this stage, I don’t expect to see a new period of extreme selling down to $19,500 or $15,500. Even though there might be short-term spikes due to drying liquidity, such a scenario will not occur in daily or weekly closings.”

According to the analyst, $23,500 could be a good buying zone in the event of a possible downturn.

Türkçe

Türkçe Español

Español