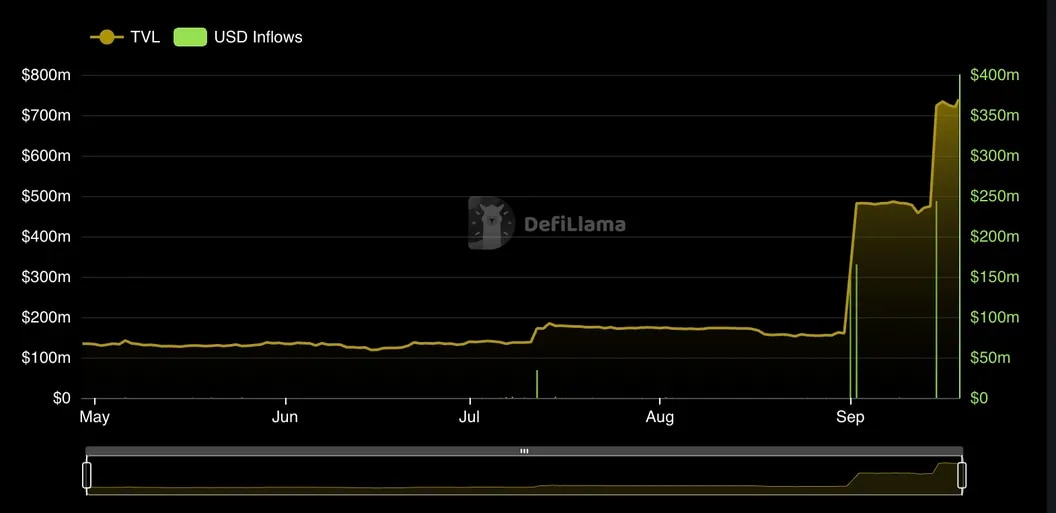

Data from decentralized finance data provider DefiLlama shows a significant increase in BETH deposits, which enable Ethereum‘s native asset ETH to be staked as liquid assets, at Binance. The total locked value (TVL) in BETH stake contracts has increased more than fourfold to $731 million.

Interest in Binance’s BETH is Growing

Following Binance’s transition to the Ethereum Blockchain’s Proof of Stake consensus mechanism, interest in BETH, the liquid staking token introduced by Binance in April, has been growing. The TVL of BETH stake contracts fluctuated between $120 million and $170 million until it reached $165 million in two transactions on September 1st, and then $243 million in a single transaction two weeks later. Apart from these two transactions, daily inflows into BETH stake contracts remained below $500,000.

Liquidity staking tokens are derivative tokens obtained by staking Ether (ETH) in services offered by DeFi protocol Lido Finance or crypto exchanges like Coinbase or Binance, and receiving derivatives in return. By staking ETH in these services, users hold an asset that they can use in the DeFi market and elsewhere, while also earning interest.

Etherscan data shows that all four largest BETH holders are wallet addresses controlled by Binance. This could indicate that the activity in these wallet addresses reflects transactions by Binance users on the chain.

Institutional and Individual Investors Continue to Trust Binance

Although BETH’s total locked value is relatively low compared to the $14 billion worth of ETH staked in Lido Finance and the $2 billion worth staked in Coinbase, irregular inflows show that institutional and individual investors continue to trust Binance despite regulatory uncertainty surrounding the cryptocurrency exchange.

Lido Finance currently offers a 3.6% APY for staked ETH, which is significantly higher than BETH’s 3.25%. However, it is not entirely clear how ETH stakers on Binance earn gains, unlike decentralized ETH staking systems like Lido Finance.

Türkçe

Türkçe Español

Español