Bitcoin’s (BTC) good performance last year enabled many investors to make a profit after the 2022 bear market. However, it was discovered that the current state of unspent transaction outputs (UTXO) in profit might have put the BTC price at risk. UTXO in profit represents the percentage of cryptocurrencies that were worth less at the time of their creation compared to their current value. On the other hand, UTXOs at a loss are tokens that are worth less now than at the time of their creation.

Metrics Influencing Bitcoin’s Price

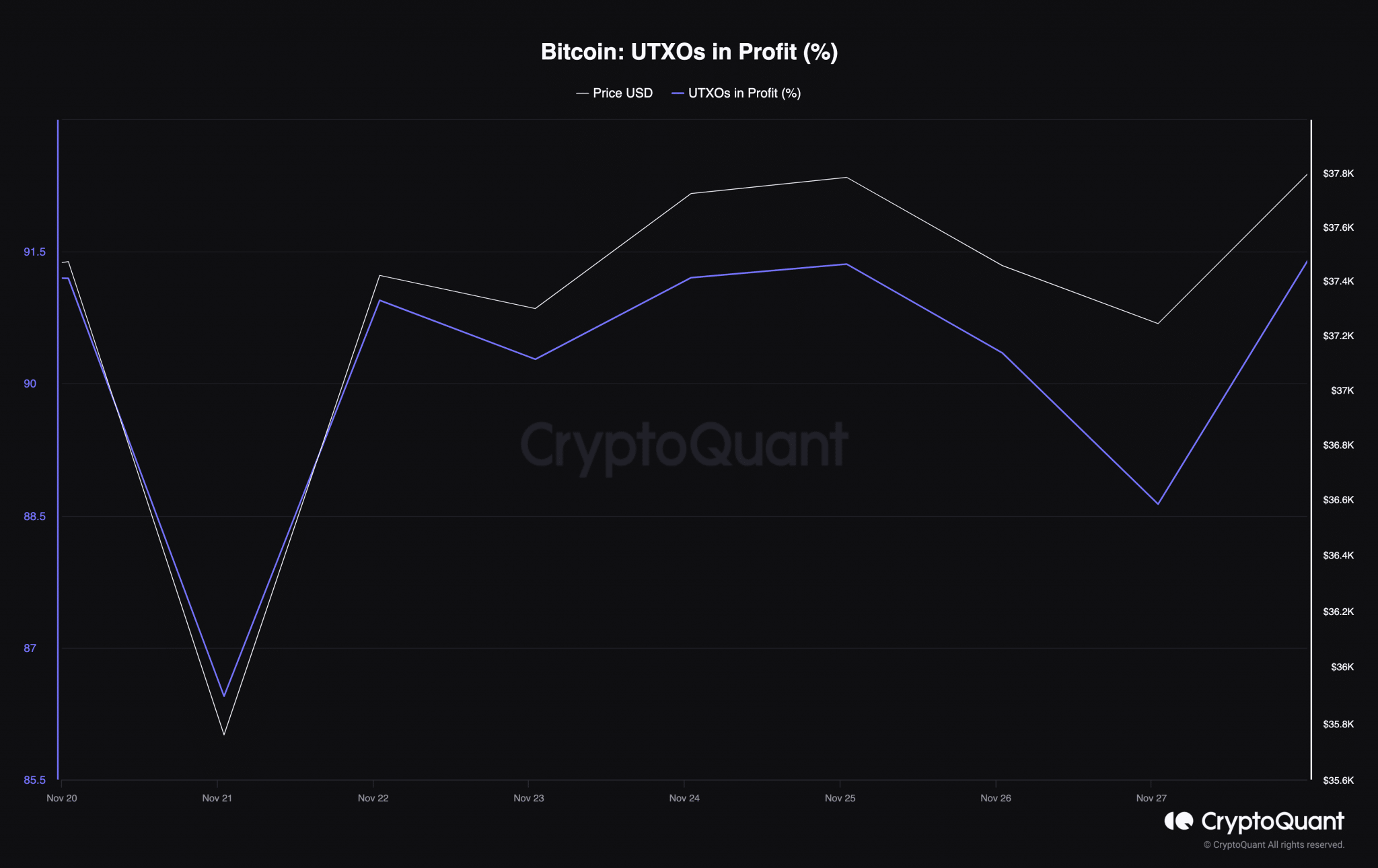

The mentioned metrics can be very important in determining the market’s peak and trough points. Data obtained from CryptoQuant showed that UTXO in profit rose to 88.63%. In past cycles, when UTXO in profit reached 95%, Bitcoin’s price corrected. Therefore, if the cryptocurrency price rises and converts more UTXO into profit, a significant drop could occur. This idea was also confirmed by on-chain analyst SimonaD. SimonaD, who published her analysis on CryptoQuant, said the following:

The last time the market was in a high state where more than 95% of UTXOs were in profit was during the biggest bull market of 2021. This means we need to pay close attention to this area if it is touched and surpassed in the coming period.

The analyst continued to check whether investors were being cautious. However, the estimated leverage ratio (ELR) suggests otherwise. ELR shows the average leverage used by investors in the market. A decreasing ELR indicates that investors are taking low-leverage risks. Yet, Bitcoin’s ELR had increased. This rise indicates that investors are making significant investments based on price movements.

Glassnode Reports

On the other hand, 49.79% of the 24-hour open positions consisted of short positions. Such a scenario could indicate that investors are uncertain about the direction BTC might move. Currently, BTC could continue to trade sideways, exposing both long and short positions to the risk of liquidation. Data from Glassnode showed that Bitcoin’s STH-SOPR rose to 1.02.

STH-SOPR evaluates the behavior of short-term investors using sensitivity shown within 155 days. STH-SOPR values below 1 indicate a good entry for buyers. Therefore, at the time of writing, Bitcoin’s STH-SOPR suggests that the time to exit the market might be approaching. For now, the Bitcoin price could drop to $42,000. However, there is a widespread expectation that the 2024 bull market could send prices to a new all-time high (ATH).

Türkçe

Türkçe Español

Español