Crypto markets might be ready for a relief rally after the surge in June; some analysts suggest the selling pressure on exchanges has decreased. Blockchain data analysis platform Santiment team stated on July 2 on X that there are significant reasons to be optimistic after so much selling pressure when looking at the outlook for July.

Is the Selling Pressure Over?

During this period, negative market sentiment and investor losses could mean a relief rally is just beginning. According to Tradingview data, Bitcoin fell nearly 7% in June, dropping to $59,500 within the month, and with the $60,000 level acting as support, it was trading at $62,833 at the time of writing.

TradingView data shows that the total value of the crypto market decreased by approximately $400 billion between its peak of $2.5 trillion and last month’s lowest level, with many other cryptocurrencies following suit. Analyst and CryptoQuant-approved author Minkyu Woo had a similar reason for optimism, stating in a July 1 post that sellers had finally exhausted.

Details on the Subject

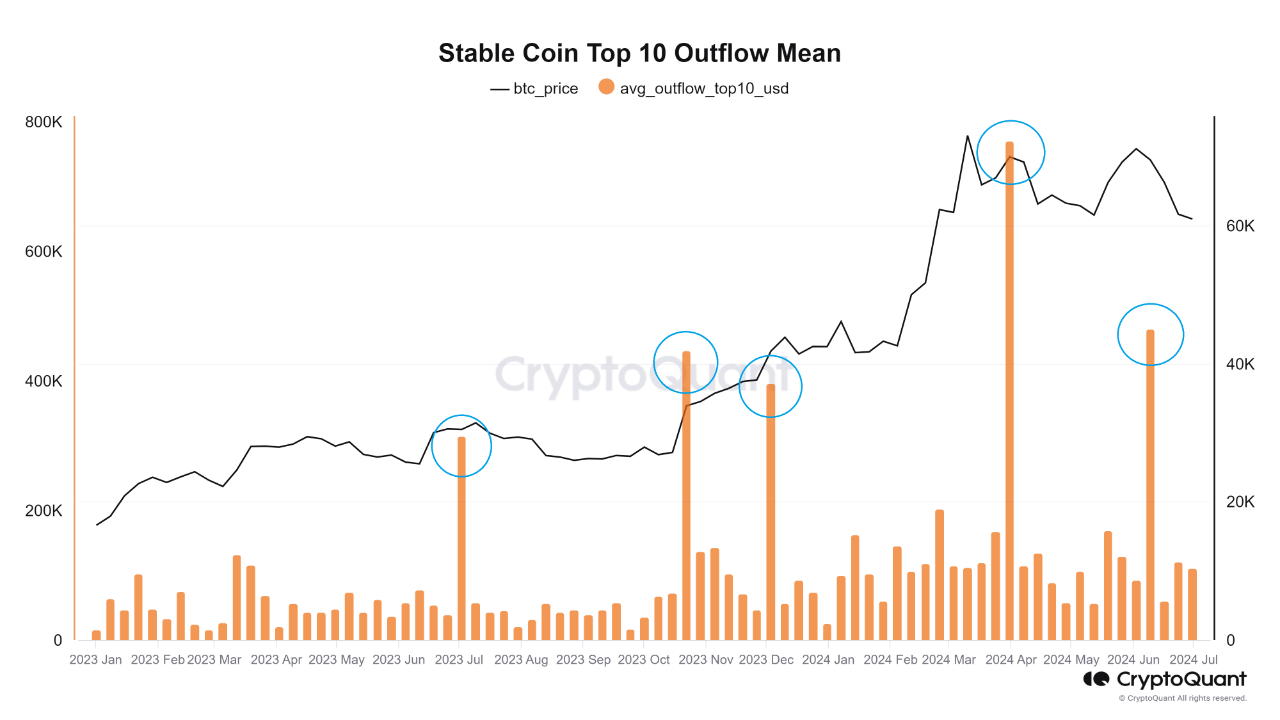

Since January of last year, the average size of the highest Tether outflows from exchanges showed a decrease in outflows following a strong rise, indicating that the recent increase in June showed a reduction in large-scale selling pressure on exchanges. Regarding the subject, Minkyu Woo shared the following statements:

“This decrease in outflows indicates that investors tend to hold onto their assets rather than cashing out. This could mean that investor sentiment has become more positive following the Bitcoin halving event.”

Bitcoin is currently trading around $62,950, down 0.4% in 24 hours. Some of the negative events for Bitcoin and the crypto market this month include the unlocking of $9 billion worth of Bitcoin by the long-bankrupt crypto exchange Mt. Gox, which could lead to selling pressure as creditors try to cash out their cryptos that have been locked up for a decade.