Metaverse altcoins were in high demand among investors at the end of 2021, but the excitement has faded in 2023. While Bitcoin has seen double-digit gains on a weekly basis, many cryptocurrencies like SOL Coin have managed to multiply their prices. However, APE Coin is not showing the expected performance.

APE Coin Review

APE Coin hit its yearly low in September and then rose to $1.5, but it couldn’t do more. Interest in NFTs and the metaverse has significantly weakened, and it doesn’t seem to be able to recover in the short term. Market data also suggests that the expected rise in APE Coin won’t happen anytime soon.

Between October 20 and November 10, despite a more than 10% recovery in price, open positions for APE Coin decreased by a surprising rate of 30%. As seen in the Velo chart below, the total open position for APE decreased from $55 million to $38 million. We have previously mentioned how open positions for BTC and Ether have multiplied during the same period.

The weakness in open positions indicates that investors are not interested in APE Coin. The lack of interest in the futures market also suggests a significant weakening of risk appetite in the spot markets.

APE Coin Could Fall

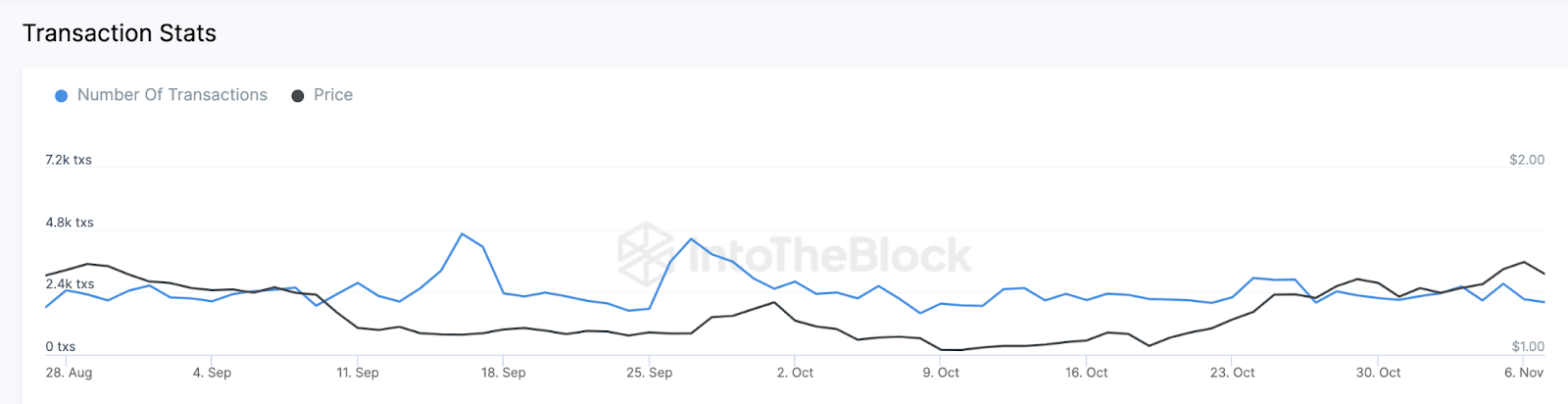

The number of transactions on the ApeCoin network also suggests a weak belief in the rise. As seen in the IntoTheBlock chart, daily transactions for APE have remained relatively stable since the bull rally in the crypto market began.

Since surpassing 4,460 transactions on September 27, the daily transaction count for APE has significantly dropped. As of November 10, APE recorded only 2,020 transactions, showing a decrease of over 50% compared to the September peak.

During yesterday’s BTC decline, APE Coin price dropped to $1.15 and is now at $1.388. Although weak, closings above $1.2 for now could indicate a continuation of the rise, but the $1.5 resistance may not be overcome with this lack of demand.

In a possible bearish scenario, the price could drop to $1.2 and $1.08 with closings below $1.275. The next stop would be a new low below the psychological support of $1.

Türkçe

Türkçe Español

Español