The bull of 2021 was short-lived and we even experienced an intermediate drop. However, bear markets are notoriously frustrating. The bear market that intensified in 2022 with the Federal Reserve’s start of interest rate hikes peaked with the collapse of LUNA and others. The cherry on top was the FTX collapse, but we have yet to clearly see the end of the bear season.

Opportunities in Bear Crypto Markets

Influential projects like Solana, Cardano, and CryptoKitties were developed during bear markets. Bitcoin itself was designed by Satoshi Nakamoto in the midst of the 2008 global financial crisis, which was the king of bear markets and a loud wake-up call about how flawed traditional finance could be.

Bull runs can make almost every asset appear attractive and the sector may seem less risky than it actually is. However, when the waters calm and the charts start to weaken, even the most ardent optimists may find themselves in a dangerous situation where their familiar decision-making approaches are no longer effective. Bear markets are the right times to build and seize opportunities. Unlike bulls, you will find the opportunity to enter most promising projects at very low costs.

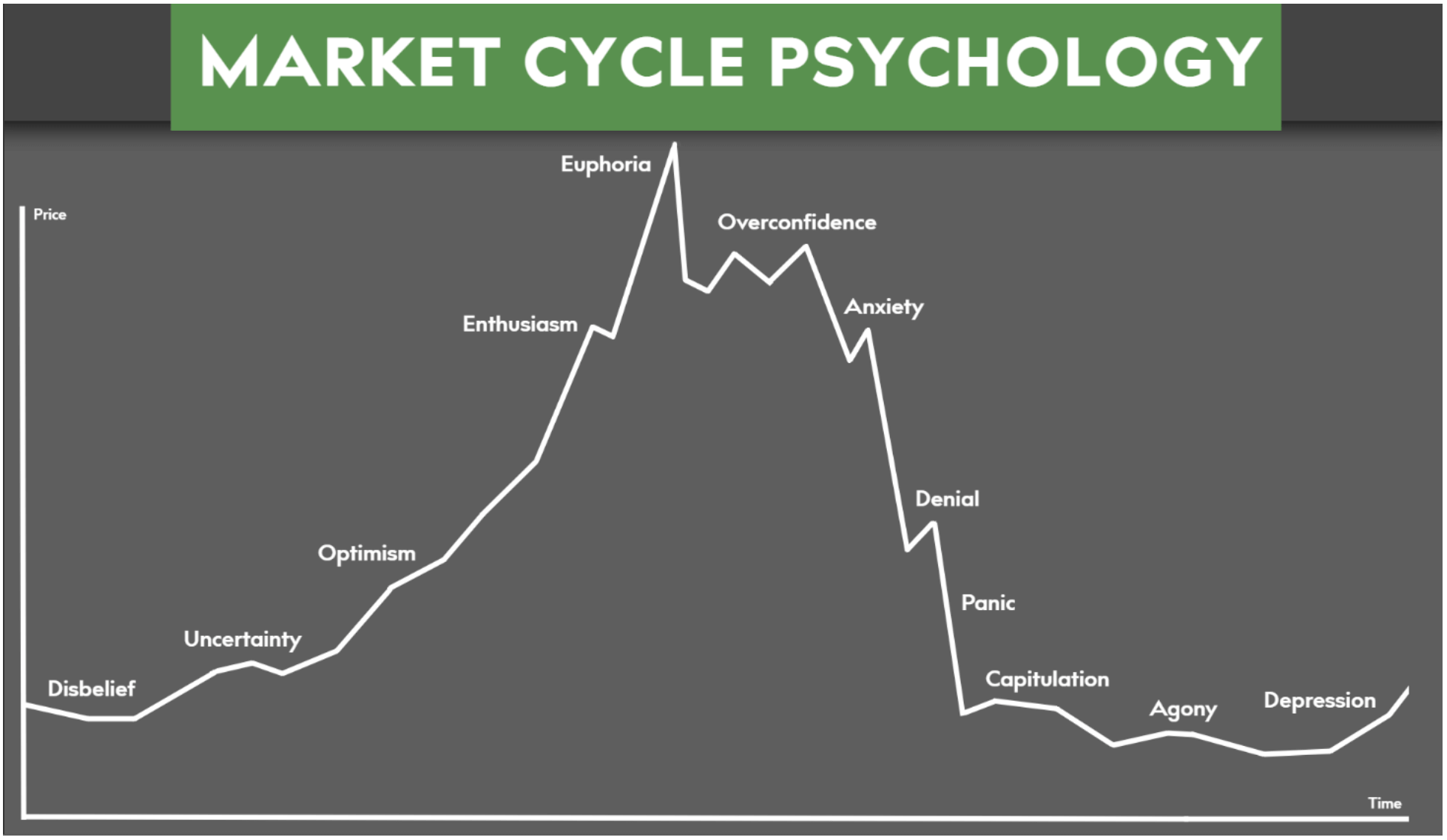

Market Psychology

Projects that have just been launched cannot reach their deserved value in bear markets. But when the bull season arrives, we see many unnecessary tokens reach ridiculous market values. Therefore, while developers continue to build during the bear season, loyal crypto participants should look for entry opportunities into the right projects. It is not surprising that BlackRock and others dive into crypto in the middle of the bear season.

Crypto Projects and Bear Season

According to Alchemy’s Web3 Development Report, despite a significant drop in consumer crypto confidence in the 4th quarter of 2022, there was a remarkable 453% increase in blockchain developer activities. This decrease coincided with a tough market environment where there was no positive outlook. Stars of the bull are born in bear markets and those who take risks at the right time gain bigger profits than those who are reckless in the bull.

Regardless of market conditions, in 2022 alone, crypto projects from all over the world collectively raised about $15 billion in VC investments, showing the unwavering determination of developers to build and the enduring vision of venture firms to seize opportunities.