The largest cryptocurrency exchange in the world by volume, Binance, has recently published its latest report. The report provides important information about the current sentiment of users. So what does the last report tell us? Are entries into cryptocurrency markets still ongoing? Here are the details.

Binance Reserve Report

After the collapse of the FTX exchange, Binance and others felt the need to take action regarding proof of reserves. FTX, which moved and used customer assets without permission, went bankrupt because it could not adjust the risks it took correctly. Since the money it bankrupted was customer balances, the investors’ perspective on centralized exchanges was negatively affected during this process. Central crypto exchanges also send the message “you are safe” to investors with on-chain reserve proofs to eliminate the emerging mistrust. Binance recently published its eighth regular reserve report.

Binance did not see massive outflows amidst recent lawsuits and FUD. However, it is a fact that customer assets have decreased. A large number of investors preferred to reduce their risk with the US targeting cryptocurrencies.

Is Binance Safe?

If customer assets are kept in exchange wallets at a 1:1 ratio, this situation shows that assets can be withdrawn smoothly in any bank-run. The only easy solution for conversion from fiat money to crypto is to use centralized exchanges. That’s why crypto investors still trade heavily on CEX platforms instead of DeFi.

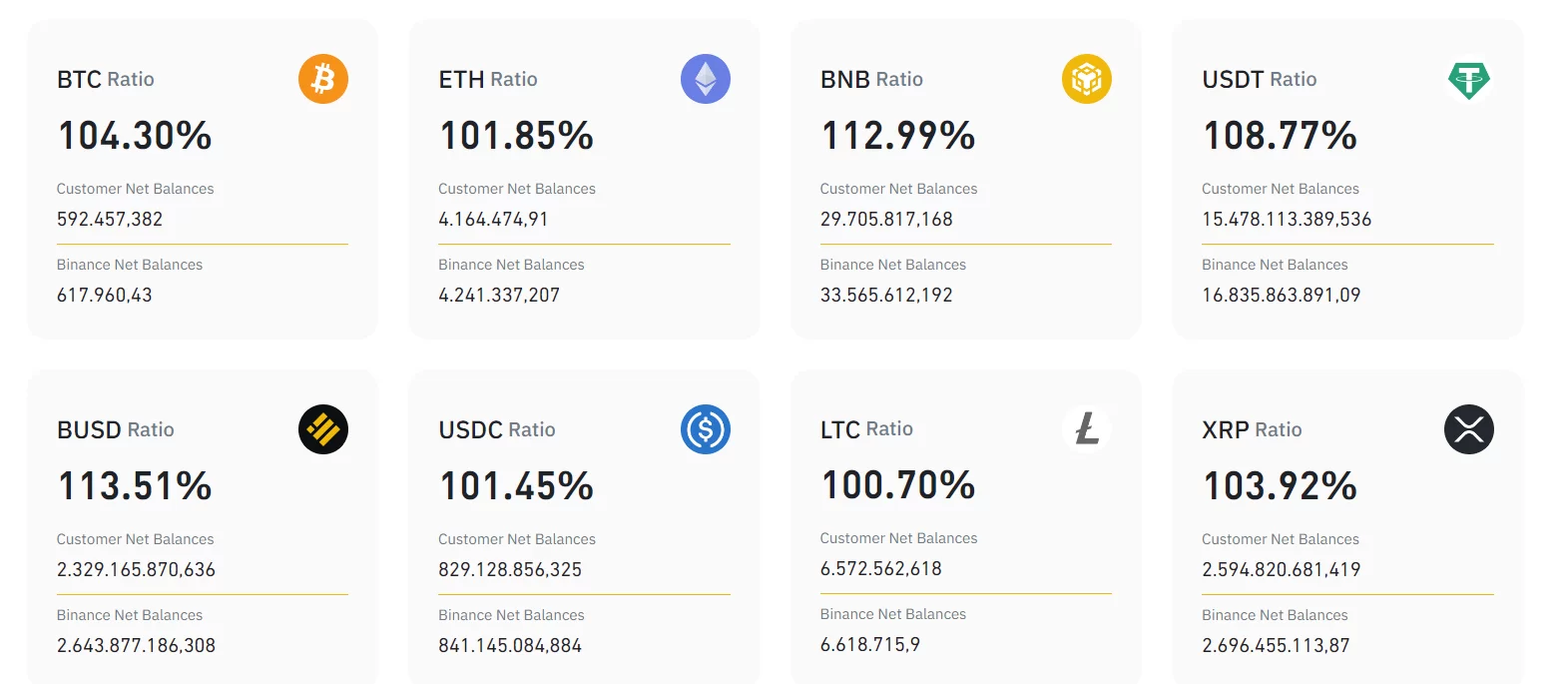

With a snapshot taken at the beginning of July, Binance published its latest reserve proof certificate. Compared to last month’s report (June 1 report), customer assets decreased noticeably. The summary of the change is as follows;

- BTC accumulation decreased by 3.6%, 22,000 BTC.

- ETH accumulation decreased by 4.4%, 192,000 ETH.

- USDT accumulation decreased by 9.45%.

However, BNB assets of investors increased by 6.6% (1.83 Million BNB). This shows that their customers increased their BNB accumulation during the downturns.

On the other hand, the assets that the exchange has against customer assets seem sufficient. ETH, LTC, and USDC assets are covered by about 101%, while BUSD and BNB assets are 12-13% above the total customer balance.

You see the details of customer and Binance balances in the graphic above, specifically for cryptocurrencies.