The nightmare days of 2022 feel like yesterday, but they have passed. Bitcoin has returned to the splendor of 2021. A significant portion of altcoins also reached their 2022 peaks and are expected to continue their ascent in the rally. But what do market experts say about the current situation? Are cryptocurrencies breaking records only in terms of price?

Crypto Market Expert Insights

Cryptocurrency analysis firm CryptoSlate’s research and data analyst James Van Straten has taken a comprehensive look at the current market in his latest assessment. Billions of dollars worth of Bitcoin leaving exchanges was the focus of his attention. Although many metrics have yet to report a massive increase in the number of new investors in the markets, exchange reserves are being depleted.

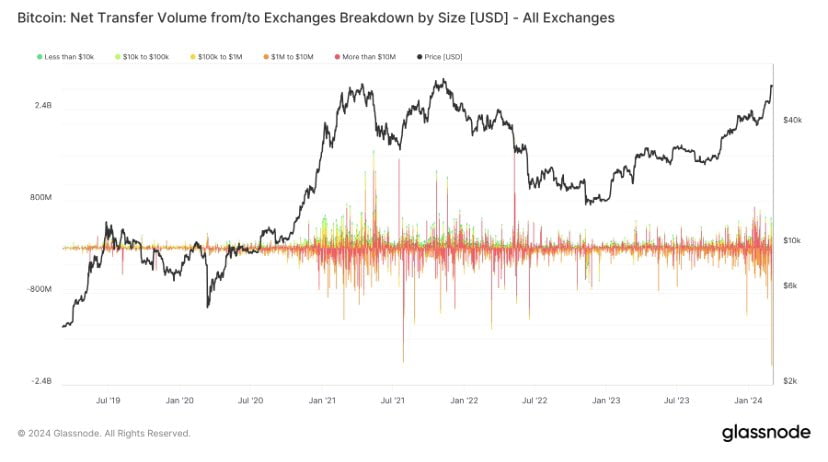

According to data from Glassnode, Van Straten revealed that on March 1st alone, BTC withdrawal transactions were around $2 billion.

“I don’t think I’ve ever seen anything like this. On Friday, a total of just over $2.3 billion worth of Bitcoin left the exchanges. It was one of the largest BTC withdrawal events in the last five years.”

Moreover, these exchange outflows are not only linked to Coinbase. This indicates activity beyond the demand caused by ETFs.

“Binance saw about $400 million and there have been quite large outflows in the last few days. The remainder was seen by Coinbase. The outflows from Binance are interesting because they have nothing to do with ETFs.”

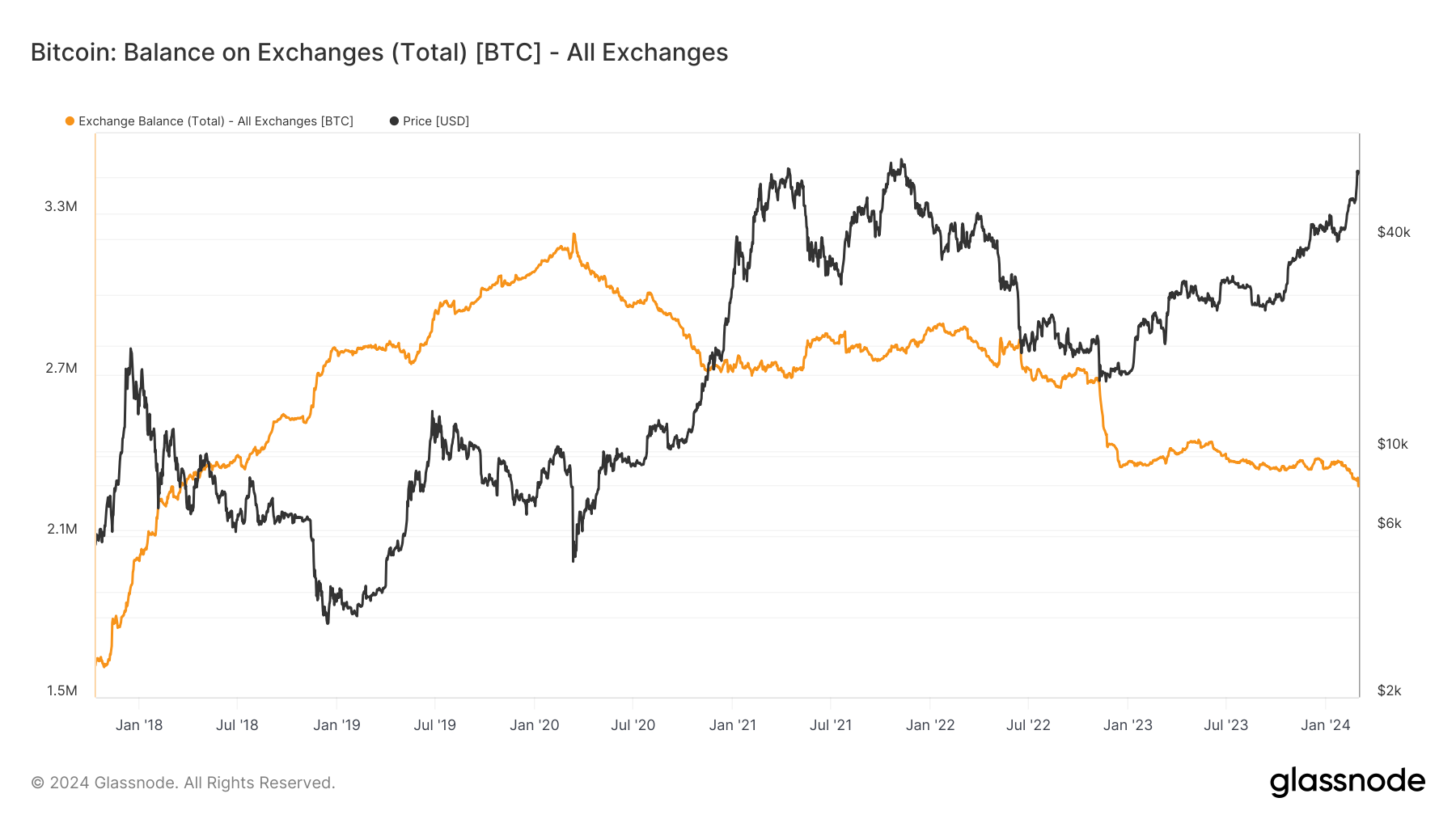

The total Bitcoin reserve in major crypto exchanges has dropped to as low as $142.5 billion. The last time this figure was seen was in March 2018 when BTC was at $8,000.

Influx of Investors into Cryptocurrencies

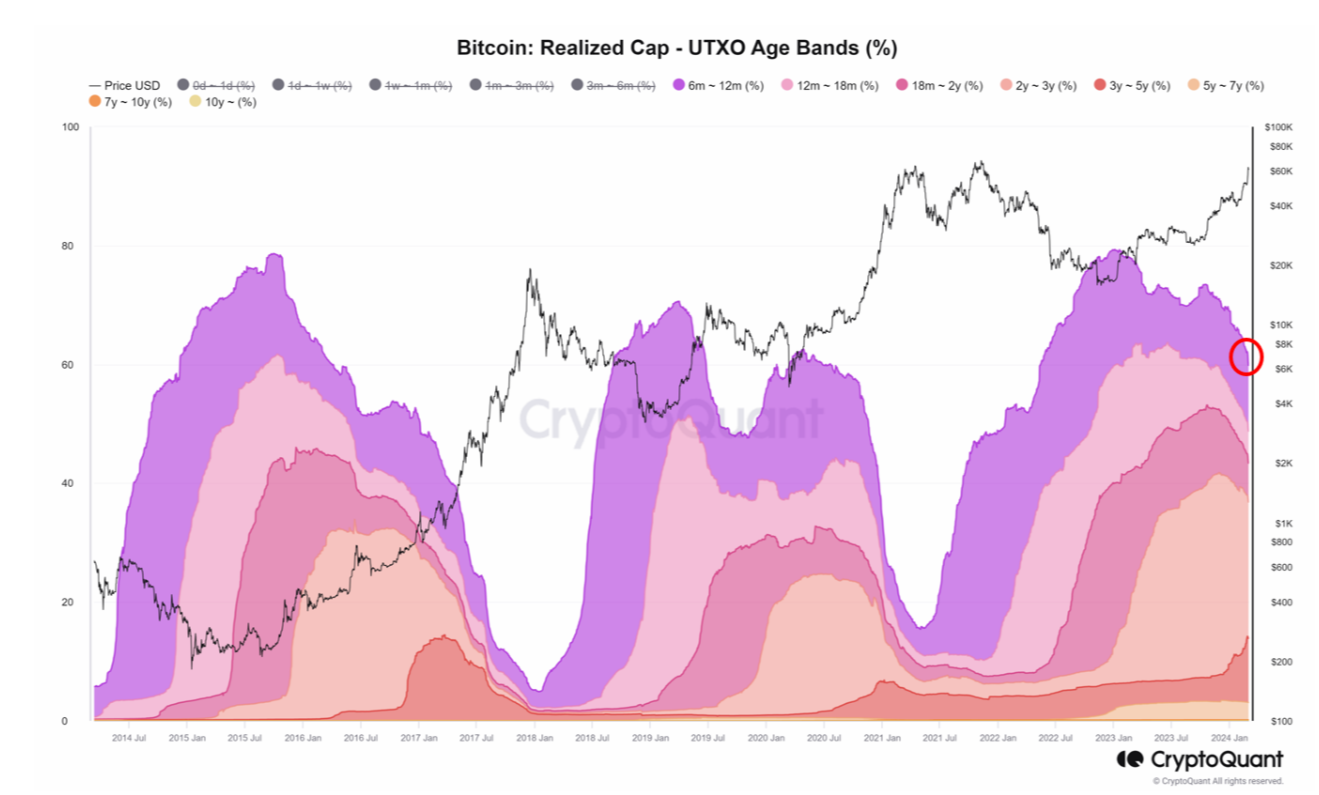

Crypto Dan, a contributor to CryptoQuant, in his latest Quicktake market assessment, pointed out changes in the unspent transaction output (UTXO) data. This data focuses on how long BTC assets have been held by investors. With the awakening of “older” coins that have been inactive for six months or longer, the number of young Bitcoin investor wallets is increasing.

“New investors are flocking in, and we can expect many new ‘individual’ investors to join soon. Eventually, this rate will continue to drop sharply, leading to the ‘real bull market’ we desire.”