The fluctuation in the king of cryptocurrencies persists, reaching a peak close to $53,000 this week before entering a decline. The losses in the last 24 hours are primarily due to the slowdown of ETF inflows and the excitement around the Fed Minutes and NVIDIA earnings reports, which fortunately were not against cryptocurrencies. However, the price is not recovering as quickly following the sell-off by those who entered the market with expectations.

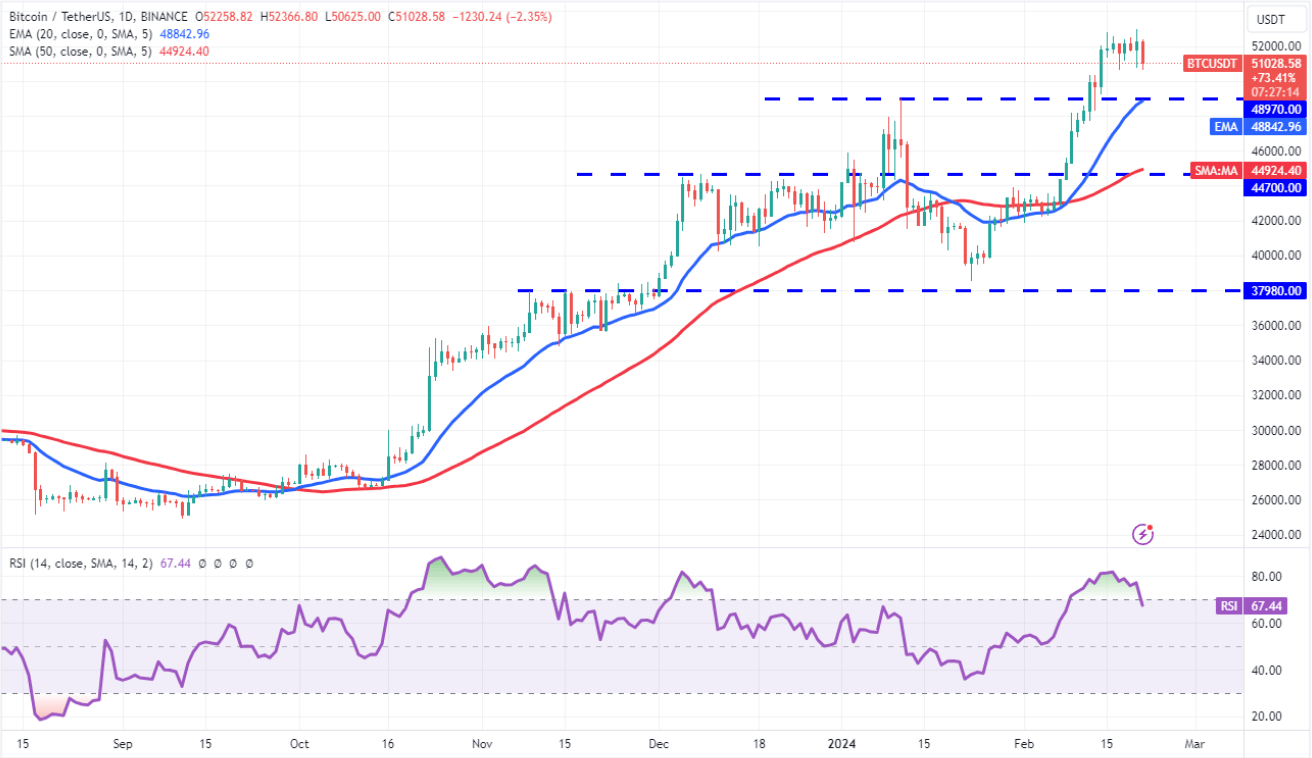

Bitcoin (BTC)

The Fed will not reduce interest rates as quickly as the market had anticipated, and the market is starting to adapt to this. The decline we see in the U.S. stock markets today is because of this. We have been saying that the Fed would temper the excessive optimism, and Powell did just that in the latest policy statement. The Fed minutes are not more hawkish, but the most optimistic rate cut forecast has shifted from March to June or even July, so these sell-offs are normal.

Bitcoin was unable to sustain above $52,000 and despite ongoing recovery efforts, the key region has not been reclaimed. If it falls below $50,000, it may be time for short-term investors to step aside and observe, likely leading to a deeper bottom. Conversely, if BTC can hold above $52,000, the opposite scenario could unfold.

In a potential downturn scenario, a retraction to the 20-day exponential moving average ($48,842) would not be catastrophic, but double-digit losses in altcoins are possible. However, if a rise begins, it may need to continue up to $60,000. Investors waiting for a deeper dip will have their eyes on the $44,924 and $40,600 levels.

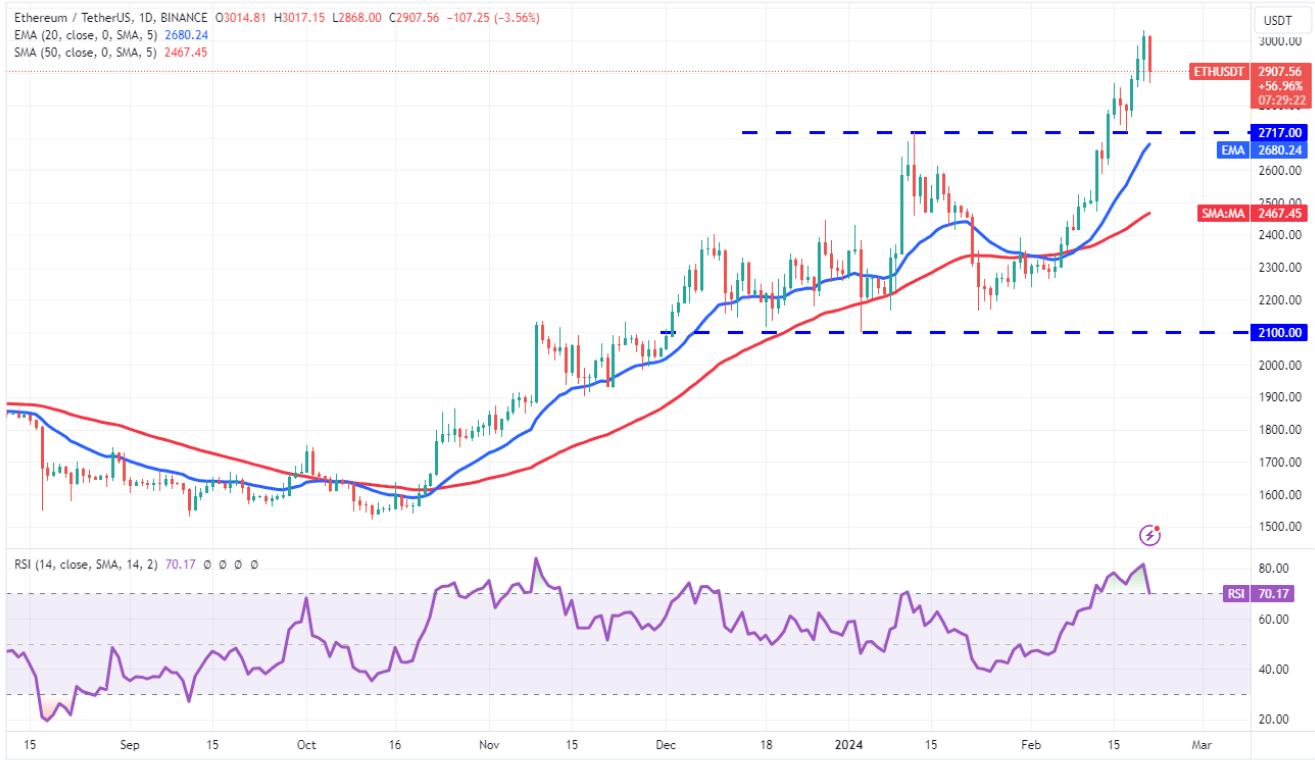

Ethereum (ETH)

There are plenty of reasons for the price of Ethereum (ETH) to rise this year, but for now, the BTC barrier is preventing new highs. ETH price has not suffered significant losses and is currently finding buyers at $2,947. The short-term breach of the $3,000 psychological resistance, even if temporary, is motivating for the bulls.

During a strong uptrend, a loss period of over three days is not expected, and decisions for both BTC and ETH will be made before the week ends. We’ve discussed the targets for BTC earlier, and for ETH, $3,300 seems reasonable for now. On the downside, the targets are $2,717 and $2,680, followed by $2,467.

Türkçe

Türkçe Español

Español