Bitcoin (BTC) is nearing its fourth block reward halving, and insights from crypto analysts, experts, and commentators are heightening expectations about the potential outcomes in the coming months. Historical precedents, considering their profound impact on the network, indicate that Bitcoin‘s price typically responds positively to a block reward halving. With the halving, the new BTC production rate drops by 50%, and this decrease, combined with steady or increasing demand for the asset, usually leads to an upward price movement.

Prices Soared Following Previous Block Reward Halvings

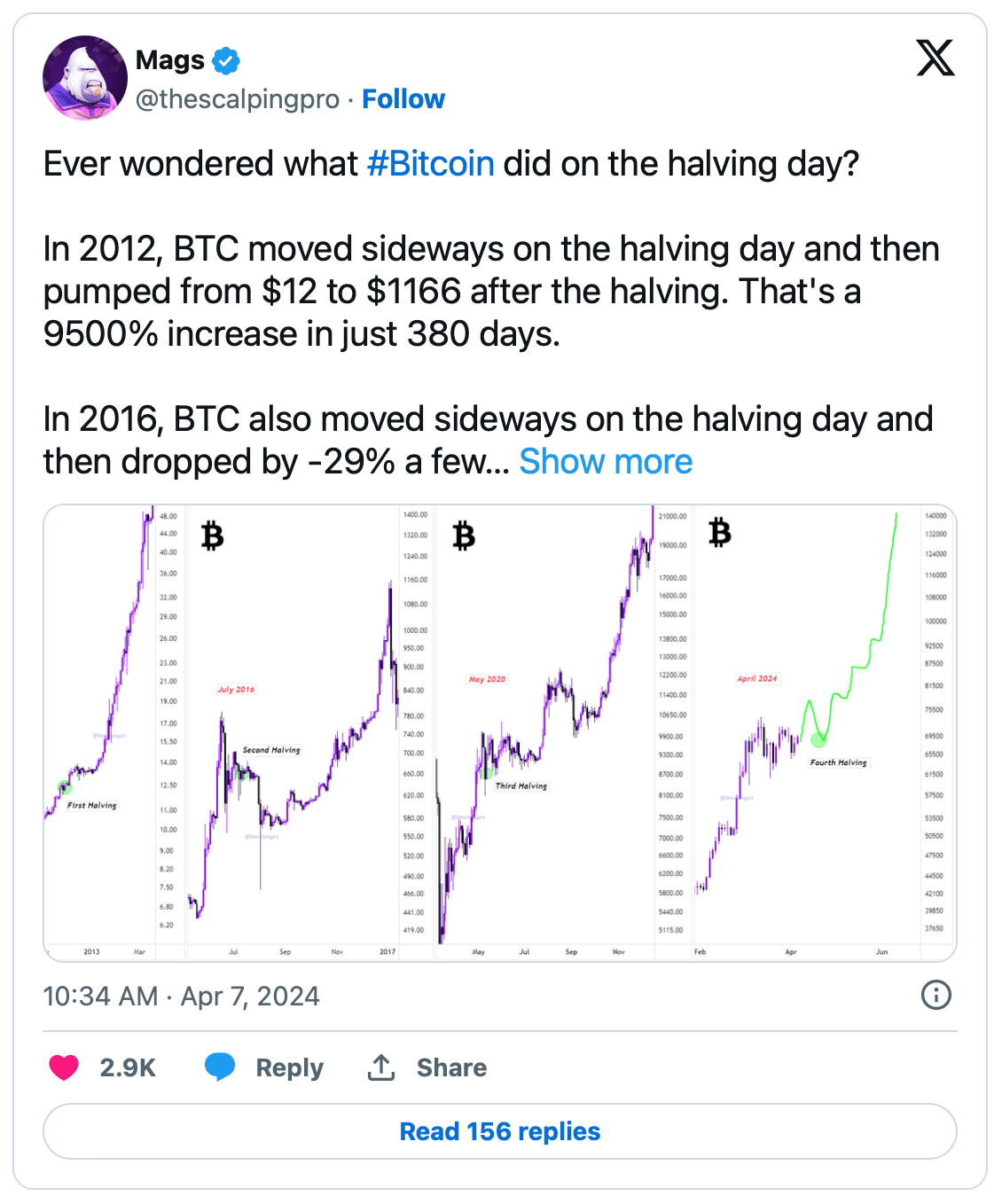

Bitcoin’s first block reward halving occurred at the end of November 2012, reducing the production rate from 50 BTC per block to 25 BTC. As the anonymous crypto analyst Mags noted, Bitcoin’s price showed relative stability on the day of the event, but in the following months, it skyrocketed from $12 to $1,166, culminating in an extraordinary bull run with gains of 9,500% in just over a year.

Similarly, Mags pointed out that the second block reward halving in early July 2016 cut the block reward by another 50% to 12.5 BTC. Although Bitcoin’s price reacted calmly on the day of the halving, it experienced a significant drop of about 30% within the first week. However, this downward trend was short-lived, and Bitcoin’s price entered another ascent over the following 500 days, climbing from $470 to about $20,000, reaching its all-time high for that period.

Moreover, the analyst highlighted that during the backdrop of the COVID-19 market crash, the third block reward halving on May 11, 2020, saw Bitcoin going through a volatile period with a roughly 17% drop in the days leading up to the event. Although the bull run did not start immediately, Bitcoin’s price eventually soared from about $8,700 in November 2021 to an all-time high of $69,000, corresponding to an astonishing 700% increase.

The Situation is Quite Different for the 4th Block Reward Halving

While Mags expects a sharp rise in price following the upcoming fourth block reward halving, the analyst emphasizes that this halving is different from the previous ones. This difference stems from Bitcoin already setting a new record by reaching $73,750 on March 14, 2024.

Despite this turning point in price, investors are anticipating that the largest cryptocurrency will dominate the global agenda with its sharp movements towards and after the block reward halving.

Türkçe

Türkçe Español

Español