Bitcoin price is currently trading at $36,350 and the cumulative volume has dropped to $67 billion. Crypto markets have been stuck in a narrow range after the recent uptrend. So what is the reason behind the pause in the uptrend? What do the latest data tell us? Let’s take a look at the current situation in the markets.

BTC reached up to $38,000 but there are unresolved issues. The price surge was driven by the excitement around ETFs and the increased demand in the US. So what is the problem? According to Kaiko data, Bitcoin liquidity is currently at levels seen after the collapse of FTX in November 2022. As we have mentioned before, even though prices are rising, the demand is still not in the desired range.

Daily volumes are gradually surpassing $50 billion, whereas a few months ago they had dropped to $14 billion. The Kaiko report states the following:

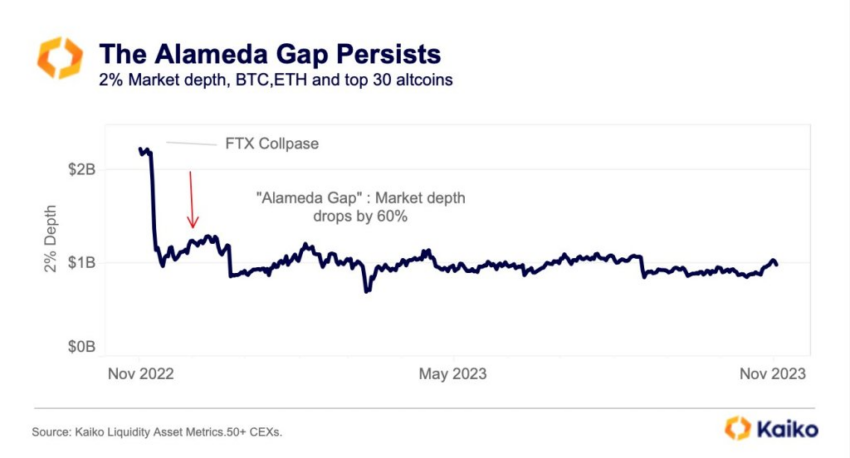

“Even though BTC has risen by more than 20% in October, the ‘Alameda gap’ still persists. Market volumes continue to remain significantly below pre-FTX levels.”

Many crypto companies went bankrupt along with the collapse of FTX. Market makers like Jump Trading also withdrew from the sector, leading to reduced liquidity. Market depth is still 60% below the desired level.

Will Crypto Currencies Rise?

In a shallow liquidity environment, small amounts of capital often lead to larger price movements. The lack of liquidity is not a positive thing, as even a small short-selling volume can push the Bitcoin price down. This is also a concern for investors.

However, some believe that the approval of a spot Bitcoin ETF could bring back liquidity. The possible approval of a spot Bitcoin ETF could mean another improvement in market liquidity.

For a quick and real market turnaround, liquidity needs to return first. The more capital circulates in the market, the less likely unexpected price movements will occur. The sudden ups and downs we have seen in the past few weeks are related to the concentration of liquidity in futures markets. The fluctuating prices between liquidation levels hinder the stable rise of cryptocurrencies.

For investors to be confident about bull markets, daily volume above $100 billion needs to normalize and market makers like Jump Trading need to rejoin the game.

Disclaimer: This article does not contain any investment advice. Investors should be aware of the high volatility and associated risks of cryptocurrencies and should conduct their own research before making any transactions.