In the largest cryptocurrency Bitcoin (BTC), the market trading ratio of buyers (takers) recently increased in various cryptocurrency exchanges, reaching the highest level in at least the last year. Experts see the increase in the ratio as the clearest explanation for Bitcoin’s reversals below $29,000 turning into an upward trend.

Ratio Reaches the Highest Level in the Last Year

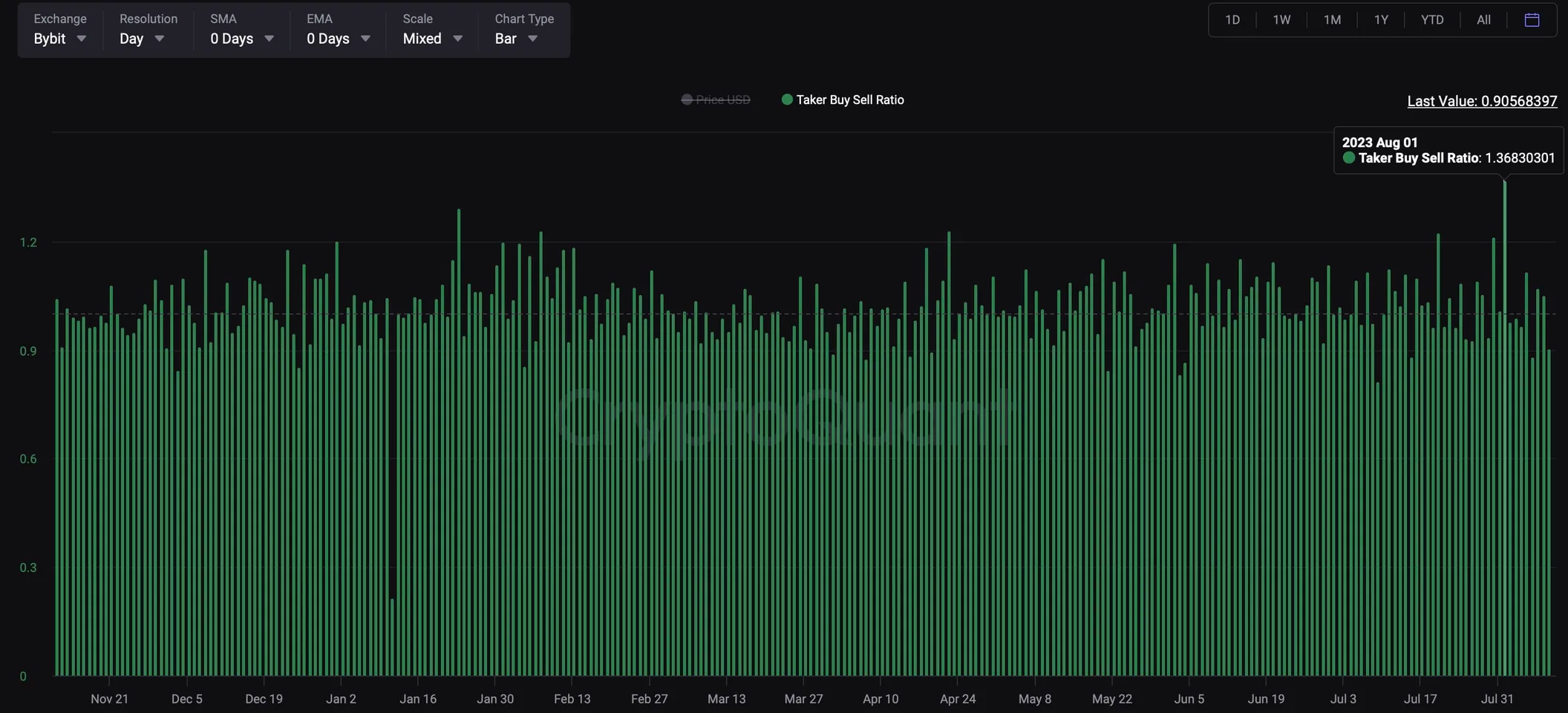

According to the data followed by the South Korean-based Blockchain analysis company CryptoQuant, the market trading ratio of buyers (takers) in Bitcoin reached 1.36 on August 1 on the world’s third-largest cryptocurrency futures exchange, ByBit, based on open interest and trading volume, reaching the highest level in at least the last year. A value above 1 indicates that the buying volume generated by buyers exceeds the selling volume and is considered a bullish signal for the market.

On August 8, the ratio reached 1.17 on the crypto derivatives exchange BitMEX, which is the highest level in the last three and a half months, and 1.31 on July 30 on the crypto exchange OKX, which is the highest level in six months. The market trading ratio of buyers is the ratio obtained by dividing the buying volume in perpetual swap markets by the selling volume of buyers. Perpetual swaps are derivative contracts similar to futures contracts with no expiration date that allow investors to speculate on the price of the underlying asset.

Market buyers are institutions that place orders to buy or sell assets immediately and withdraw liquidity from the order book. Trading companies and individual investors fall into the buyer category. Market makers are the institutions involved in creating liquidity in the order book.

An Important Bullish Signal

Experts argue that the increase in current market buyers’ trading ratio is the clearest explanation for Bitcoin not staying below $29,000 and turning its direction upward. Indeed, the largest cryptocurrency has been bouncing back with long wick candles on a daily time frame every time it falls below $29,000 since July. The price of BTC recently quickly recovered from below $29,000 on August 8 and rose above $29,000, even surpassing $30,000.

According to Ki Young Ju, CEO of CryptoQuant, the increase in the market trading ratio of buyers on low-volume cryptocurrency exchanges like BitMEX is generally considered a sign of increasing purchases by whales or large investors and an important bullish signal.