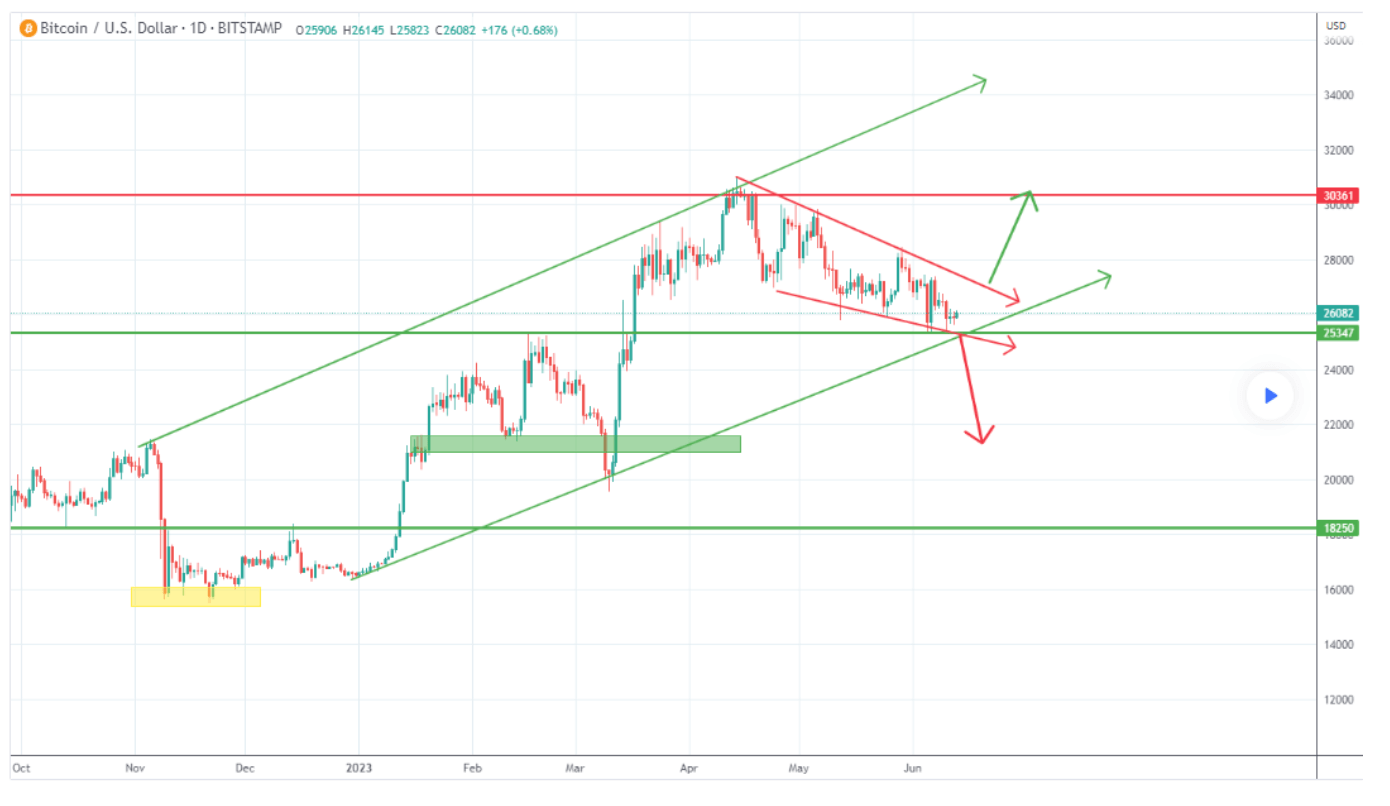

The recent weeks of uncertainty in the crypto market have inevitably shaken Bitcoin (BTC). The most significant cryptocurrency finds itself trading within an accumulation formation, a situation expected to resolve only once the BTC price breaks out from this formation.

The $25,000 Mark: A Strong Support for BTC Price

The U.S. Securities and Exchange Commission (SEC) significantly jolted the crypto market by filing a lawsuit against Coinbase and Binance, the world’s largest crypto exchange by volume. They are accused of listing and facilitating trades of unregistered securities. The possible classification of several prominent altcoins like Cardano (ADA), Solana (SOL) as securities amplified this impact, especially hitting the altcoin market.

Anonymous crypto analyst Mihai_Iacob emphasized Bitcoin’s ability to maintain an upward outlook by exhibiting notable resilience and managing to stay within a significant range.

Historically, when adverse news fails to profoundly disturb BTC or cause a technical collapse, the process generally concludes with a surge. Currently, Bitcoin appears to be showcasing an example of this situation, indicating a potential rise on the horizon.

From a technical perspective, Mihai_Iacob highlighted that Bitcoin’s price found robust support at the $25,000 mark, a critical price point defined by a trend line that originated earlier this year and a horizontal support level.

Rising Point in Bitcoin’s Chart

The analyst suggested that should Bitcoin maintain above $26,000 and manage to surpass $27,000, it would confirm an uptrend. He further stated, “Strictly from a technical viewpoint, $25,000 was a powerful convergence support given by the trend line starting earlier this year and the horizontal level. Moreover, the recent drop from the $30,000 level resulted in a falling wedge formation. However, should BTC climb above $27,000, it will confirm the bullish outlook, leading to a retest of the recent peak, and potentially even reach a new level around $35,000.”

Meanwhile, the resistance Bitcoin’s price has shown in the face of recent challenges has increased optimism among investors and traders. News of BlackRock, the world’s largest asset management company, applying for a Bitcoin Exchange-Traded Fund (ETF) to the SEC has further fueled this optimism.

Regulatory measures taken by the SEC are seen to be a significant source of decline affecting the overall crypto market. In addition to this, expectations of a slump in the crypto market are being fed by the prospects of a long-term tight monetary policy, necessitated by inflation not falling to expected levels in the U.S.

Nice one