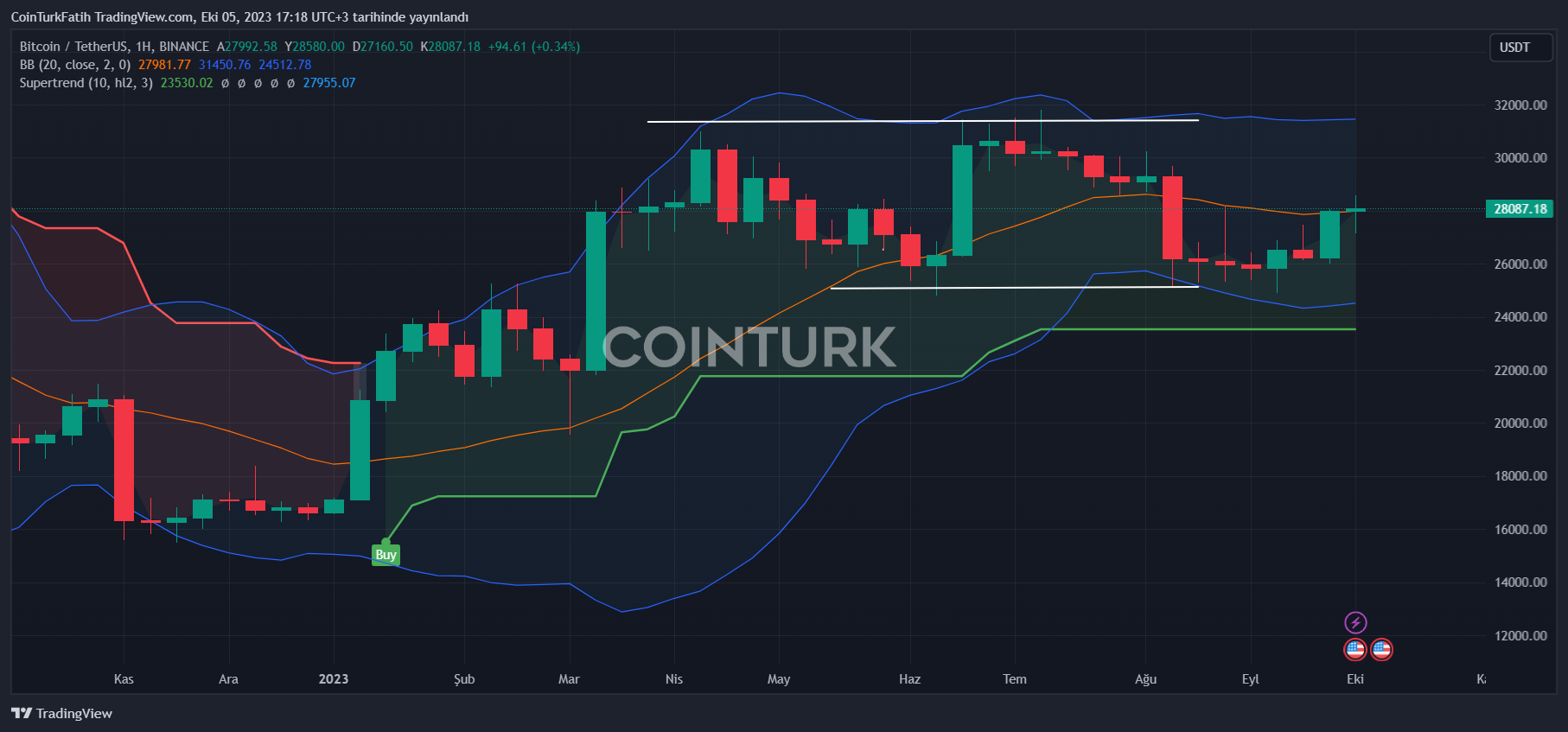

Bitcoin, the king of cryptocurrencies, was struggling to reclaim $28,000 at the time this article was written. However, profit-taking was preventing it from doing so. Altcoins, on the other hand, have experienced further declines due to the fluctuating BTC price, resulting in BTC dominance hovering around 50%. But today, we will discuss another interesting report.

Bitcoin and the Fight Against Inflation

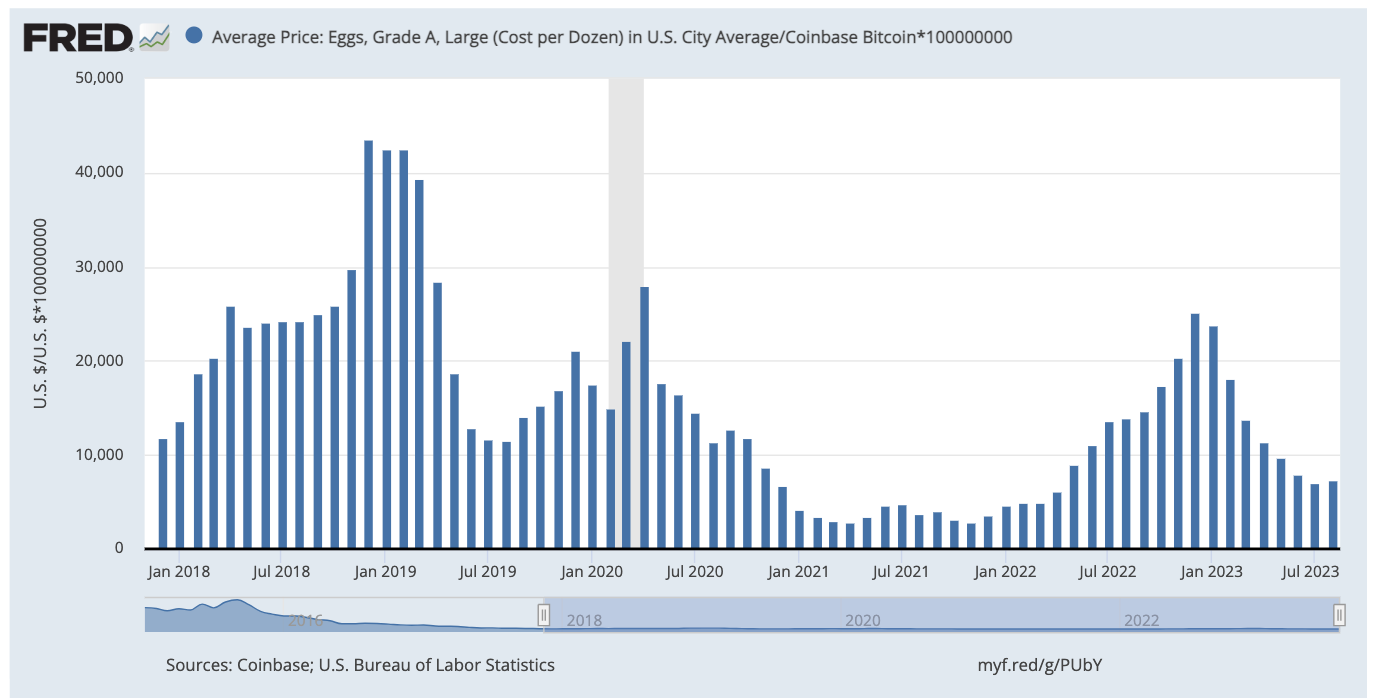

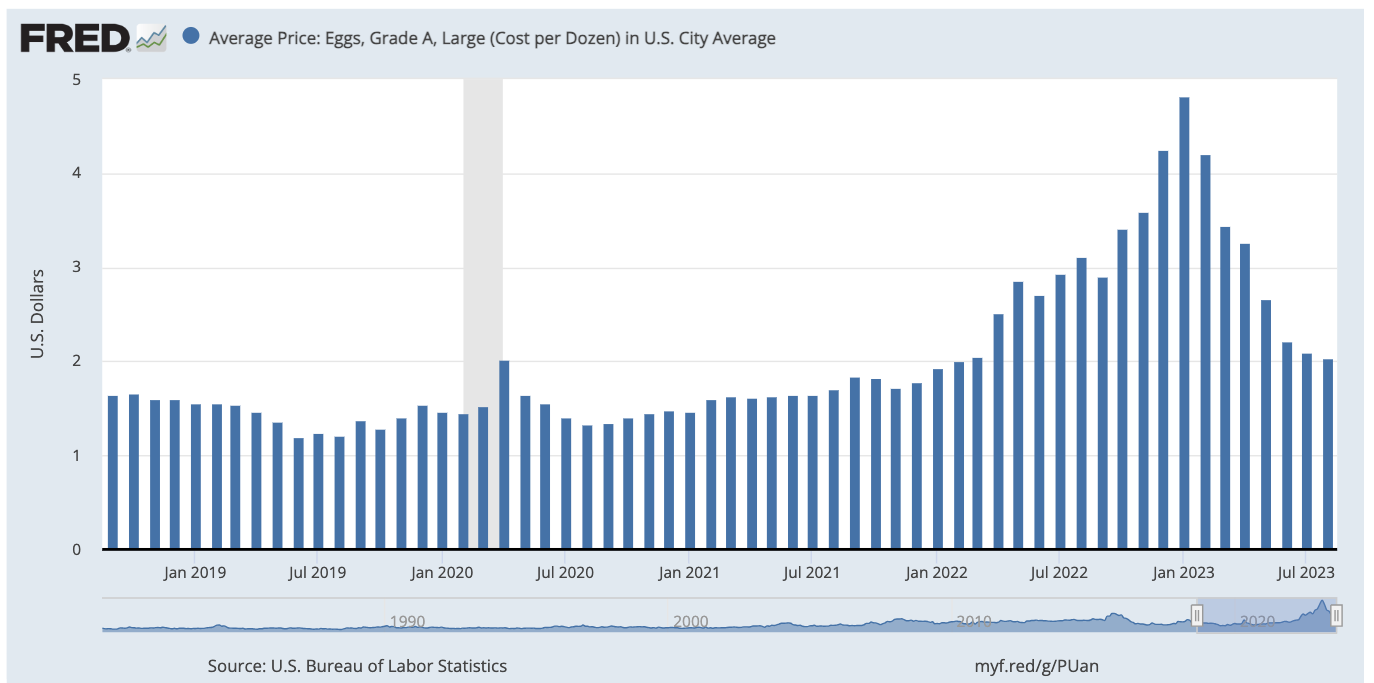

The St. Louis Fed, in a blog post initially published in June 2022 and continuously updated since then, makes an interesting comparison. The focus here is on the purchasing power of BTC and USD when it comes to buying eggs.

Bitcoin investors may not use BTC to buy eggs, but this indicator can provide important insights into the purchasing power of the king cryptocurrency against the US dollar. The price of one dozen eggs is used as the basis for the calculation.

“The price fluctuates between 2829 and 6086 satoshis, which is more volatile than the price of USD. Additionally, you need to take into account the BTC transaction fee, which has recently been around $2 but can sometimes exceed $50.”

However, the charts show that since reaching their peak in December 2022, the number of satoshis needed to buy the same dozen eggs has decreased more in BTC than in equivalent USD.

As of August 2023, the price in BTC had decreased by 70%, while the price in USD had dropped by 58%.

In conclusion, while Bitcoin can be a good option for fighting inflation at times, it is not feasible for BTC to be used as a currency due to its high volatility. Even if transaction costs are significantly reduced through solutions like the Lightning Network, it is not very practical. On the other hand, businesses in El Salvador also prefer to convert BTC payments into fiat currency instantly.

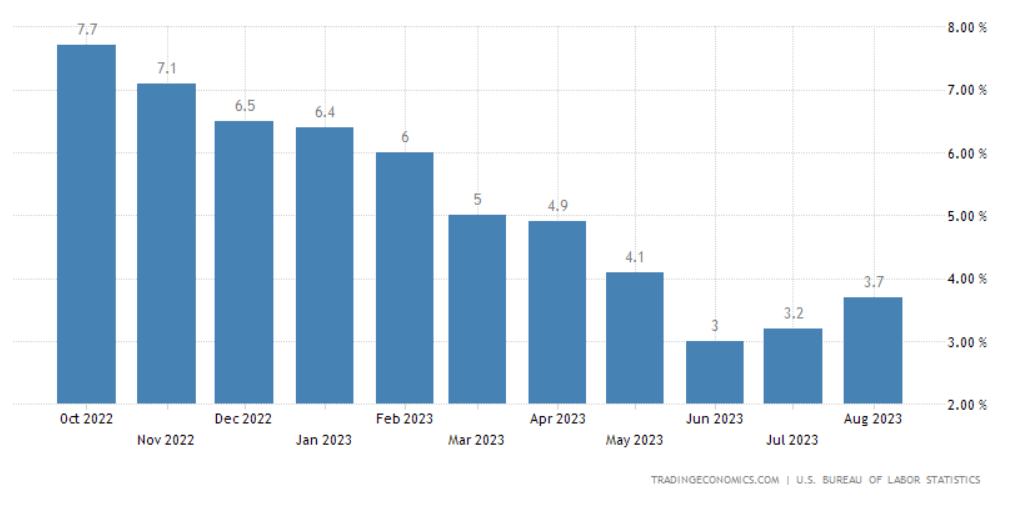

US Inflation and BTC

The US inflation, which reached its peak in 2022 at 3%, hit rock bottom in June but then climbed back to 3.7% due to various factors. September’s inflation data is yet to come, and concerns about a price increase in oil are also present as it aimed for $100 last month.

On the other hand, the fact that inflation came this close to the Fed’s 2% target in June did not have a significant impact on the BTC price. In fact, we witnessed a rapid decline in price due to the impact of the Binance and Coinbase cases. However, the application for a BlackRock ETF reversed the situation.

In conclusion, at some point, the problems within the crypto space seem to be more important than inflation. Chain bankruptcies last year, followed by the collapse of FTX and regulatory pressures, contributed to the multiplier effect of the Fed tightening on the crypto market.

Türkçe

Türkçe Español

Español