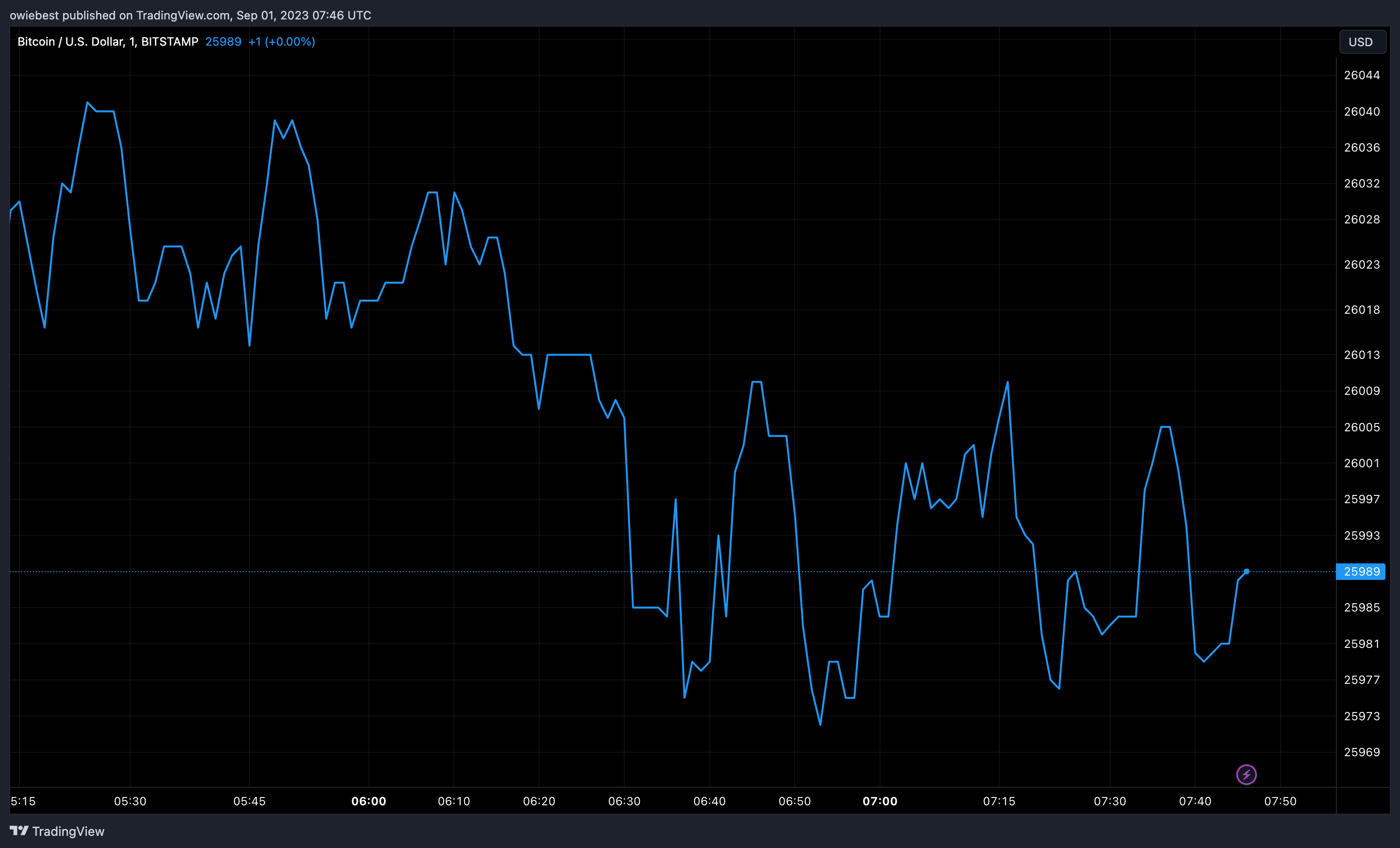

29 August, flagship cryptocurrency Bitcoin, rose to $28,000 after Grayscale’s victory. However, it lost these gains as the US Securities and Exchange Commission (SEC) chose to postpone their decision on seven Spot ETF applications.

SEC extended the timeline to decide on the ETF applications of BlackRock, WisdomTree, Invesco, Fidelity, Valkyrie, VanEck, and Bitwise, causing Bitcoin to fall by over 4% to $26,000. This price movement contradicts the positive reaction of the cryptocurrency to Grayscale’s victory news and the favorable decision of the US Appeals Court in favor of the asset manager against the Commission.

Many investors were eagerly awaiting SEC’s decision on these ETF applications after Grayscale’s victory, hoping that the legal setback would soften the regulator’s approval of these applications.

However, Bloomberg ETF analyst Eric Balchunas previously stated that he would not be surprised if SEC delays these applications. According to the analyst, the timelines may not be so important as SEC is likely to “give up” at some point, and we will eventually see these applications approved.

Following this, SEC will have an additional 45 days to review and decide whether to approve, reject, or postpone these applications. The regulator also has a maximum of 240 days to decide whether to approve these applications. However, there are several important deadlines in between.

Critical Process in Bitcoin!

Approval of the Spot Bitcoin ETF was expected to lead to a significant increase in the Bitcoin price. However, SEC’s decision to delay these applications shows that it is not yet ready to back down and resistance against the approval of Spot Bitcoin ETF may continue.

Meanwhile, as the approval of the spot Bitcoin ETF remains uncertain, Bitcoin may continue to decline throughout this month. Historical data shows that the cryptocurrency tends to close in a downward trend at the end of September, indicating a consistent downward trend in Bitcoin price in September.

Furthermore, Bloomberg analyst James Seyffart’s mention of the next deadline for these ETF applications being in October makes October more promising as there could be significant days to follow. Ethereum Futures ETFs are also expected to launch in October, which could provide significant support for the market. However, analysts are not hopeful for Bitcoin to reach a new high this year. It is predicted that Bitcoin will consolidate between $25,000 and $32,000 for the rest of the year.