Famous expert opinions on price predictions are closely followed by investors. One of them is Poppe. The analyst, who has shared many accurate price analyses in the past, now draws attention to the year 2015. If he is proven right, a significant recovery could be expected in this scenario.

Bitcoin Expert Price Prediction

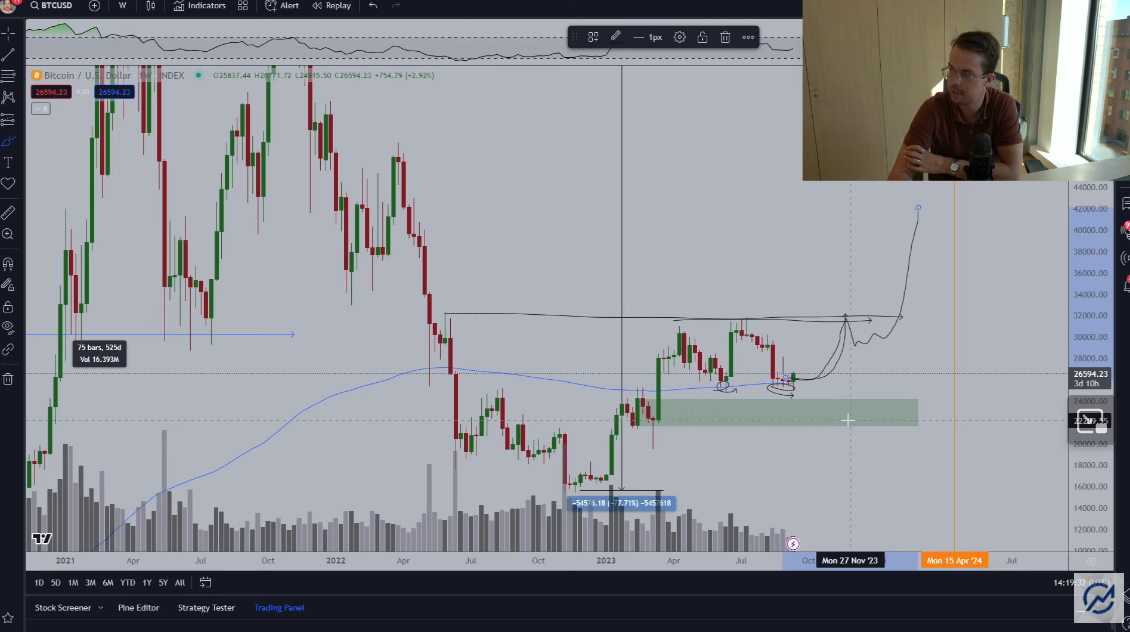

Van de Poppe is followed by hundreds of thousands of investors and has shared his prediction that a past movement could repeat. Before the halving event in 2016, the price experienced a similar consolidation as it does today. The halving event, which occurs every four years, will happen in April next year.

In his recent market analysis, the analyst said the following;

“You can see that we have formed a nice range, which is very similar to the price movement we witnessed in 2015. Let’s go there. We were creating a range that had been moving sideways for a long time in 2015 and we couldn’t break it until the bull came.”

Bitcoin Price Target

Crypto analyst Poppe says he is closely monitoring the 200-week exponential moving average (EMA), which he claims is currently serving as support. He suggests that the market correction of Bitcoin has ended and the king crypto will now retest higher ranges, which could lead to a price increase of up to 70% from its current value.

“It wouldn’t surprise me if Bitcoin rose to $45,000. The situation here is most likely this… Our chance to retest the 200-week level of EMA is relatively low. So, if we stay above a few important levels, I believe we will continue with upward momentum.”

According to the analyst’s prediction, the price will rise to $32,141 next month. Then, we will see a pullback to $28,700.

Bitcoin (BTC) is currently being bought for $26,429 at the time of writing the article. Cumulative volume has dropped below $30 billion again, and as the market remains low in volume, expecting a significant recovery seems difficult. Bitcoin’s market dominance is at 49%. The most important data to watch for investors will be the volume. If volumes can climb back above $100 billion daily, we may see the realization of Poppe’s medium and long-term bullish scenario. Otherwise, it seems that shallow movements will continue.