The cryptocurrency market continues to experience a volatile period. Accordingly, on April 5th, Bitcoin left behind fears related to US inflation signals amidst new excitement over future institutional investments. According to data from TradingView, after the Wall Street opening, the renewed Bitcoin price support that pushed the BTC/USD pair to $68,630 stood out.

What’s Happening on the Bitcoin Front?

Currently trading around $68,000, Bitcoin gained value following the news that the world’s largest asset manager BlackRock added major US banks as participants to its spot Bitcoin exchange-traded fund. The names listed in a shared file include Goldman Sachs, Citadel, UBS, and Citigroup.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, stated in part of his response via X:

“The bottom line; big firms now want a piece of this business and are openly associating with it.”

Balchunas suggested that the developments are likely a result of the mega inflows or successes of ETF funds. Additionally, nine new products in the ETF space, as of April 4th, hold over 500,000 Bitcoins in assets, not including those in the Grayscale Bitcoin Trust (GBTC).

The BlackRock narrative served to protect the latest Bitcoin price movement from US inflation signals. These came in the form of higher-than-expected employment data, suggesting that the Federal Reserve could maintain higher interest rates for a longer period.

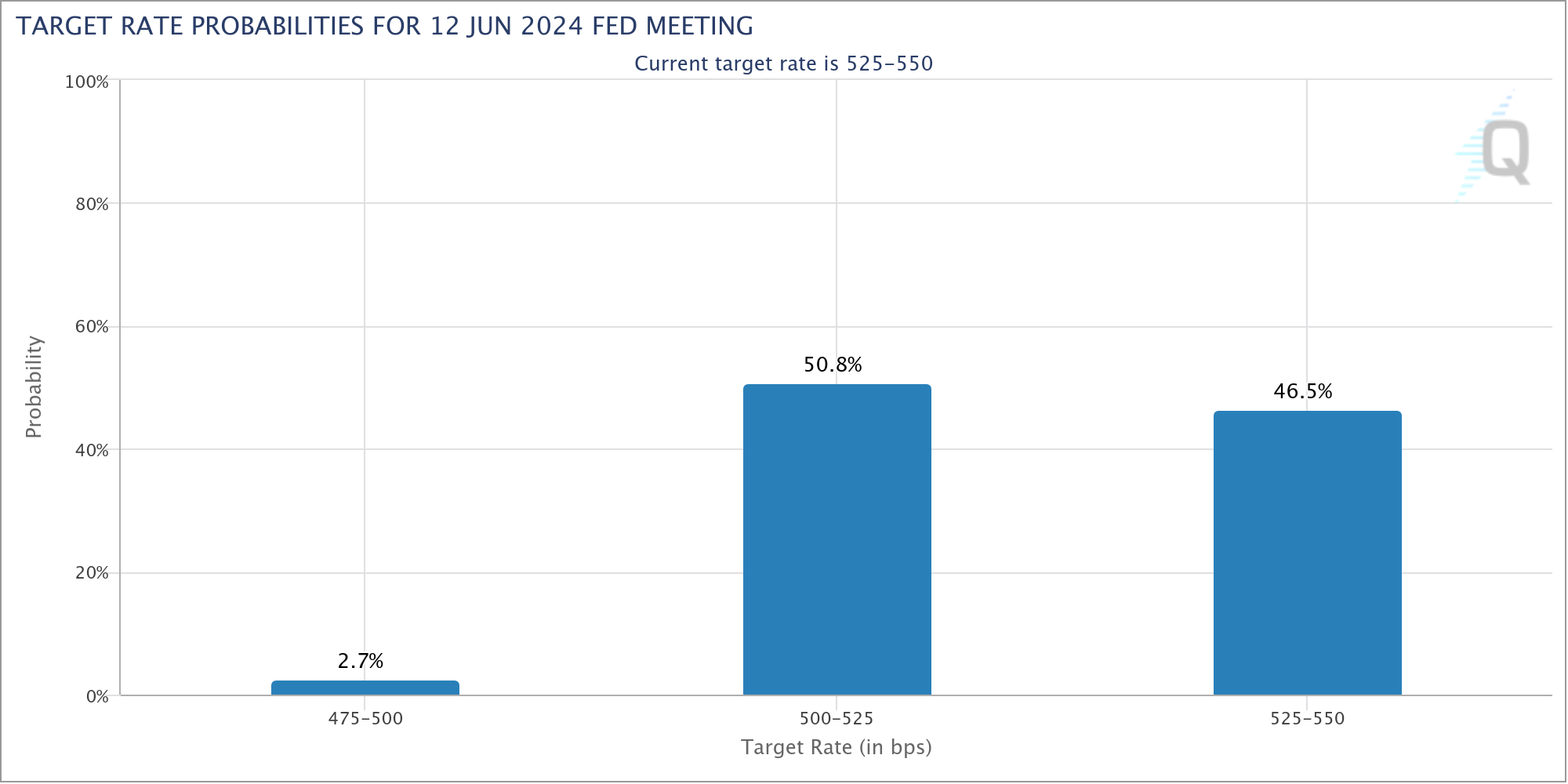

The latest data from the CME Group’s FedWatch Tool showed that the probability of an interest rate cut in 2024 was pushed back further towards the end of the year. The likelihood of a rate cut in June decreased by 10% compared to the beginning of the week, occurring just above 50%.

Notable Predictions for Bitcoin Price

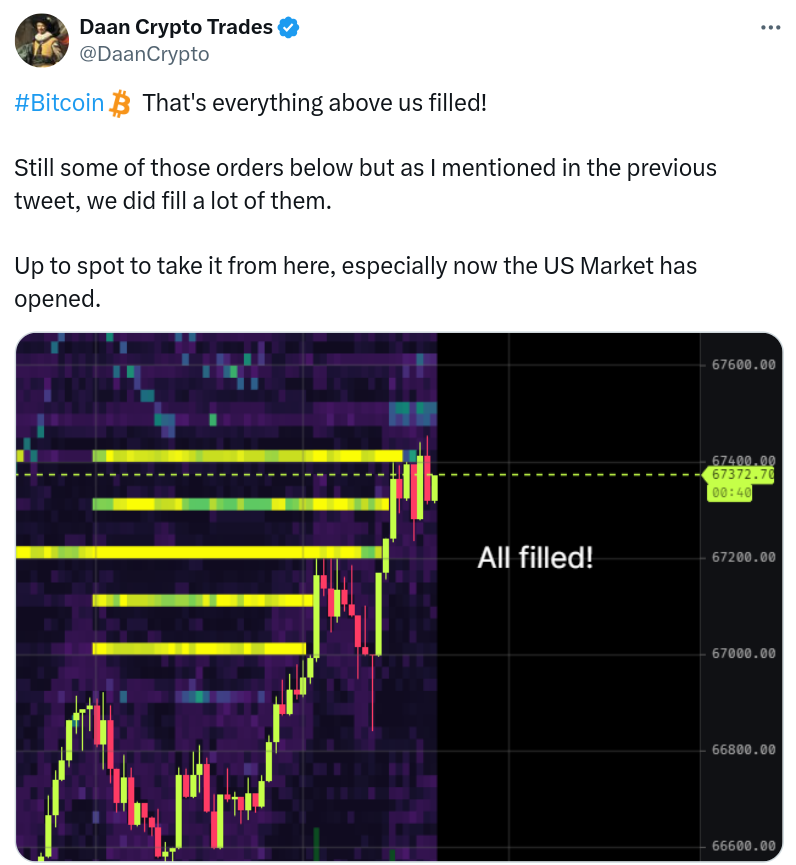

Popular investor Daan Crypto Trades, who analyzes market order, noted that sell-side liquidity was taken around the open.

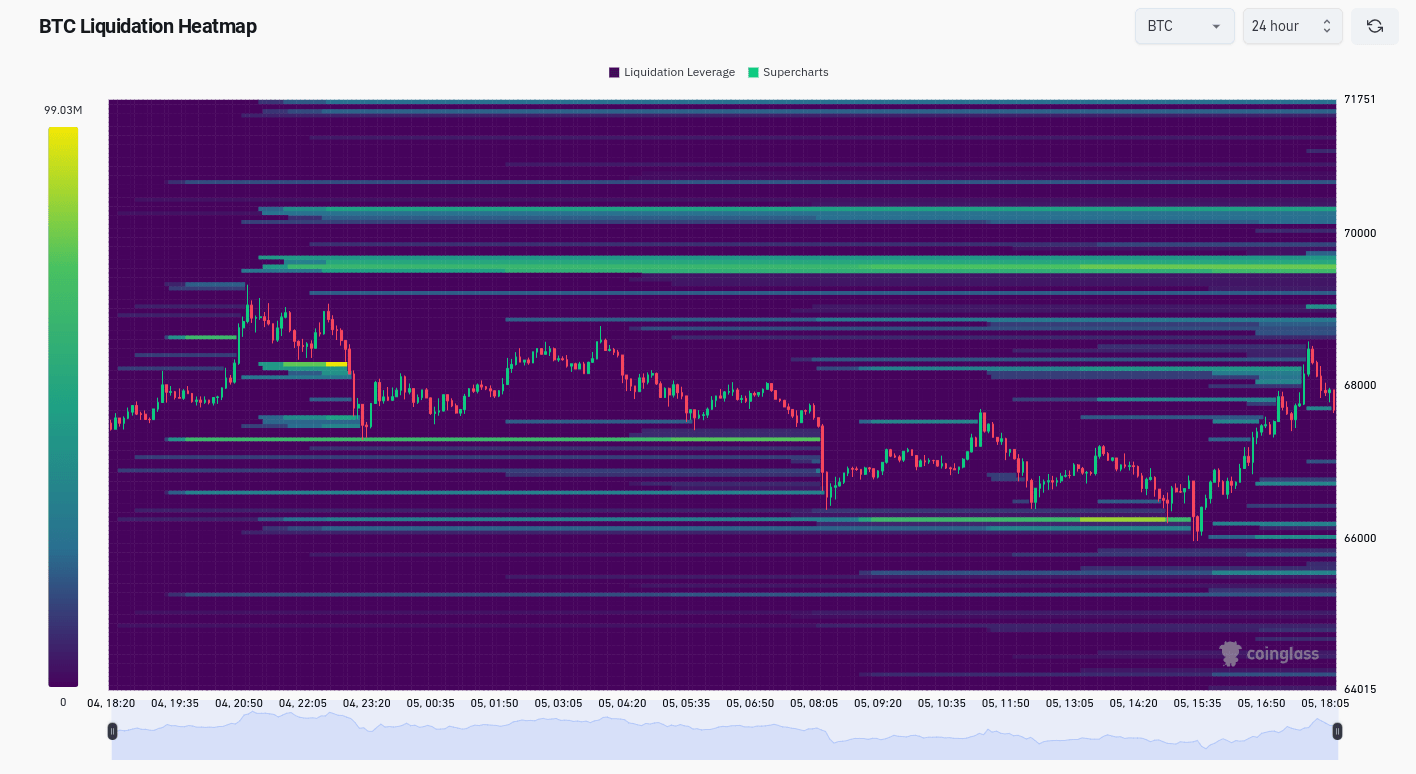

Other data from the data analysis source CoinGlass showed significant sellers lined up beyond the focal point of the current price movement, $69,000.

Another popular analyst, Jelle, pointed out in part of his X analysis that with the breach of the $69,000 level, short positions in the futures market should be closed. Jelle noted that the BTC/USD pair managed to create a higher low in hourly time frames, potentially setting up the pair for an upward continuation.

Türkçe

Türkçe Español

Español