The leading cryptocurrency, Bitcoin (BTC), continues to recover following incidents related to Binance and Coinbase, as experts disclose their expectations for the currency.

Bitcoin Expectations!

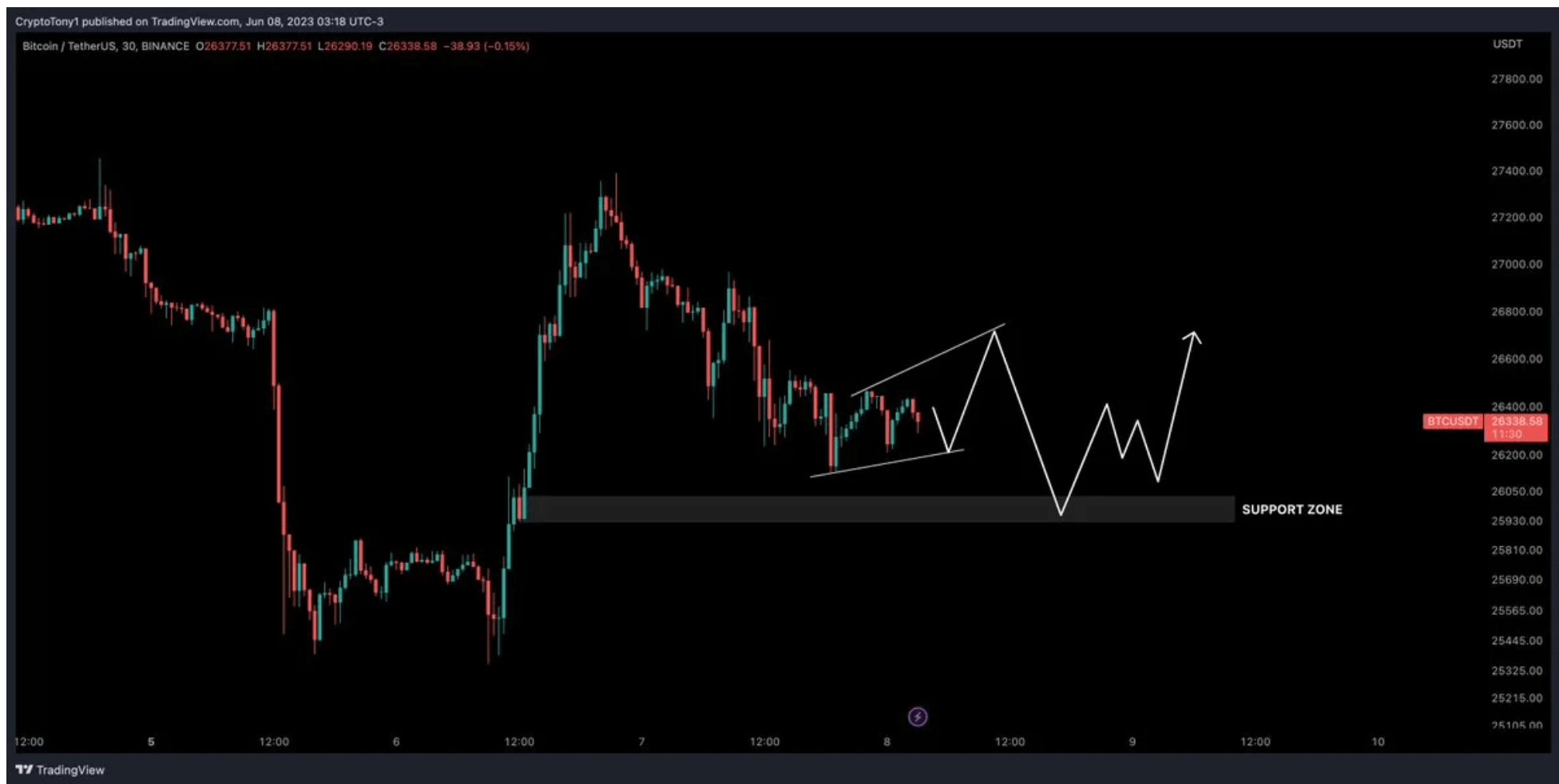

The BTC/USD pair has charted a significant long-term trend line near $26,500. Following sudden volatility surrounding industry news, the pair returned to horizontal trading after bouncing from the lowest levels in three months.

Now, the 200-week moving average (WMA) has become a critical focus point. Trading group Decentrader stated in a part of the day’s analysis:

We are sitting right above the 200WMA.

Decentrader opted for a cautious short-term perspective, warning of a growing long/short ratio on exchanges and potential selling at the start of the US trading session. Popular analysts, including Crypto Tony, remain on the sidelines until a clearer trend emerges. In recent comments to his Twitter followers, he said:

This is the structure I’m watching in Bitcoin right now, and I stay out of a position while it’s mid-range. There’s no need to rush entries when things aren’t clear. We had a good short circuit before, now we’re preparing for the next entry.

Critical Level!

In the shared chart, by emphasizing a “support zone” just below $26,000 as a potential downward target, he underlined:

Unchanging view about Bitcoin. Consolidation, falling wedge. It’s not too interesting until we find an exit.

Contrarily, more optimistic statements come from popular investor King La Crypto, who has been observing a potential bullish repeat since early March. Noted analyst Mikybull Crypto was among those who drew a positive conclusion for BTC. The expert stated in his remarks:

We can see the market maker model in play when we correlate the Dollar Index DXY and Bitcoin. BTC still has another leg up.