BTC has once again surpassed the $47,500 threshold and continues its ascent following a strong daily close. What’s happening? Today, the US CPI data was revised, showing a 0.1% monthly increase. As Bitcoin races to new highs, altcoins are experiencing some weakness due to an increase in BTCD. Let’s quickly take a look at what’s going on.

Latest Developments in Cryptocurrencies

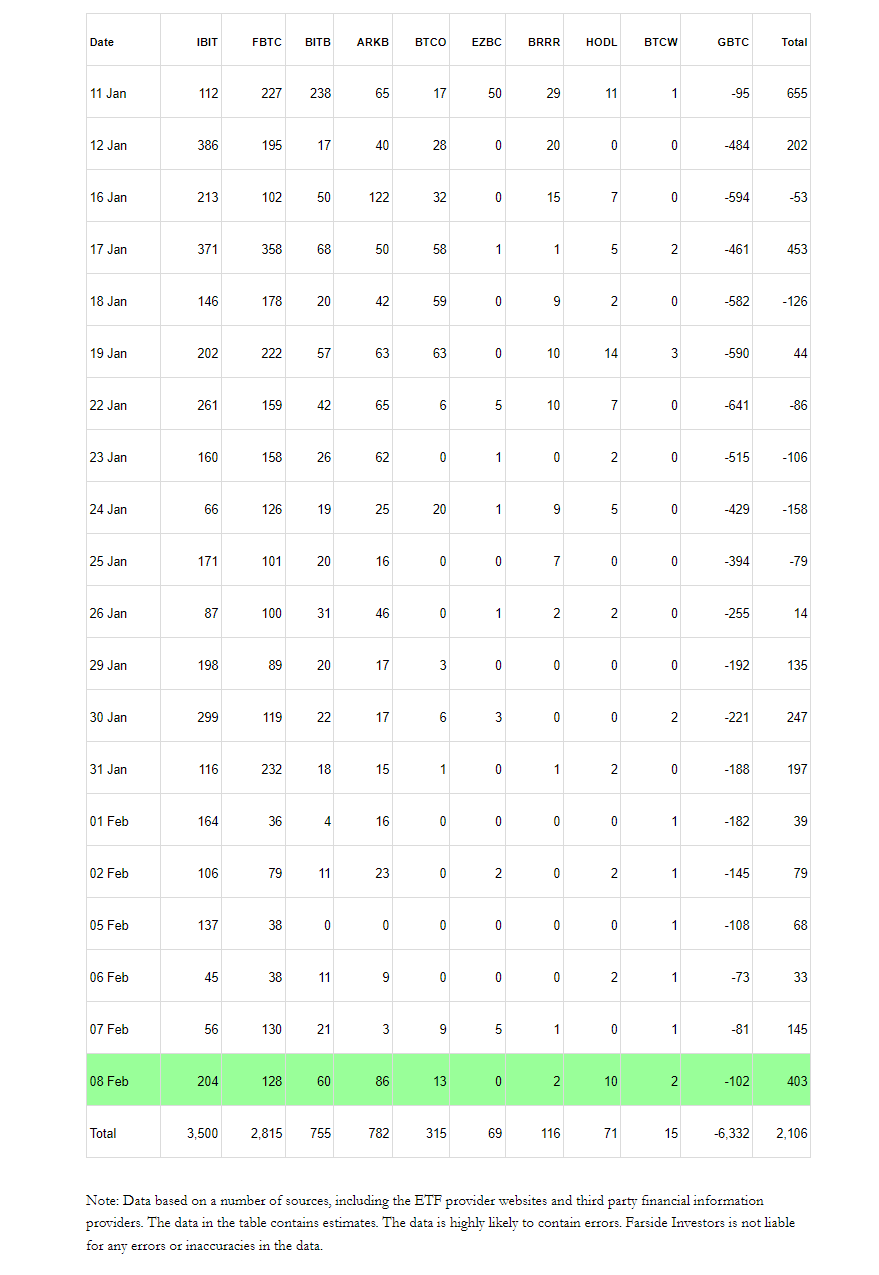

Yesterday, spot Bitcoin ETFs recorded the third-largest daily inflow of $403 million. This inflow reflects the ongoing excitement and is quite significant, offering hope for the medium-term price performance. BlackRock and Fidelity’s spot Bitcoin ETFs have accumulated more assets in just one month than ETFs launched in the last 30 years.

The historic spot Bitcoin ETF launch confirms expectations, and what we’ve seen since then shows that this is not just a passing fad. Since the launch day, net inflows have exceeded $2.1 billion.

BlackRock iShares Bitcoin Trust (IBIT) led yesterday with $204 million in inflows. Fidelity and BlackRock were the alternatives with the largest net inflows among all ETFs. The outflow from GBTC, however, dropped to $102 million on February 8th.

Kraken exchange received a license in the Netherlands. Hong Kong has started the process of establishing rules for OTC crypto service providers.

Bitcoin on the Rise

A significant slowdown in GBTC outflows and lively demand for other ETFs has led to Bitcoin’s price climbing to $47,700 today. Even though there are profit-taking sales at the time of writing, the ETF-supported rise could continue steadily.

BlackRock’s IBIT and Fidelity’s FBTC ETFs are ranked first among 5500 ETFs in terms of assets accumulated, according to Bloomberg data. Bloomberg ETF analyst Eric Balchunas describes this as unprecedented. The ongoing inflows suggest that the rapid investor flow may continue for a while longer. What will happen in a scenario where other asset management companies boldly offer these ETFs to their clients after a 3-6 month performance is established? Most likely, the years 2024-2025 will trigger new highs for BTC on this foundation.

Türkçe

Türkçe Español

Español