Ark Invest recently released a report titled “Bitcoin – Breakout or Breakdown?”, stating that “Bitcoin’s volatility reached the lowest level in the last 6 years in July, indicating significant potential for price movement in both directions.” This is not new news for investors who have been following the cryptocurrency markets.

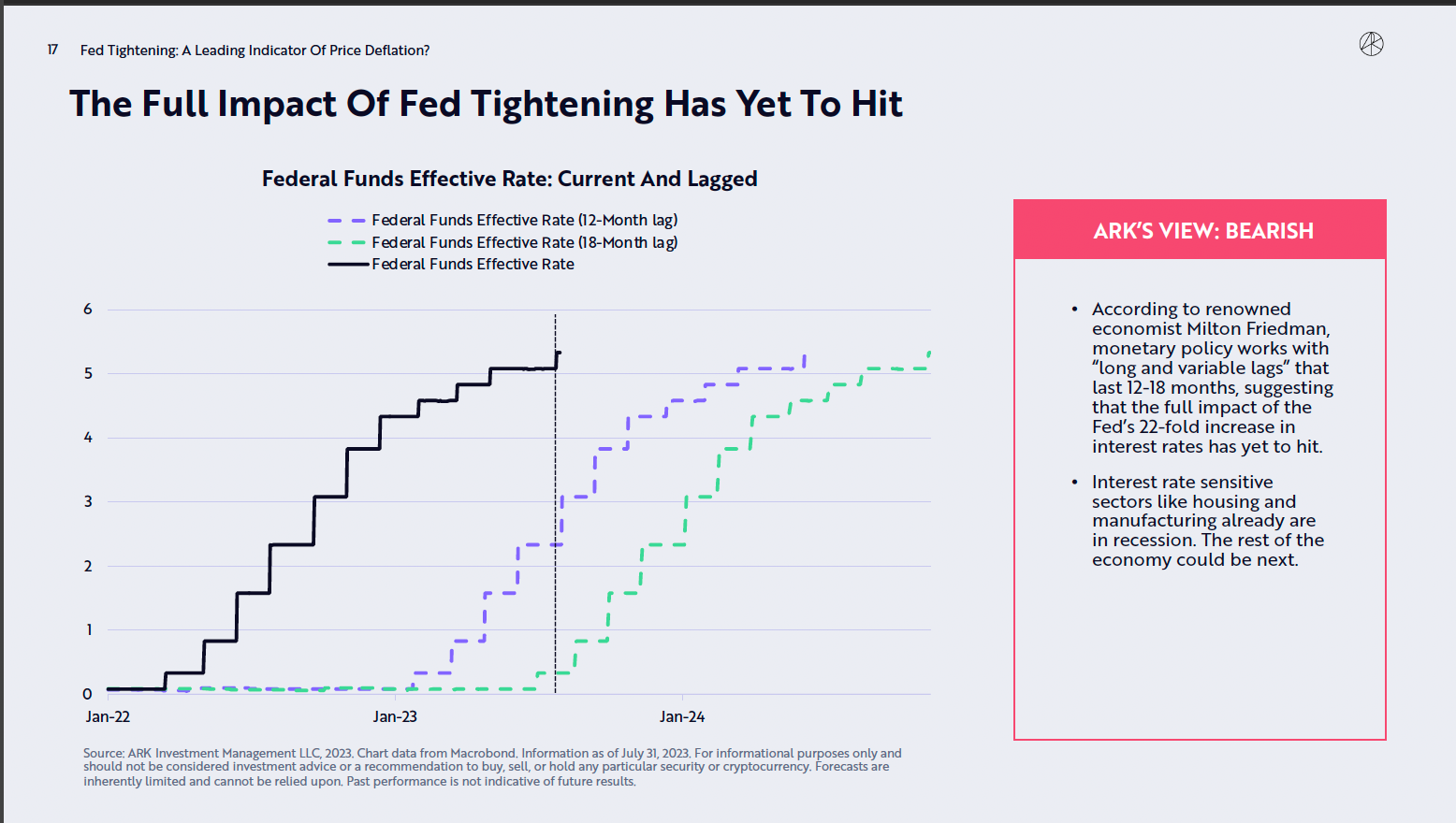

Fed Decisions Have Not Been Priced In Yet

The Ark Invest report suggests that the Fed tightening could be a “leading indicator of price deflation” and there may be a lag associated with monetary policy. In other words, “the real economy and inflation have not yet absorbed the Fed’s tightening of 300-500 basis points.” The report also mentions that China’s deflationary exports have been driving prices down continuously.

This indicates that the delayed effect of Fed tightening will coincide with Bitcoin’s halving rally in 2024-2025. If Ark’s analysis proves to be correct, the next bull run will likely be more subdued compared to previous cycles. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

However, some analysts believe the opposite. Martin Froehler, CEO of Morpher, recently stated that he expects the Bitcoin rally to continue in 2023:

“We have almost completed the interest rate hike cycle, so the current macroeconomic tailwinds will soon start to diminish. At the same time, we are about 9 months away from the next Bitcoin halving event, which historically has always dramatically increased the price.”

Kyle DaCruz, the product manager of digital assets at VanEck, expressed similar sentiments, stating that the scarcity of Bitcoin combined with unprecedented growth in money supply could lead to a continuous rally.

Will the BTC Rally Continue?

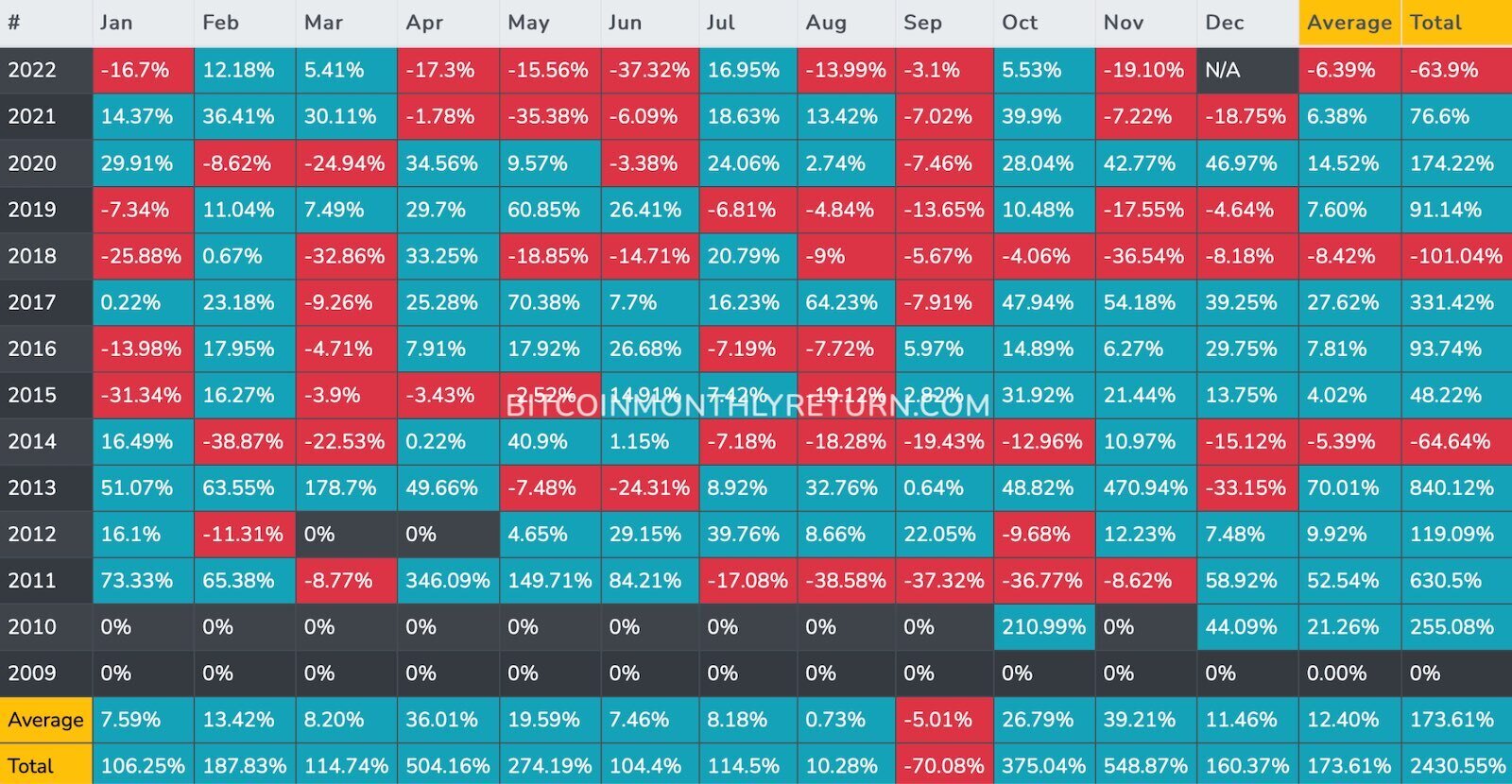

Historically, August and September have been the worst months for BTC price. Between 2011 and 2022, August had only five positive performances for BTC, while the other seven months were in the red. September performed even worse, with only four out of twelve months showing positive performance.

Furthermore, out of the twelve negative September months, only five had single-digit price drops, which is a small move for a historically volatile asset like BTC/USD. The average movement in September is -5%, while the average movement in August is +0.73%.

The recent sideways movement of Bitcoin’s price, accompanied by record-low BTC price volatility, suggests that the worst bear market may be behind us, as pointed out by Bitcoin investor Will Clemente, who noted that all years of negative performance for Bitcoin occurred two years after the halving.

However, this does not necessarily mean that the biggest gains for Bitcoin will occur in 2024 and 2025. As mentioned before, if this timeline aligns with the predicted deflation and potential recession by Ark Invest, the downward pressure on BTC price will offset most of the gains in the next potential bull cycle.

Türkçe

Türkçe Español

Español