Historical data can help us understand the current period and what may happen in the future. Many metrics have been tracked for Bitcoin for many years. These data have often guided investors in the past. So what do the same data tell us today?

When Do Cryptocurrencies Rise?

To answer this question definitively, one would have to be able to travel through time. If that’s not possible, we need to make some inferences from recurring patterns by looking at historical data.

Bitcoin has long been the most influential force in the cryptocurrency market, directing emotions and market dynamics. However, recent measurements reveal a worrisome trend. If we are not at the bottom according to the following data, BTC may have taken a bad path due to permanent indifference.

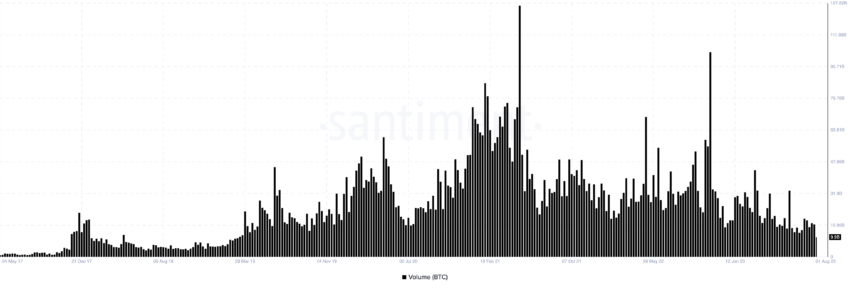

Transaction Volume

According to CoinGecko’s data, the current quarterly spot transaction volume for Bitcoin is $721.10 billion. It is worth noting that in the second quarter of this year, Bitcoin’s transaction volume reached $1.25 trillion, showing a 14% decrease compared to the previous month. If this trend continues until September, quarterly transaction volumes could drop to an unprecedented level since the first quarter of 2019.

A similar outlook applies to Ethereum. If this trend continues, Ethereum’s quarterly transaction volume will surpass $650 billion, another low point similar to 2019 levels.

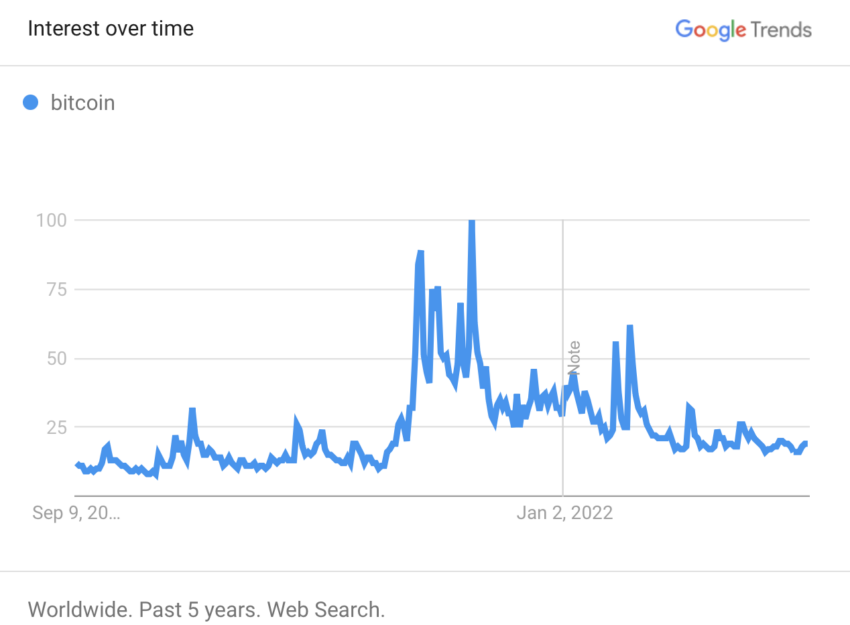

Google Bitcoin Search Volume

The significant decrease in Bitcoin and Ethereum transaction volumes is just the tip of the iceberg. Google Trends data is even more concerning. Organic search traffic for the two popular keywords “Kripto para” and “Bitcoin” has returned to levels not seen since 2019. Will Clemente, co-founder of Reflexity Research, said, “This looks exactly like indifference.”

While Bitcoin’s search traffic remains somewhat stable, the declining trend for the broader term indicates a waning interest among the public.

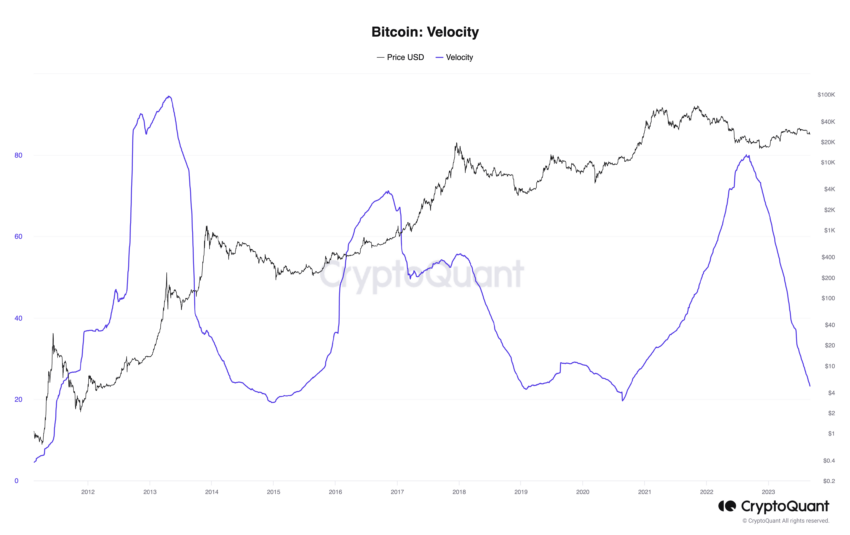

Low Volatility and Investor Sensitivity

Even more concerning is the historically low volatility measures for Bitcoin, which is known for price fluctuations. In a recent report, the cryptocurrency exchange Bitfinex highlighted that the delta between implied and historical volatility is only 1.3%, indicating market expectations for sustaining low volatility.

Conclusion

The market is experiencing a cooling-off period. Despite transaction volumes exceeding the average with $2.8 billion last week, the total outflows reaching $342 million in the past seven weeks indicate a negative sentiment.

Considering all the data together, BTC is clearly in an uncertain period. The decline in institutional investment products and weak volumes in spot markets suggest that if a bottom is approaching, it may have been perceived as “indifference.”

Only time will tell whether Bitcoin will regain its former glory or enter a troubling period of calmness.