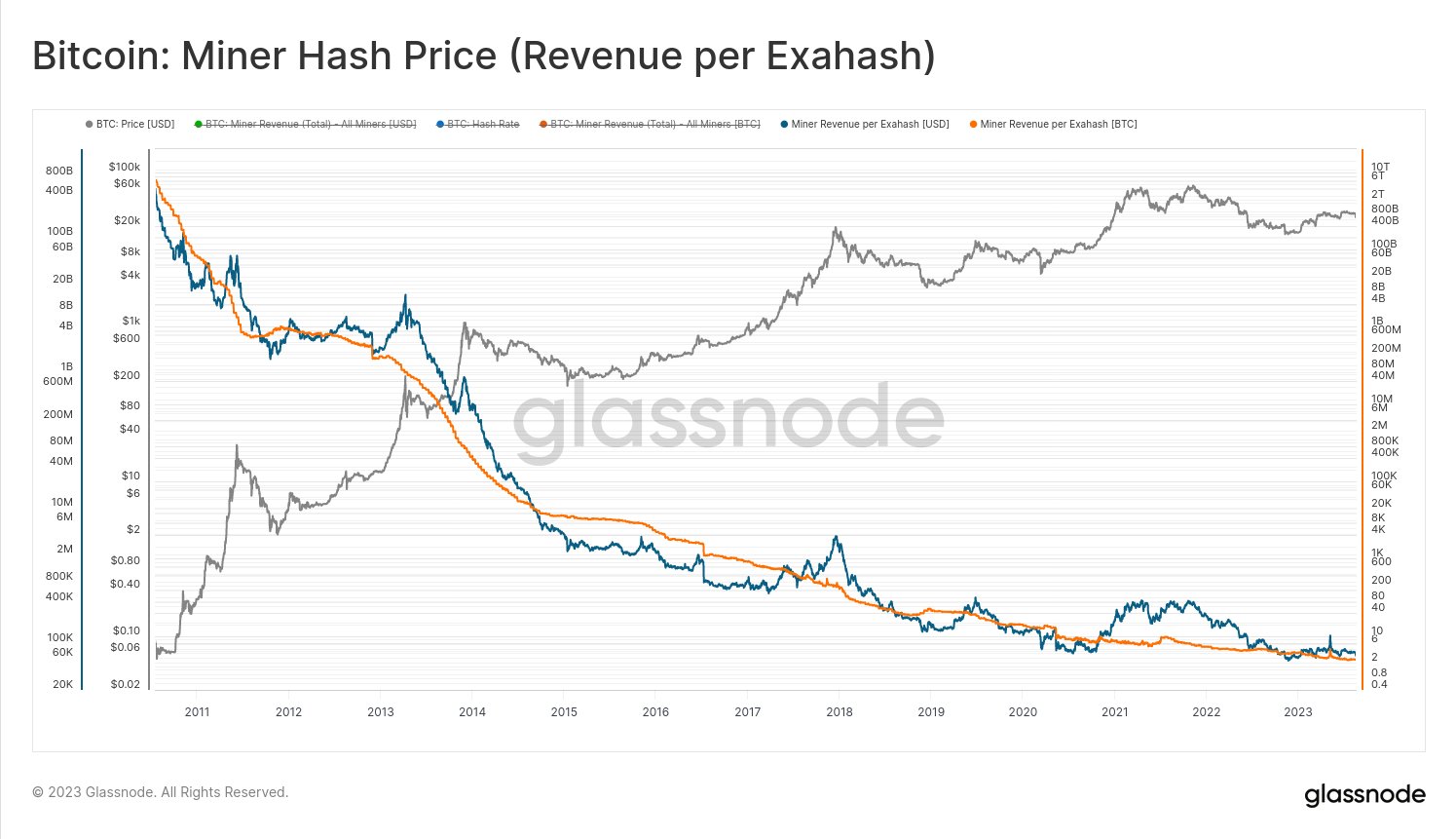

According to Checkmate, one of Glassnode’s leading analysts, Bitcoin‘s hash price, which essentially reflects the reward per hash given to miners or the reward they earn for verifying transactions, has reached its lowest level in history.

Bitcoin’s Hash Price Hits Rock Bottom

The hash price, which reflects the reward per hash given to miners or the amount of BTC they earn for verifying transactions, has hit its all-time low. Experts point out that this reward has never been so low in both Bitcoin and US dollars.

The hash rate of the Bitcoin network serves as proof of the network’s value and increasing computational power. Current data reveals that Bitcoin’s hash rate has reached an impressive level of 429.72 million Terahashes per second (TH/s). This represents a 1.85% increase compared to the 421.91 million TH/s on August 21.

Even more impressive is the astonishing 108.8% increase compared to the figures recorded one year ago, which stood at 205.77 million TH/s. Meanwhile, Bitcoin’s price has been hovering around $26,000 since the beginning of the week after experiencing a 10% drop last week.

Proof of Work Ensures Bitcoin Network’s Continued Strength

Along with Checkmate, many experienced cryptocurrency experts emphasize the flexibility of Bitcoin’s Proof of Work consensus algorithm despite the striking decrease in the hash price of the largest cryptocurrency. Checkmate argues that despite the declining security budget, the Bitcoin network remains strong without any disruptions. This observation points to the fundamental power and security supporting the Bitcoin network.

Another cryptocurrency expert, Beau Breedlove, argues that the focus should shift from income per hash to fixed income, especially considering the increasing hash rate. In response to Breedlove’s comment, Checkmate highlights the importance of measuring miner income in relation to the value preserved in the network.

Nicholas Gregory, who engaged in the debate with Breedlove and Checkmate, suggests that regulators in different jurisdictions may find it easier to ban Bitcoin rather than undermine it. However, Gregory emphasizes the daunting costs and complexities associated with challenging the Proof of Work consensus mechanism, suggesting that it may not be feasible. Checkmate agrees, stating that the Proof of Work consensus mechanism continues to be a costly option against potential attacks.

Türkçe

Türkçe Español

Español