With a market value of $567.54 billion, Bitcoin (BTC), the world’s largest cryptocurrency, continues to consolidate around $29,000. Investors are trying to make sense of the market, which has been experiencing the lowest volatility in recent years, without any directional movement, along with many on-chain indicators. However, the Bitcoin chart offered by QCP Capital, a Singapore-based crypto trading company, indicates that this silence will be broken in September.

Bitcoin’s Silence Will Be Broken in September

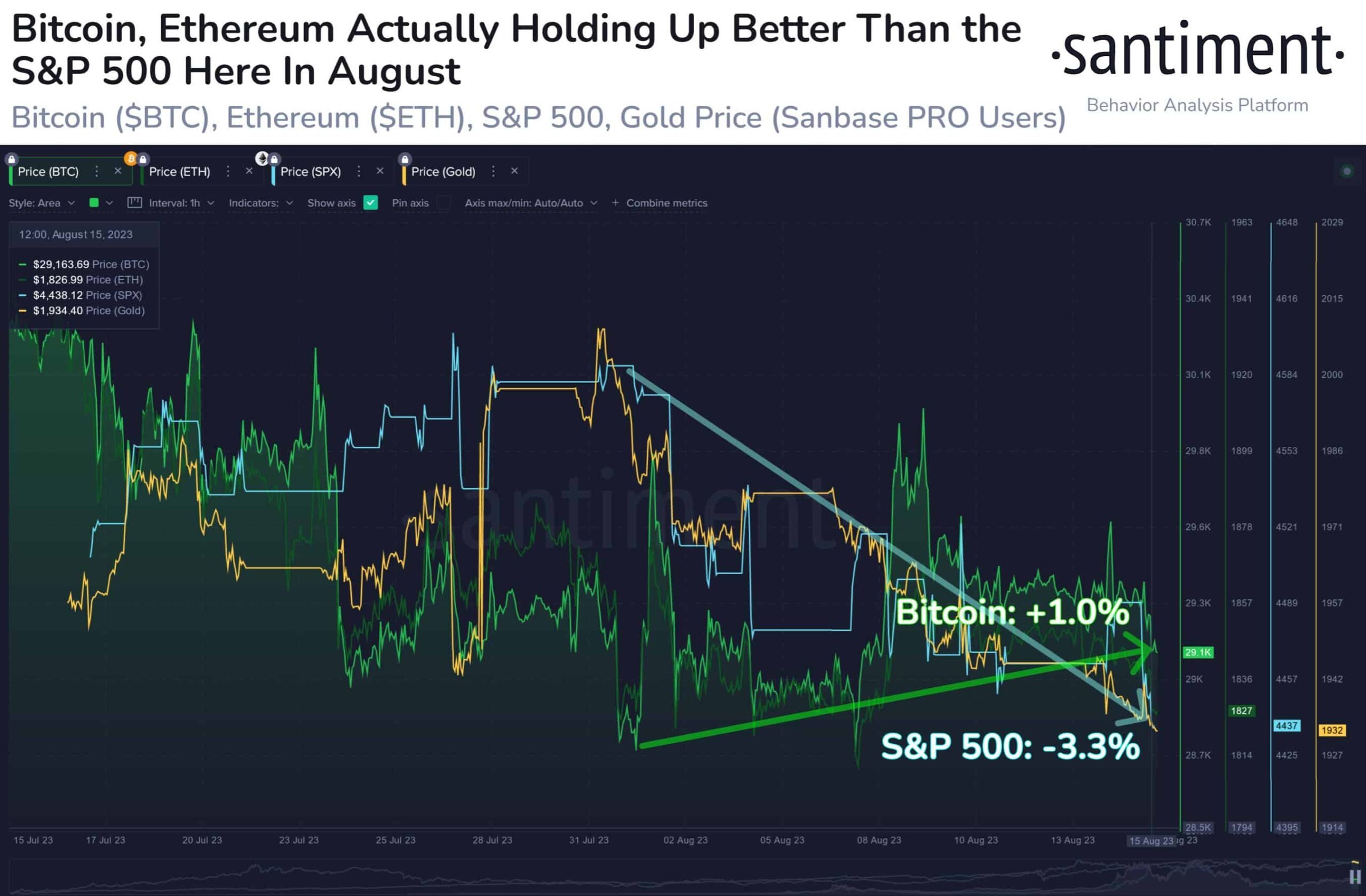

Despite being consolidated in a narrow range for a while, Bitcoin has outperformed the US stock market. On-chain data platform Santiment pointed out that despite Bitcoin staying within a narrow price range of $29,400, the largest cryptocurrency performed better than stock indexes like the S&P 500 in August. Furthermore, the data platform added that the correlation between Bitcoin and US stock indexes has broken since mid-July, and this breakdown has always favored the crypto market.

QCP Capital expects Bitcoin to move towards $34,000 as it is based on a significant support level on August 15. According to QCP Capital analysts, September will be a key month, and the $29,300 level can serve as a specific area of interest, triggering an upward movement:

Looking at the charts, the wedge pattern in which BTC has been trading since its last dip level of $15,000 will reach its first termination point at the beginning of September. Could there be a bounce that will take the price to the $34,000 resistance as it did in the previous three occasions when the price relied on the support trend line this year? We think there will be a few more weeks of silence before we find out. We are on alert to withdraw our short calls until the end of September and extend our short call until the end of December if necessary.

Bitcoin and the State of Altcoins

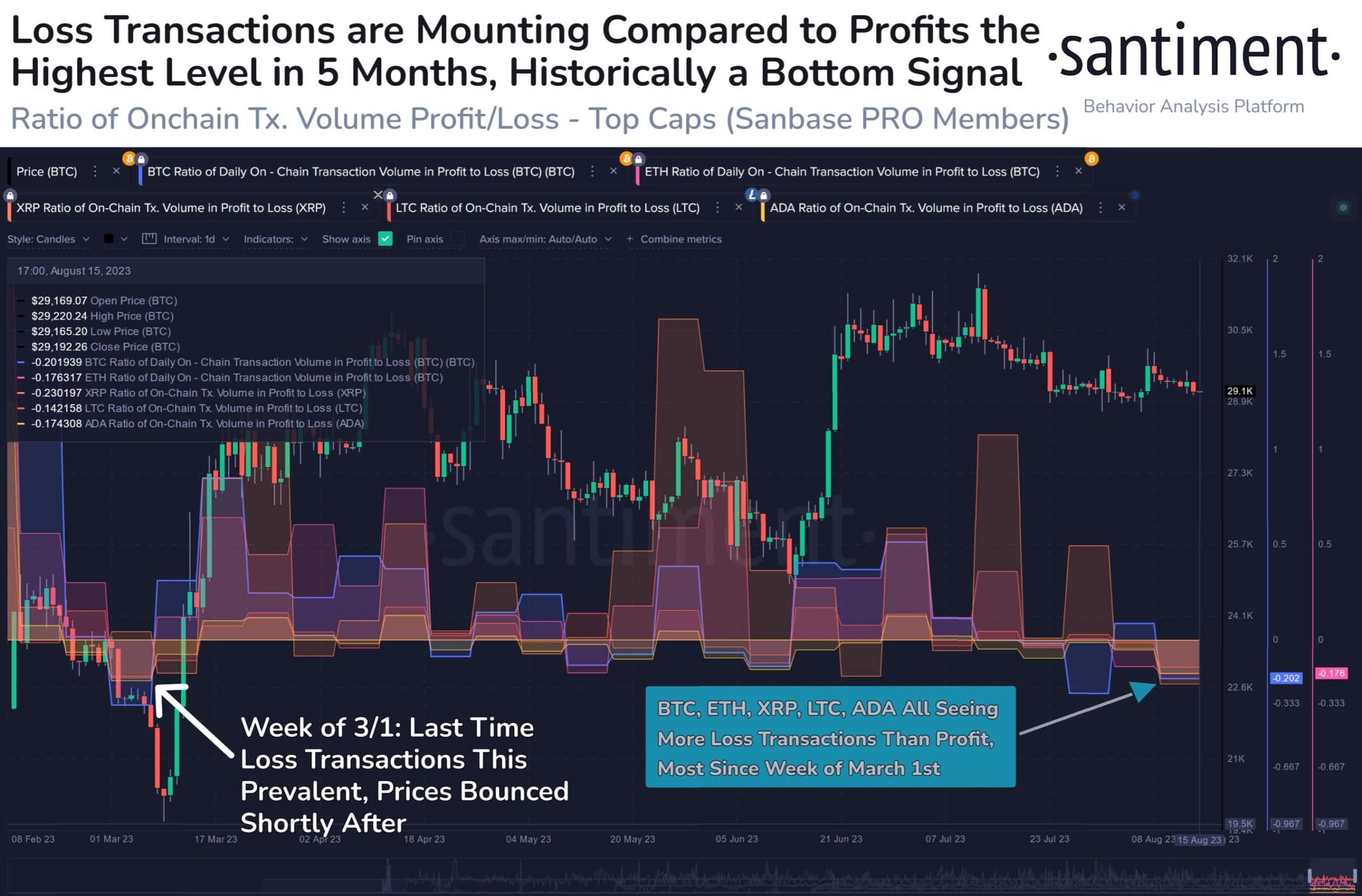

While Bitcoin faced a 0.7% drop in the last 24 hours, altcoins experienced a bigger drop, causing the market to move downwards. Santiment’s fundamental analysis comment on this situation states, “As markets continue to show weakness in a rally, investors are becoming increasingly indifferent between assets. Historically, an increase in the ratio of losing trades to winning trades strengthens the possibility of a bounce.”

In a recent report, Bloomberg highlighted that the trading activity of altcoins classified as securities by the SEC is higher than others. Just two months ago, the value of the crypto market decreased by approximately $20 billion due to the targeting of many leading altcoins as illegal securities by the SEC. Currently, 19 altcoins classified as securities at that time are experiencing a significant increase in trading volume. Data shows that the market share of all these altcoins has increased by approximately 2% to 13%.

Türkçe

Türkçe Español

Español