Bitcoin (BTC), the world’s largest cryptocurrency by market value, is trading at $26,232 with an approximately 2% jump in the last 24 hours. With a market value of $512 billion, the crypto king’s recent surge is seen as a relieving development due to the significant selling pressure it has faced in the past few weeks.

Increasing Number of Bitcoins on Crypto Exchanges

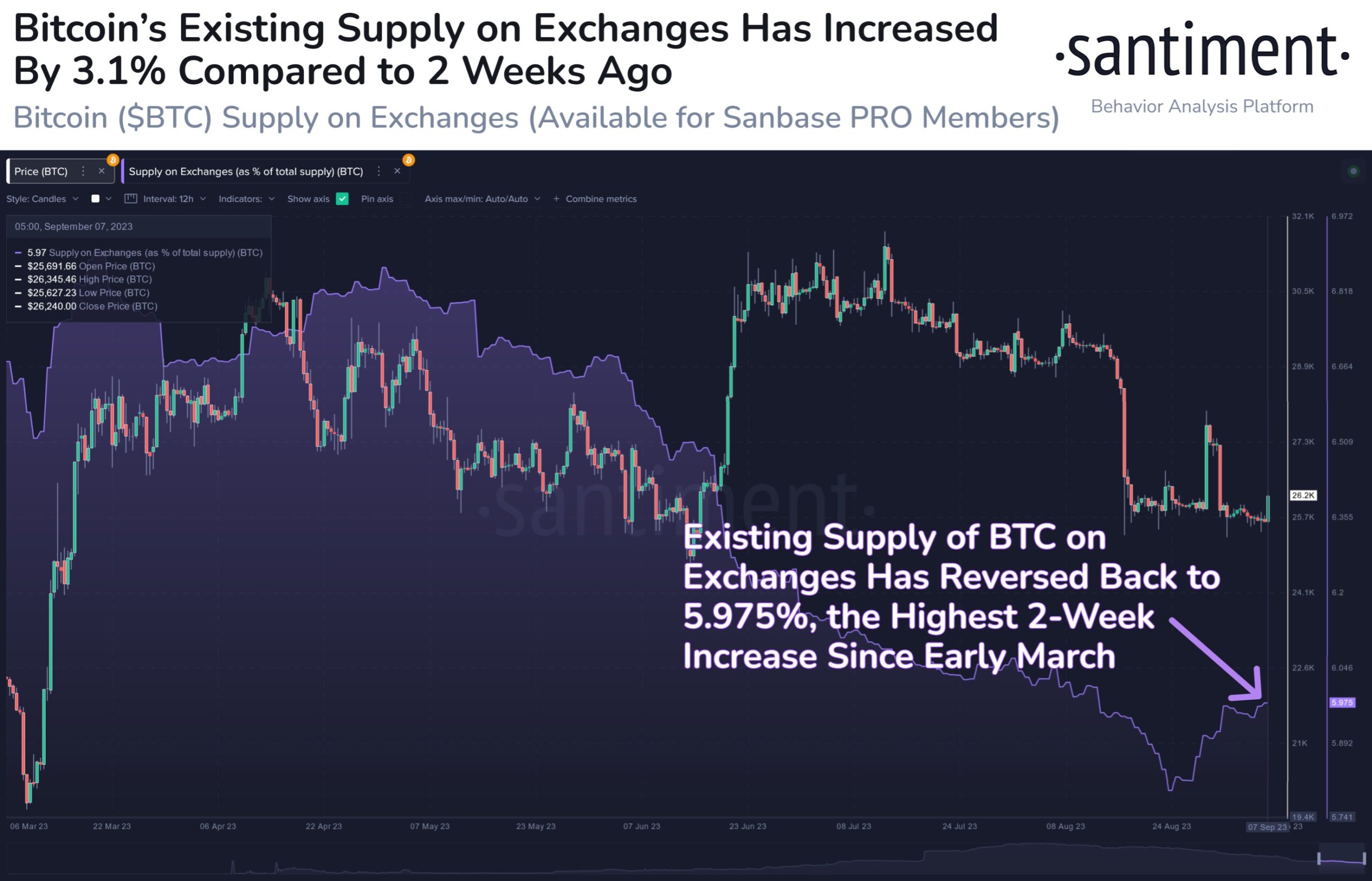

Experts and market analysts emphasize that the recent rise in Bitcoin’s price could turn into a selling opportunity due to the increase in the number of BTC on crypto exchanges. On-chain data provider Santiment highlighted the danger created by Bitcoin’s supply on crypto exchanges reaching its highest level in the past two weeks. According to the data, more than 5,000 BTC worth $128.5 million were sent to crypto exchanges in the last 24 hours.

In its note, Santiment stated, “Bitcoin recorded a modest price increase of 2% by reaching $26,300 again after a week. It is necessary to closely monitor the 3.1% increase in BTC supply on crypto exchanges in the past two weeks.” Santiment emphasized that traders and investors are motivated by the desire to make modest profits and highlighted that the recent price increase could be seen as an opportunity to take profits.

Furthermore, the $26,000 level is a key level that investors need to carefully monitor after the recent price surge. An inverse head and shoulders formation has been formed, indicating a potential further decline in the price of BTC. Sustaining above the $26,000 level will invalidate this inverse head and shoulders formation.

Possibility of Bitcoin’s Price Decline

Although the recent upward jump in Bitcoin’s price is a positive development, the $25,500 level continues to serve as a significant support level in the downward direction. Additionally, the crypto king continues to replicate textbook-like price movements before the block reward halvings. Historically, the months of August and September have witnessed significant declines for Bitcoin before the block reward halvings.

Experienced crypto analyst Stack Hodler shed light on Bitcoin’s future by focusing on its performance in the medium to long term and stated, “We are approaching the end of an important debt cycle, and governments will continue to devalue their currencies to fulfill their nominal debt obligations.”

Assets with limited supply, such as Bitcoin, tend to gain superiority in the long run against devaluation. For example, during the COVID-19 wave, governments devaluing their currencies led to a price increase of over 340% for Bitcoin.