As global markets face severe sell-offs, the cryptocurrency landscape is not spared from the turmoil. The trade war initiated by U.S. President Donald Trump through tariffs has caused significant upheaval in Asian stock markets. Concurrently, major cryptocurrencies like Bitcoin  $117,313 and Ethereum

$117,313 and Ethereum  $3,717 have experienced substantial value declines. Market sentiment is dominated by a “Sell now, think later” mentality, which is pressuring risky assets.

$3,717 have experienced substantial value declines. Market sentiment is dominated by a “Sell now, think later” mentality, which is pressuring risky assets.

Bitcoin, Ethereum, and Other Cryptocurrencies Crash, Liquidations Surge

The first trading day of the week in Asia opened with sharp declines. Bitcoin fell over 9% in the last 24 hours, retreating to around $74,000, while Ethereum saw a staggering 20% drop to approximately $1,400. The overall market capitalization of cryptocurrencies also reflected this trend, declining by over 10% to $2.37 trillion.

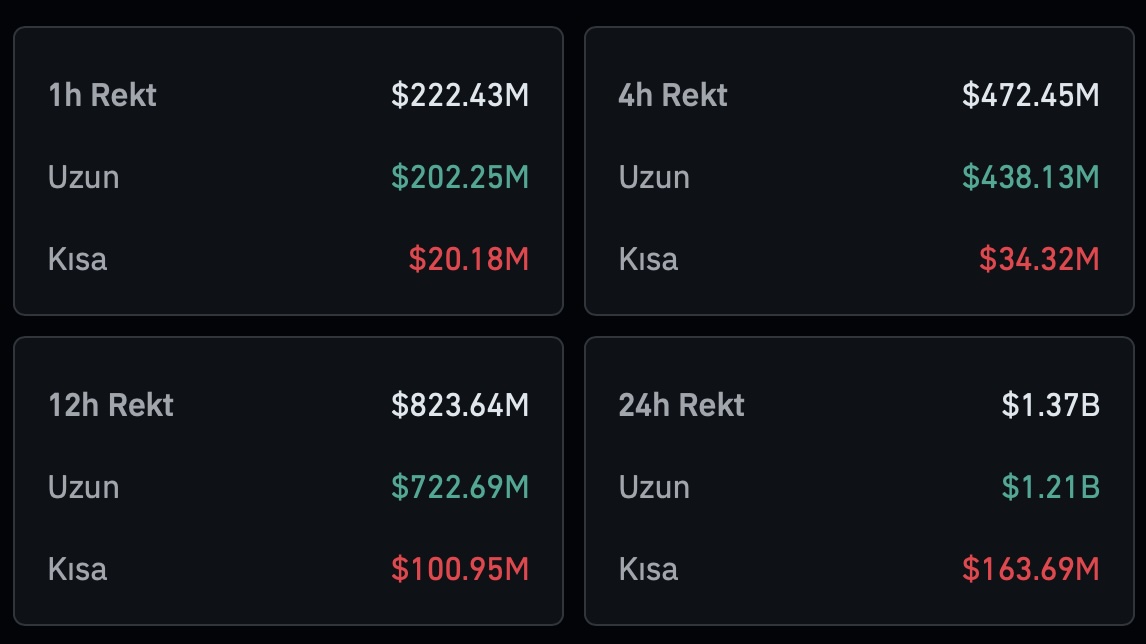

The prevailing panic in the market led to widespread liquidation of positions in futures trading. According to Coinglass data, roughly $1.37 billion in positions were liquidated within the last 24 hours. Of this, approximately $1.21 billion consisted of long positions, while short positions accounted for only $164 million. This ratio indicates that most investors were holding bullish positions, but with market directions contrary to expectations, they are facing significant losses. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Jeff Mei, COO of BTSE exchange, indicated that the cryptocurrency market is prone to earlier movements on weekends compared to traditional exchanges, and this trend was confirmed by the Asian market’s opening. Analysts suggest that the steep declines over the weekend were already priced into the panic atmosphere in Asian markets.

Asian Markets Hit Hard

Major stock indices in Asia opened the week in the red. Japan’s Nikkei 225 index fell by 8% at the opening, triggering its circuit breaker. South Korea’s Kospi index dropped by 4.6%, while China’s Shanghai Composite index experienced a 5.8% decline. The Shenzhen Composite index witnessed a remarkable drop of 7.2%.

The Taiwan stock exchange reopened after a long holiday, and as it joined the market, nearly a thousand stocks hit their daily decline limit. TSMC, the world’s largest chip manufacturer, immediately dropped to its lower limit as the market opened, intensifying worries surrounding technology-heavy stocks.

According to Presto Research Director Peter Chung, the timeframe for market recovery hinges on three fundamental factors: the global reaction level, whether the Trump administration can present a coherent long-term plan, and the Federal Reserve’s response to prevailing instability.

Chung emphasized that “Growth Fear 2.0 has returned with full force,” pointing out that markets have priced in expectations of a 100-basis-point interest rate cut this year. He noted that the U.S. trade policy’s aggressive stance has undermined investor confidence, leading to turbulence in both traditional finance and cryptocurrency markets.

LVRG Research Director Nick Ruck mentioned that this uncertainty could exacerbate exaggerated sell-offs in cryptocurrencies, as investors are responding not only to external developments but also to the evolving sentiments within the cryptocurrency markets. The uncertainty faced by investors is challenging both traditional and crypto markets, making stabilization in the short term seem unlikely.

Türkçe

Türkçe Español

Español