Cardano (ADA) holders faced tough times last week as prices fell. However, interest in the DeFi sector increased. Cardano’s decentralized exchange (DEX) daily volume exceeded 23 million ADA.

DEX Volume in ADA

Despite the increase in DEX volumes, the TVL (total value locked) for Cardano decreased. Data from Artemis revealed that Cardano’s TVL dropped from $430 million to $230 million. This drop in TVL may be due to a lack of interest in dApps on the Cardano network. Another factor that could negatively impact Cardano is the NFT transactions on the network. Last month, there was a significant drop in the floor price and overall transaction volume of popular NFTs on the Cardano network.

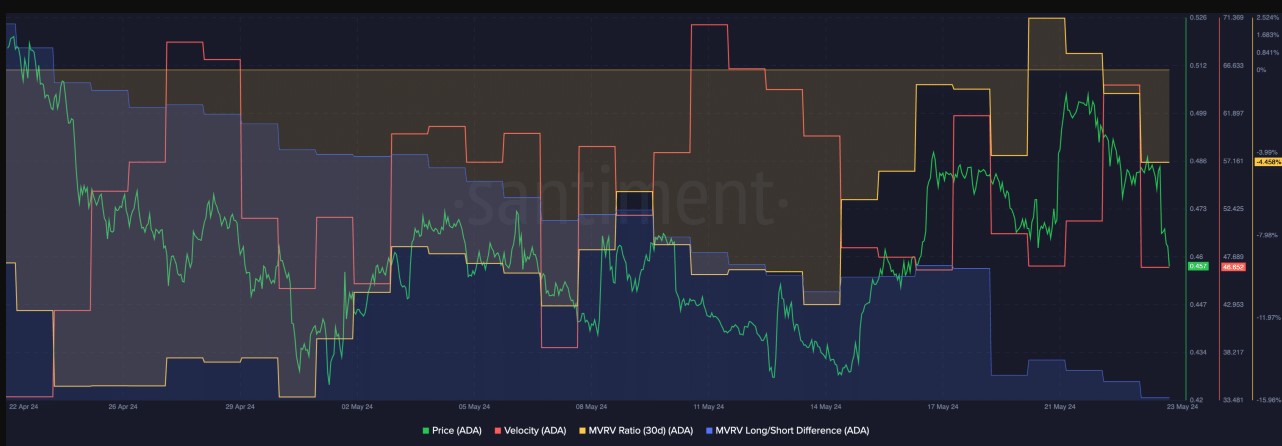

The declining interest in Cardano’s ecosystem could seriously affect the protocol and negatively impact the price movement of ADA. At the time of writing, ADA is trading at $0.4489. Over the past few weeks, ADA’s price has shown numerous lower lows and lower highs, indicating a downtrend. Subsequently, ADA traded between $0.512 and $0.421. The $0.512 level was tested multiple times during this period.

Technical Outlook for ADA

If ADA retests and weakens the $0.512 level again, there could be a potential reversal in price moving forward. However, at the time of writing, the data does not support a bullish outlook for ADA. The relative strength index (RSI) for ADA showed a significant decline, indicating a drop in bullish momentum. Moreover, Cardano’s CMF (Chaikin Money Flow) also declined significantly.

This could indicate a significant reduction in the money flowing into ADA. Another concerning factor for ADA is the decrease in its velocity. The declining velocity shows that the frequency of ADA transactions has significantly decreased in the last few days. Additionally, ADA’s MVRV ratio dropped significantly. This indicated that the profitability of most addresses had decreased. The drop in ADA’s Long/Short ratio could also indicate a decrease in the number of long-term addresses holding ADA.

Türkçe

Türkçe Español

Español