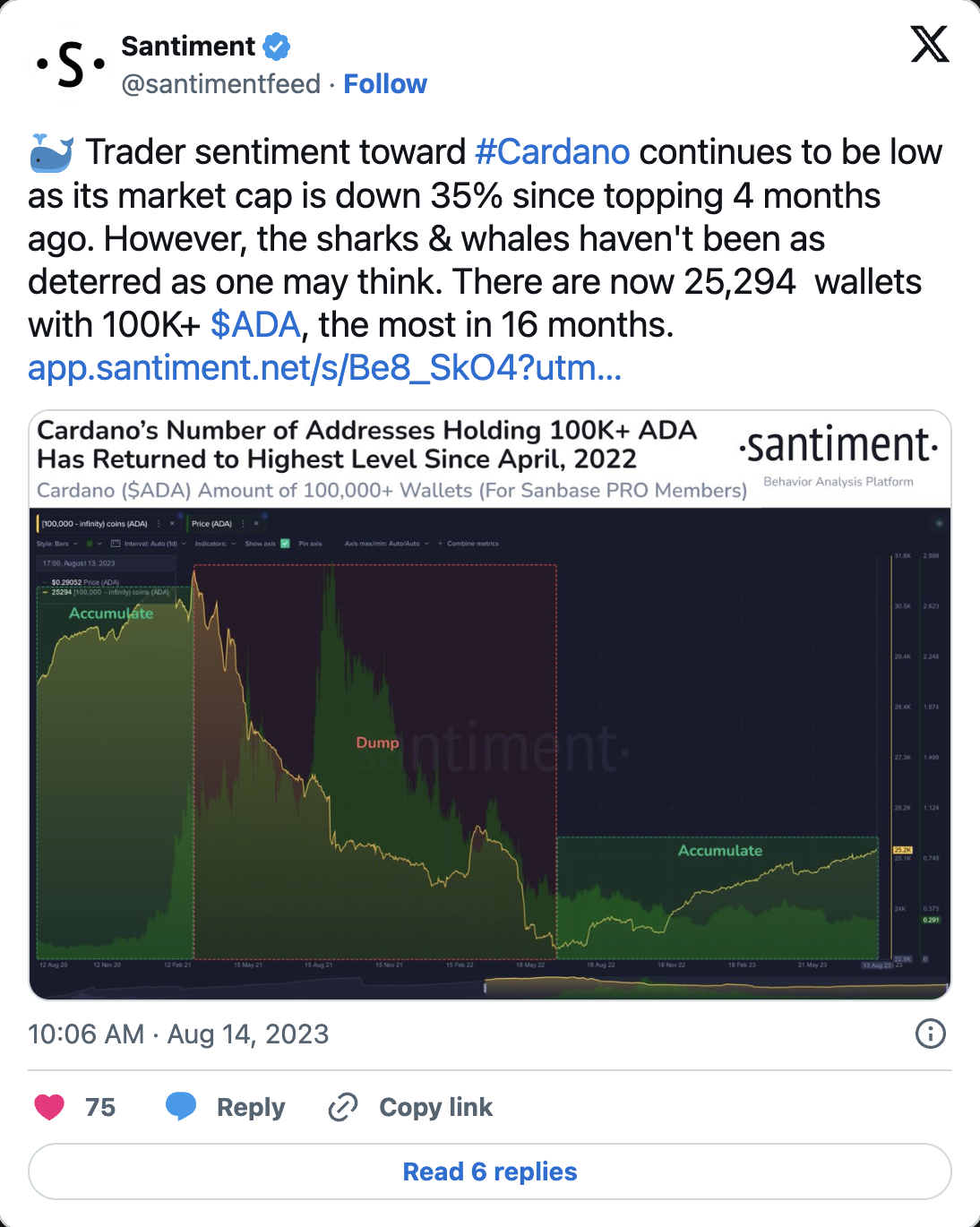

After the significant token distribution between February 2021 and May 2022, Cardano investors holding more than 100,000 ADA tokens have started accumulating the cryptocurrency asset again. However, despite this important development, most Cardano investors are still in the red, and daily investors continue to sell ADA.

Investors Continue to Buy ADA

According to Santiment, these investors continue to buy ADA despite the steady decline in the altcoin’s value, but the cryptocurrency asset’s market value has decreased by 35% in the last four months. At the time of writing, Cardano’s market value was $10 billion, ranking it as the ninth-largest cryptocurrency asset in terms of market value.

The token price has also decreased by 69% since the investor group started accumulating the token. In May 2022, ADA was trading above $0.7. Currently, it is trading below $0.3.

ADA Investors Unable to Make Profit

On-chain data analysis of ADA’s profitability as a digital asset last year revealed that the majority of investors have been unable to make a profit since April 2022. According to Santiment, the Market Value to Realized Value (MVRV) ratio of the token turned negative on April 7, 2022, and remained below the median line.

This metric tracks the ratio between the current price of an asset and the average price at which each token was purchased. A high MVRV ratio indicates that the asset is overvalued, while a low MVRV ratio indicates that its value is low. At the time of writing, this ratio was -51.36%, meaning that more than half of all investors would incur losses if they sold ADA at its current value.

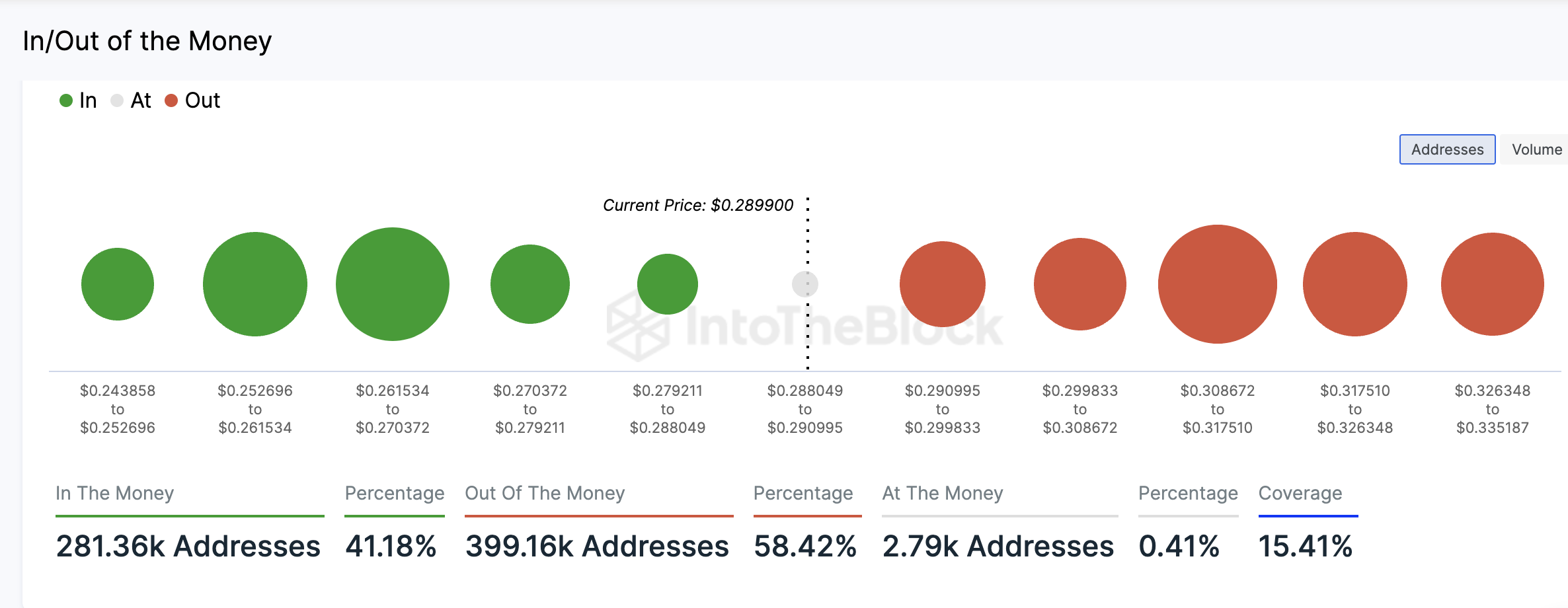

Additionally, data from IntoTheBlock revealed that 3.94 million addresses holding ADA are “out of the money.” This means that investors are currently holding the altcoin at a loss. This figure represents 89% of all token holders, while only 10.26% of all ADA addresses holding the token are in profit.

With further price drops, daily investors continue to sell ADA. The Relative Strength Index (RSI) was 42.99, and the Money Flow Index (MFI) was at 23.67, almost at oversold levels, according to press time.

Both fundamental indicators have shown a momentum shift from the buyer side to the seller side since the beginning of August, staying below their centerlines. Sellers were dominating the ADA market with the positive directional index (green) below the negative directional index (red) at the time of writing.