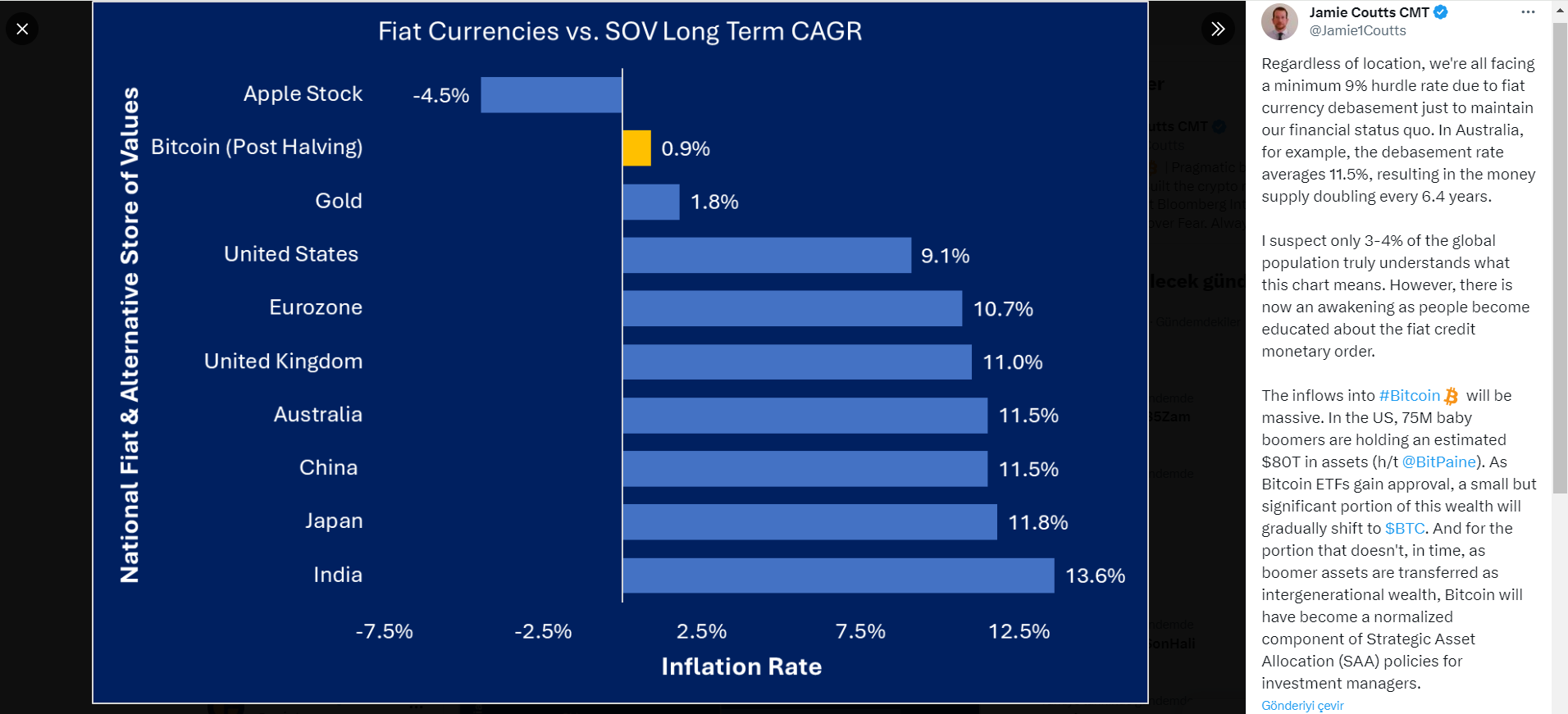

Analyst Jamie Coutts sheds light on a common challenge faced by individuals worldwide, emphasizing a minimum barrier rate of 9% due to the depreciation of fiat currency. Coutts points out that maintaining our financial status quo requires overcoming this barrier and notes that Australia has experienced an average depreciation rate of 11.5%. This rate signifies that the money supply doubles every 6.4 years, highlighting the significant impact of currency depreciation.

Invisible Challenges and Mass Entries into Bitcoin BTC

Coutts believes that only a small portion of the global population, approximately 3-4%, truly understands the consequences of this financial environment. However, he notes that there is a growing awareness among people as they become educated about the nuances of the fiat credit-based monetary system.

Highlighting a potential solution to the challenges created by the depreciation of fiat currencies, Coutts predicts a significant entry into Bitcoin. He draws attention to the United States, revealing that the 75 million individuals in the baby boomer generation collectively possess an estimated wealth of 80 trillion dollars. It should be noted that the baby boomer concept covers those born between 1946 and 1964.

With the expected approval of Bitcoin ETFs, Coutts foresees a gradual yet significant shift of this wealth into Bitcoin.

Bitcoin’s Journey to Mainstream Investment

As Bitcoin is increasingly recognized as a legitimate asset, Coutts anticipates its inclusion in Strategic Asset Allocation (SAA) policies for investment managers. Even for the portion of wealth not immediately transitioning to Bitcoin, Coutts foresees the cryptocurrency becoming a normalized component of intergenerational wealth transfer among the baby boomer generation.

In summary, Coutts paints a picture of a global awakening to the challenges created by the depreciation of fiat currency. As awareness increases, he predicts a significant movement of assets towards Bitcoin and positions the cryptocurrency not only as a hedge against inflation but also as a fundamental element in long-term investment strategies.

The integration of Bitcoin into mainstream financial practices appears to be an inevitable outcome, signaling a transformative change in wealth preservation approaches for individuals and investment managers in the face of currency depreciation.

Türkçe

Türkçe Español

Español