Crypto currency market continues to face security issues. Accordingly, in 751 security incidents that occurred in 2023, $1.8 billion worth of crypto assets were lost. This amount, although significant, represents a 51% decrease compared to the $3.7 billion lost in 2022 due to hacks and other incidents.

What Happened in 2023?

The data related to the subject was taken from the annual report titled Hack3d: Web3 Security Report 2023 by the blockchain security firm CertiK. The security company compiled data emphasizing the state of Web3 security in the report they published on January 3rd.

The report stated that the most significant losses, exceeding $686 million, were recorded in the third quarter of 2023. Additionally, the theft of seed phase data continued to be the most costly attack factor. In 2023, 47 incidents involving the theft of seed phases resulted in losses exceeding $880 million.

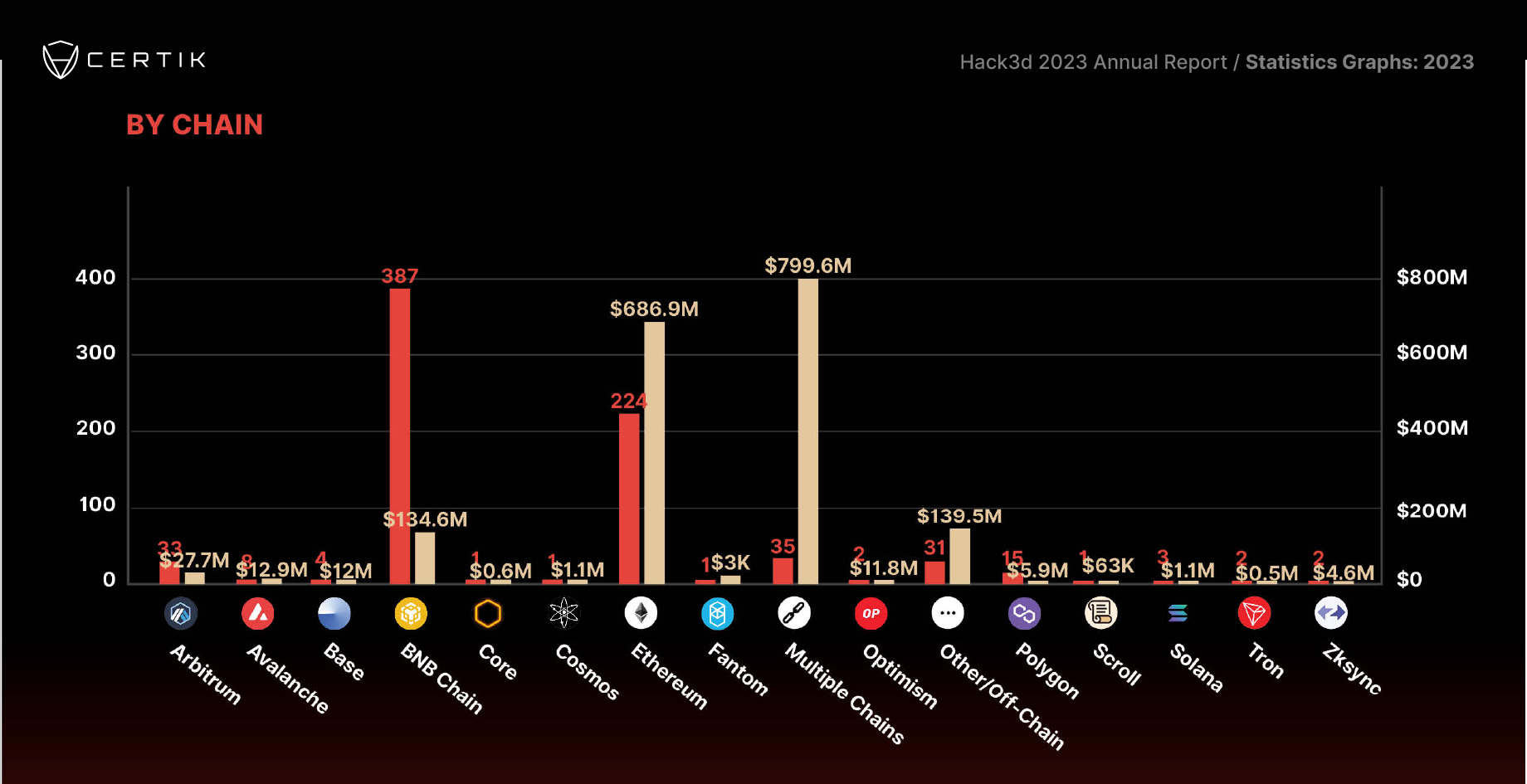

When it comes to blockchain networks, the Ethereum network was the ecosystem with the most losses. According to CertiK’s report, the Ethereum network experienced a loss of $686 million in 224 incidents. This shows that the blockchain network lost an average of $3 million per incident. On the other hand, BNB Chain recorded 387 security incidents. However, the total loss was only $134 million, which was much lower than the losses experienced on the Ethereum network.

Prominent Figure Makes Noteworthy Statements

In addition to all this, the area of interoperability between chains continues to be a problem for the crypto sector. The security report highlighted that losses from security breaches affecting multiple blockchain networks were nearly $800 million. Ronghui Gu, co-founder of CertiK, stated in a comment that all things considered, 2023 was a positive development for the security of the blockchain field. Gu explained:

“The growth of bug bounty platforms and other proactive security measures is a good sign. Hopefully, we will see a continuous decline in losses throughout 2024.”

Gu also mentioned that the 51% decrease in losses could be attributed to the broader bear market, which saw token and treasury valuations fall. However, Gu believes that keeping losses low during a bull run would demonstrate that the Web3 industry has learned its security lessons.

Türkçe

Türkçe Español

Español