The trading volumes in the cryptocurrency market saw an uptick in June for the first time in three months, driven by investor optimism following applications for spot Bitcoin exchange-traded funds (ETFs) submitted to the US Securities and Exchange Commission (SEC) by major asset management firms, including the world’s largest, BlackRock.

Spot and Derivative Trading Volume Increased by 14% in June

According to a report prepared by CCData, the spot and derivative trading volume on centralized cryptocurrency exchanges rose by 14% to $2.71 trillion in June, marking the first monthly increase since March.

The rise in trading volumes in the cryptocurrency market was boosted by increased optimism following applications to the SEC for spot Bitcoin ETFs by several high-profile American companies, including Invesco, WisdomTree, and Fidelity.

CCData noted, “The increased volatility following the SEC’s lawsuit against Binance US and Coinbase, and applications to the SEC for spot Bitcoin ETFs by companies like BlackRock and Fidelity, contributed to the positive outlook in the market, leading to an increase in trading volume last month.”

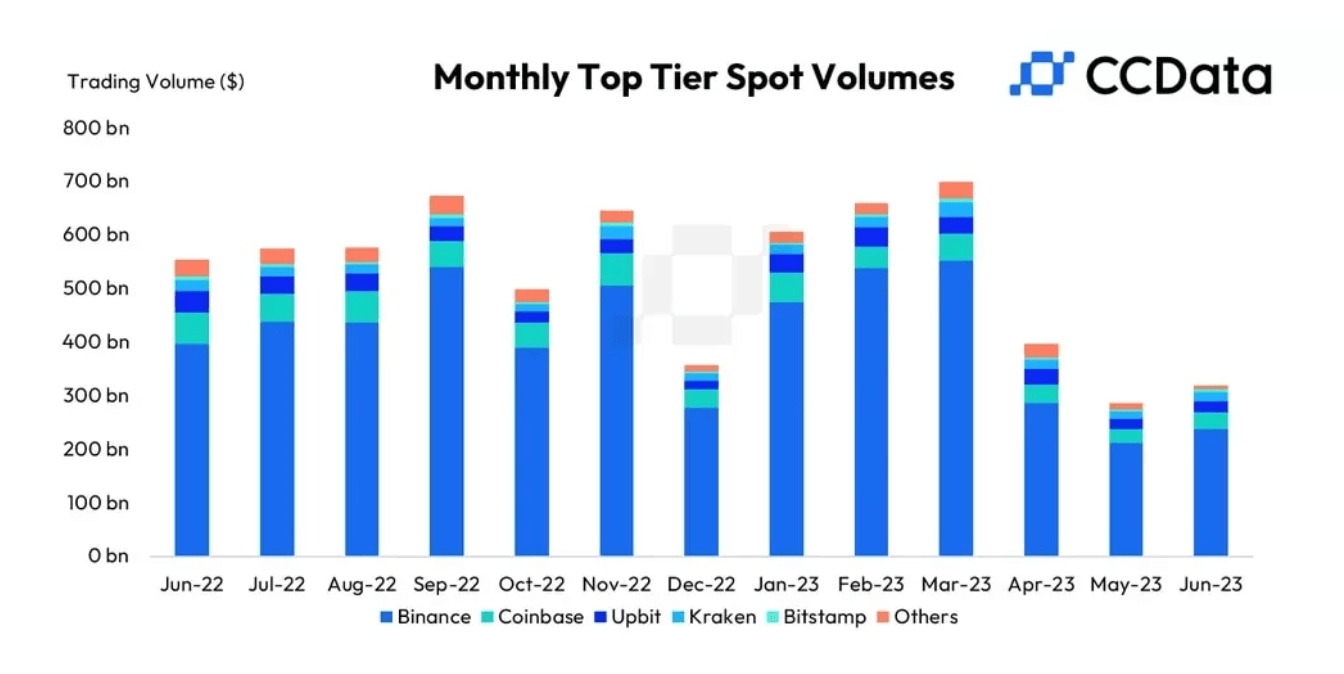

Spot Trading Volume Remains at Lowest Levels in Recent Years

Despite the combined increase in spot and derivative volume, the spot trading volume continues to remain at its lowest in recent years. According to the report, the spot trading volume in the second quarter was the lowest since the fourth quarter of 2019.

In contrast, the volume in the derivatives market increased by 14% in June, accounting for 78.7% of the cryptocurrency market. However, this proportion was down from 79.1% in May, marking the first decline in the derivative market’s share in four months and was seen as a sign that the ETF applications by the major companies were encouraging the spot accumulation of cryptocurrencies.

The report also noted that the total derivative volume traded on the Chicago Mercantile Exchange (CME) rose by 23.6% in June to $48.3 billion.