The launch of Bitcoin exchange-traded funds (ETFs) continues to spark debates about the long-term expectations of Bitcoin’s price and supply. Although it did not have an immediate impact on the Bitcoin price, the approval triggered a reversal along with institutional entities that provide Bitcoin ETF products, increasingly accumulating the crypto asset.

Noteworthy Details About Bitcoin

The inclusion of BlackRock, the world’s largest asset manager, among these institutions has raised hopes that the increased participation of individual investors in Bitcoin ETF products will contribute to future price increases. A recent report shows that 11 spot Bitcoin ETF applications currently hold about 3.3% of the existing Bitcoin supply.

Recently approved Bitcoin ETF applications include Grayscale, BlackRock, Fidelity, Franklin Templeton, Invesco, VanEck, WisdomTree, Hashdex, Bitwise, Valkyrie, and BZX. According to the latest data from Ycharts, there are currently 19.61 million Bitcoins in circulation.

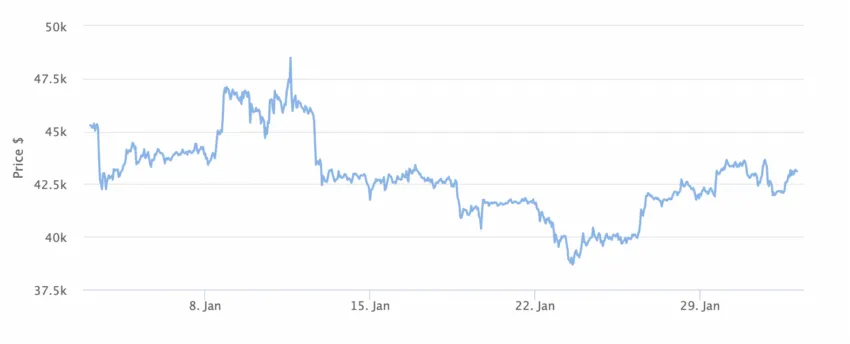

Nevertheless, speculation continues in the crypto industry about the potential impact of the Bitcoin halving event in April on both price and supply. This event, which occurs every four years, reduces mining rewards by half, thus decreasing the rate of new Bitcoin being mined and reducing the total supply. At the time of writing, the price of Bitcoin was $43,006.

What Happened After ETF Approval?

On January 10th, the SEC gave the green light to 11 spot Bitcoin ETF applications, igniting expectations of an imminent price increase. Contrary to speculation, the value of Bitcoin fell by about 10% after the approval. On January 16th, SEC Chairman Gary Gensler stated that he was being ironic in approving spot Bitcoin ETF products. He believes that such financial products contradict the principles of Bitcoin and bring centralization to the crypto asset.

Gensler warned that this decision could intensify speculation and increase volatility in an already unstable market. Since Gensler’s statements, subsequent events have proven the SEC chairman right. Particularly, investors who trade on news continue to play a significant role in Bitcoin selling.

Türkçe

Türkçe Español

Español