Dogecoin (DOGE) has always been in the spotlight due to its position in the market and the interest it attracts. As of this writing, DOGE continues to hold a crucial position, and losing this could trigger significant losses for investors. A broader market analysis shows an increasing downward trend in DOGE. This situation could potentially worsen.

Will Dogecoin’s Price Drop?

As of today, Dogecoin’s price continues to trade above a critical support level that could potentially result in a death cross. The recent rally in the crypto market could influence this outlook on altcoins.

A similar view might have emerged on the Moving Average Convergence Divergence (MACD) side, a trend-following momentum indicator that considers the price of an asset’s two moving averages to reveal trend changes. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Looking at the indicator, the decrease in green bars in the histogram could suggest a potential downward transition. Despite being the first optimistic outlook in the past month, this indicates a slowdown in the rise.

Overall, given the market conditions, there seems to be no recovery outlook, and investors might want to create a saving effect on an asset. However, investors might still want to step back, and the situation for DOGE may not go as desired.

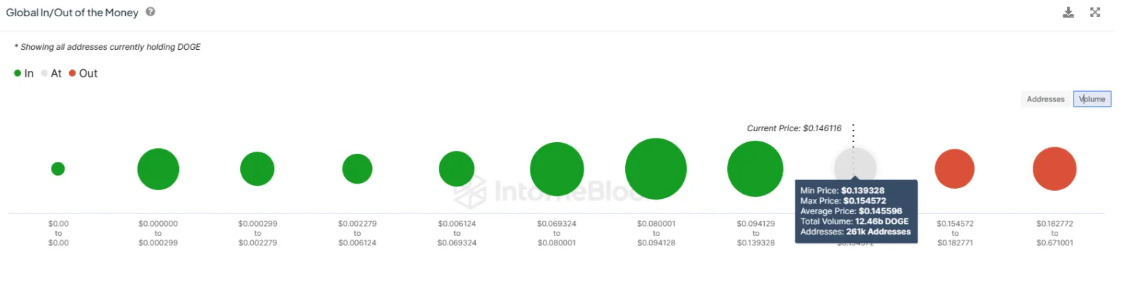

The Global In/Out of the Money (GIOM) indicator suggests that if Dogecoin’s price drops, the profitability of 12.48 billion DOGE purchased between $0.13 and $0.15 could be lost, potentially moving $1.8 billion worth of supply into a loss, encouraging investors to hold until gains reappear.

What Will DOGE’s Price Be?

As of this writing, DOGE’s price has risen above the $0.15 level, which has been tested multiple times as a significant support level in the past. Historically, a drop below this crucial support level has opened the way for a decline to the $0.12 support level.

Exponential Moving Averages (EMA) could have triggered a potential death cross formation. A death cross is known as a bearish formation where the short-term 50-day EMA crosses below the long-term 200-day EMA, potentially indicating an ongoing downward trend.

Looking at all these events, DOGE could potentially retreat to the $0.12 support level, and this process could result in a loss of $1.8 billion. On the other hand, if Dogecoin continues to stay above $0.15, this bearish thesis could reverse, bringing 12.48 billion DOGE back into a profitable position.

Türkçe

Türkçe Español

Español