According to Lookonchain, Ethereum (ETH) co-founder Jeffrey Wilcke’s wallet made a significant deposit of 4,300 ETH to an exchange. The last recorded deposit from this wallet dates back to June 2023.

Continued Outflows in ETH Market

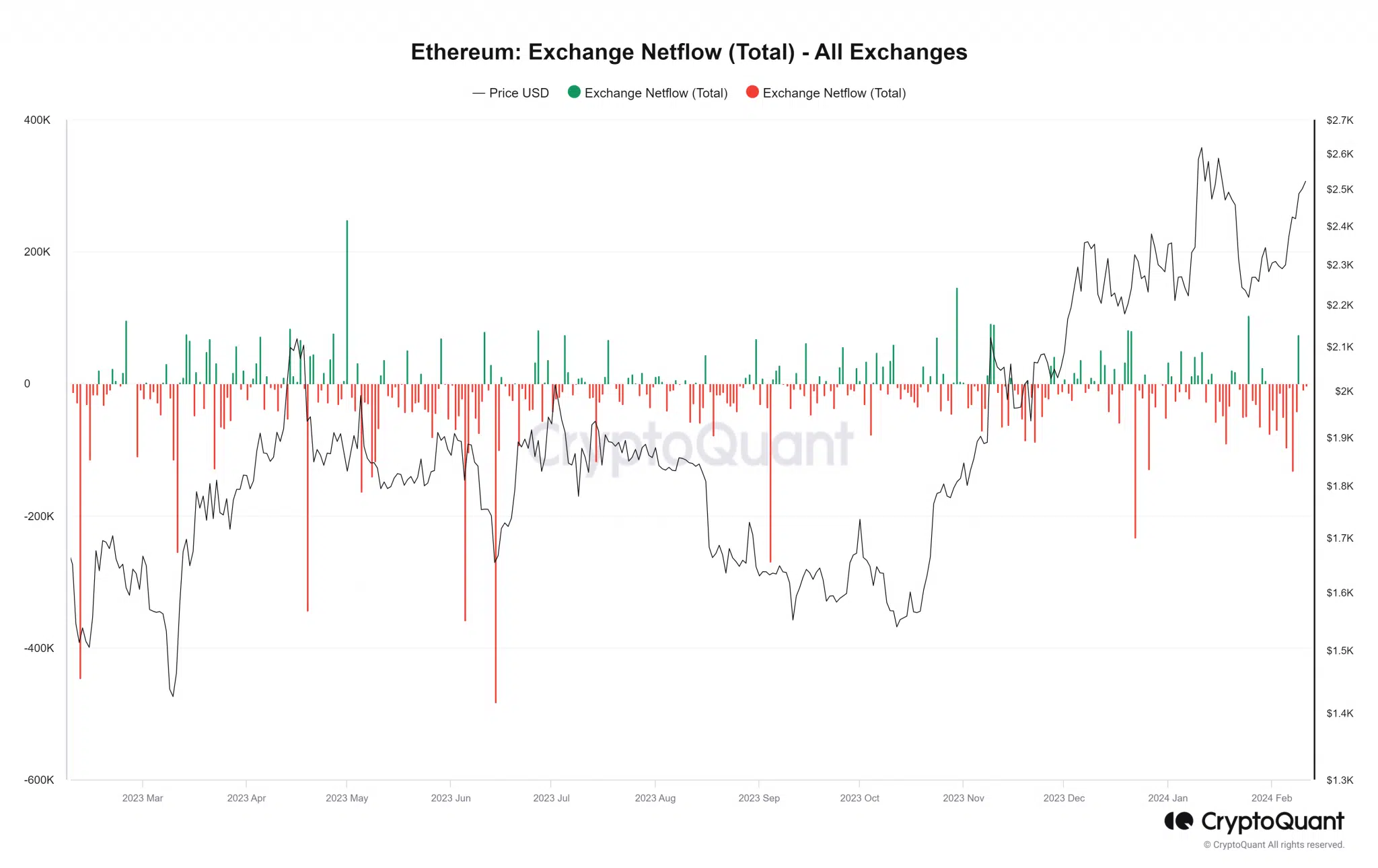

Jeffrey Wilcke had deposited 22,000 ETH, valued at approximately $41.1 million at the time, with ETH priced at $1,872 each. At the time of writing, the wallet’s balance was 46,000 ETH, with an approximate market value of $362 million. Analysis of the Netflow metric on CryptoQuant showed that the most recent deposit did not affect the overall trend. After the transactions on February 10th, the net flow remained negative, which could indicate a continued outflow of ETH from exchanges.

The chart showed an outflow of more than 9,800 ETH from exchanges, in contrast to the previous day, which saw a significant inflow of over 75,000 ETH. At the time of writing, 3,000 ETH had left the exchange. The co-founder of Ethereum seems to have timed the sale well, taking advantage of the rising ETH price trend over the past three days. Analysis of the daily time frame chart showed that ETH was trading above $2,500 at the time of writing. The strength of the positive trend was clearly visible in both the short moving average and the Relative Strength Index (RSI).

Critical Level in ETH Market

The cryptocurrency’s price was trending above the line serving as the support level. Additionally, the RSI had crossed 60 and was heading towards the overbought zone. The report also indicated that the RSI pointed to a strong bullish trend. If the mentioned metric continues to rise, ETH prices could increase, which could be good news in terms of volatility after a long period of stagnation. Jeffrey Wilcke’s wallet’s deposit of 4,300 ETH to an exchange increased the balance to 46,000 ETH. While the amount of ETH leaving exchanges is increasing, prices are in an uptrend. The RSI indicator suggests an anticipated price increase, indicating a positive trend in the ETH market.

Türkçe

Türkçe Español

Español