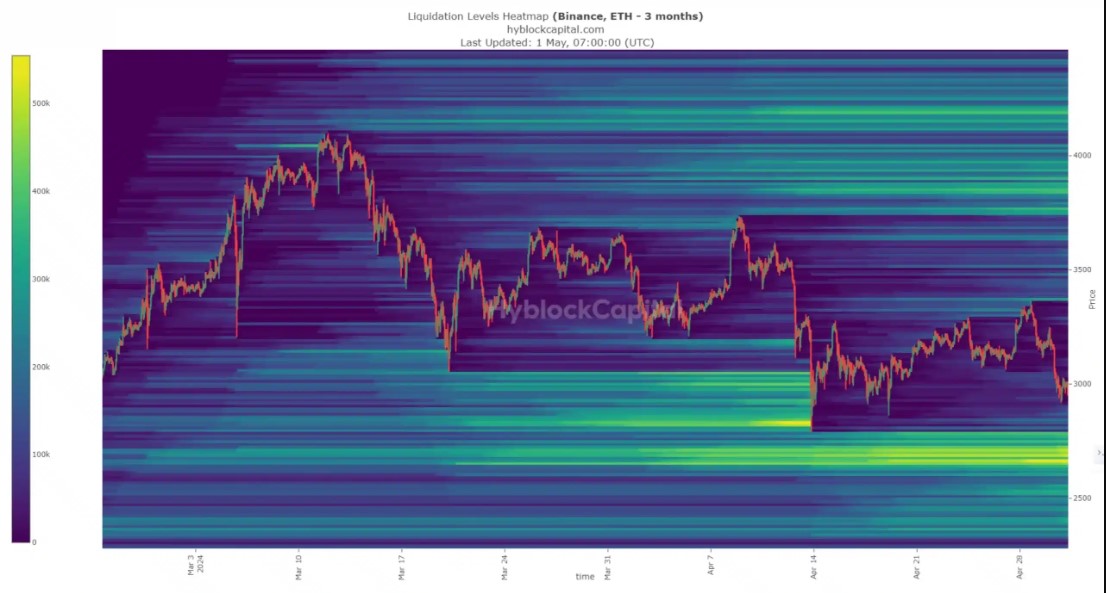

21milyon.com reports that Ethereum (ETH) continues to decline, falling below $3,000 after a 3% drop in the last 24 hours. Currently, Ethereum, the second-largest cryptocurrency, is trading at $2,914, reflecting a 13.34% decrease over the month. However, this negative price movement does not seem to be limiting demand for the token.

Santiment’s Ethereum Report

According to on-chain analytics firm Santiment, Ethereum has seen a sharp increase in the number of new users joining the network. Approximately 266,6 thousand new wallets were created on April 28 and 29, marking the largest two-day network expansion since October 2022.

Network expansion is one of the primary measures to determine whether a cryptocurrency is gaining interest. The participation of new users demonstrates confidence in ETH’s long-term potential, disregarding short-term fluctuations.

A more detailed examination revealed that individual users are also joining this trend. According to the analysis by cryptocurrency analytics firm Santiment, addresses holding between 0 and 0.1 units of ETH significantly increased while prices fell. Wallets holding more than 1 ETH were selling, as indicated by the decrease in ETH reserves.

Investor Interest in ETH

The findings mentioned above show that individual investor interest in ETH is strong, and healthy entries from this segment could contribute to a relief rally in the coming days. Most of these individual customers purchasing ETH may have been attracted by the returns offered by ETH staking services.

Glassnode data indicates that the total ETH stake had risen to 44.24 million at the time of writing, accounting for 36% of ETH’s total circulating supply. Meanwhile, the supply of ETH on exchanges continues to shrink, dropping to 12.79 million at the time of writing, which constitutes about 10% of the total circulating ETH cryptocurrencies.

Türkçe

Türkçe Español

Español