Leading cryptocurrency exchange Bitfinex sheds light on recent trends surrounding Bitcoin (BTC) miners’ reserve sales and the impact of spot exchange-traded funds (ETFs) in the US following the major cryptocurrency’s block reward halving. Bitfinex generally forecasts a positive course for the largest cryptocurrency.

Spot Bitcoin ETFs Ease Miners’ Selling Pressure

According to Bitfinex’s weekly market report published on April 22, Bitcoin miners sold off their reserves ahead of the block reward halving to mitigate potential downward pressure on prices during the event. The report indicates that the introduction of spot ETFs in the US played a role in reducing selling pressure, contributing to a more stable market environment.

CryptoQuant‘s data referenced by Bitfinex shows a significant decrease in the amount of BTC that miners sent to cryptocurrency exchanges in March, with a notable drop of over 70% compared to February’s figures. This decrease in selling activity suggests that miners preferred to liquidate their holdings or use them as collateral to upgrade mining devices and infrastructure, thus strategically managing their positions before the block reward halving.

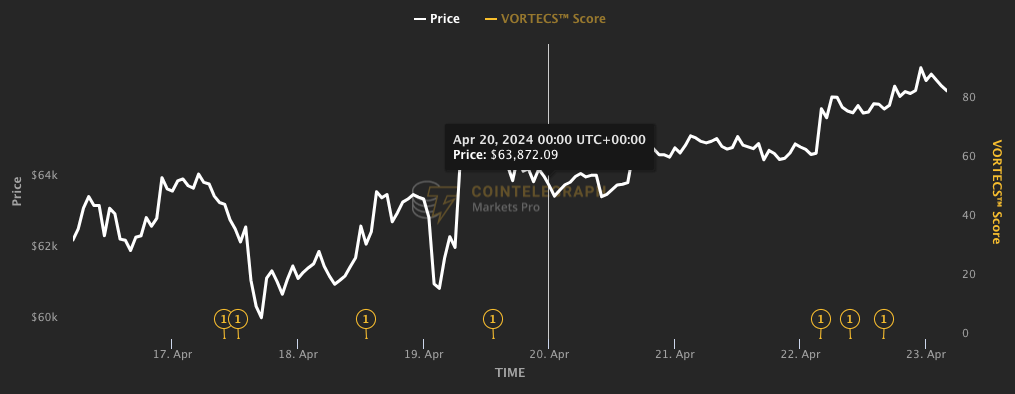

The block reward halving historically expected to impact miner revenues, yet the reward per mined block in terms of BTC dropped to 3.125 units, approximately $208,000 at current prices, showing a positive trajectory for Bitcoin post-halving. Bitfinex noted a significant upward trend in Bitcoin’s price since the April 20 halving, highlighting a trend that began on April 17 after a period of relative stagnation.

Traditionally, block reward halvings are associated with increased selling pressure from miners wanting to maximize profits before facing reduced block rewards. This phenomenon often results in short-term market volatility and price fluctuations. However, Bitfinex emphasized that historical patterns indicate the next stage of price appreciation and growth in mining activity, effectively balancing the initial market turbulence.

Furthermore, the report highlights the launch of spot Bitcoin ETFs in the US, introducing a new dynamic to the market by potentially mitigating the impact of supply shocks caused by the block reward halving. Bitfinex pointed out significant flows observed in these ETFs last week, totaling $192 million, which have a substantial impact on market sentiment and pricing dynamics. Despite occasional net outflows, continued interest in these ETFs, especially under limited supply conditions, underscores their potential to drive further price increases for Bitcoin.

Continued Uptrend in Prices Anticipated

Looking forward, Bitfinex anticipates ongoing demand for spot Bitcoin ETFs, which has been exceeding the creation of new BTC since the start of net inflows. This trend, combined with the reduced daily supply following the block reward halving, points to a favorable environment for sustained price increases in the coming months.

With demand for spot Bitcoin ETFs significantly surpassing the current supply, Bitfinex predicts this trend will continue, shaping the market outlook for Bitcoin through evolving dynamics.

Türkçe

Türkçe Español

Español